FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

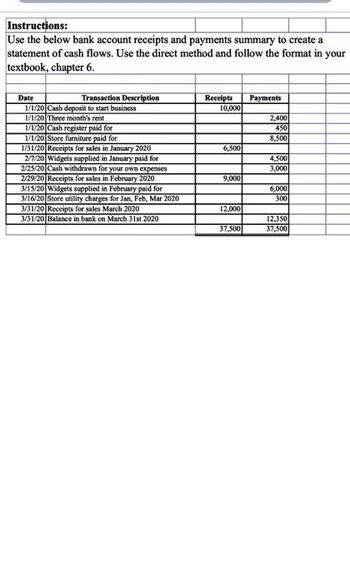

Transcribed Image Text:Instructions:

Use the below bank account receipts and payments summary to create a

statement of cash flows. Use the direct method and follow the format in your

textbook, chapter 6.

Transaction Description

Date

1/1/20 Cash deposit to start business

1/1/20 Three month's rent

1/1/20 Cash register paid for

1/1/20 Store furniture paid for

1/31/20 Receipts for sales in January 2020

2/7/20 Widgets supplied in January paid for

2/25/20 Cash withdrawn for your own expenses

2/29/20 Receipts for sales in February 2020

3/15/20 Widgets supplied in February paid for

3/16/20 Store utility charges for Jan, Feb, Mar 2020

3/31/20 Receipts for sales March 2020

3/31/20 Balance in bank on March 31st 2020

Receipts

10,000

6,500

9,000

12,000

37,500

Payments

2,400

450

8,500

4,500

3,000

6,000

300

12,350

37,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After posting the journal entries to the Cash T-account, the balance in the Cash T- account should equal the True Cash Balance on the Bank Reconciliation the Cash Balance per Books O today's Cash Balance on the Bank's internet site. the Cash Balance per Bankarrow_forwardUse the following excerpts from Brownstone Company's financial statements and complete the worksheet below to determine cash received from customers in 2018. From Balance Sheets Accounts Receivable Dec. 31, 2018 $ 25,000 Dec. 31, 2017 $20,000 2018 220,000 From Income Statement: Sales PLEASE NOTE: You are to follow the format shown in the textbook. Cash Collected from Sales Revenue [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ]arrow_forwardMakena is a salaried, exempt employee with Caxkyat Stores. Makena is single with one dependent under 17 and earns $35,500 per year. Required: Complete the payroll register for the biweekly pay period ending March 11, 2022, with a pay date of March 16, 2022. Note: Round your dollar values to 2 decimal places. P/R End Date: Check Date: Name Makena Totals 03/11/2022 03/16/2022 Filing Status Dependents Hourly Rate or Period Wage M Company Name Number of Regular Hours \ Number of Overtime Hours Caxkyat Stores Commissions Regular Earnings 0.00 Overtime Earnings Gross Earnings $ 0.00arrow_forward

- Answer full question.arrow_forwardEmporium bank lends money to a customer on a six month note. What journal entry does the bank prepare? A. Debit note receivable and credit cash B. Debit cash and credit note receivable C: debit note receivable and credit service revenue D. Debit cash and credit note payablearrow_forwardAccounting Questionarrow_forward

- Subject - account Please help me. Thankyouarrow_forwardAfter posting the July 15 journal entry below to the cash account in the ledger, what would the updated balance in the cash account--the dollar amount on the debit or credit side? (Note: The company had a beginning debit balance of $50,000 on July 1 that should be included.) JOURNAL page 2 DATE DESCRIPTION POST. REF. DEBIT CREDIT 7/15/18 Cash $12,000 Fees Earned $12,000 GENERAL LEDGER ACCOUNT TITLE CASH ACCOUNT NO. 11 DATE ITEM PREF. DEBIT CREDIT DEBIT BALANCE CREDIT BALANCE 7/01/18 Balance $50,000 7/15/18 12,000 ? or ? Group of answer choices $12,000 credit balance $62,000 debit balance $12,000 debit balance $62,000 credit balancearrow_forwardDon't use ai to answer I will report your answer Solve it Asap with explanation and calculationarrow_forward

- Please Solve With Explanation and do not give Solution in image formatarrow_forwardA. Classification of Cash For each of the items listed in the table below, place an X in the column indicating the correct classification for balance sheet purposes. The first one is completed for you. Balance Sheet Classification Cash Cash Short-term Other Equivalent Investments Checking account Savings account Rare coins kept for long-term speculation Post-dated checks received Money orders received Petty cash fund Treasury bills purchased when two months remain in term Compensating balance for a short-term loan Sinking fund to retire a bond in five years Certificate of deposit (six- month term) Short-term investment in marketable equity securitiesarrow_forwardPreparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 86,700 September 92,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers. Kailua and Company Schedule August September June: 2$ % July: 2$ % 24 % August: 2$arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education