FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

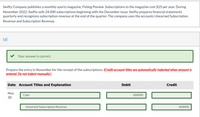

Transcribed Image Text:Prepare the adjusting entry at December 31, 2022, to record sales revenue recognized in December 2022. (Credit account titles

are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

Dec.

31

Transcribed Image Text:Swifty Company publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $25 per year. During

November 2022, Swifty sells 24,000 subscriptions beginning with the December issue. Swifty prepares financial statements

quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription

Revenue and Subscription Revenue.

(a)

Your answer is correct.

Prepare the entry in November for the receipt of the subscriptions. (Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

Nov.

Cash

600000

30

Unearned Subscription Revenue

600000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required Information [The following information applies to the questions displayed below.] Evans Ltd. publishes a monthly newsletter for retail marketing managers and requires its subscribers to pay $45 in advance for a one-year subscription. During the month of August 2019, Evans Ltd. sold 180 one-year subscriptions and received payments in advance from all new subscribers. Only 72 of the new subscribers paid their fees in time to receive the August newsletter; the other subscriptions began with the September newsletter. Table 6-4, Table 6-5 (Use appropriate factor from the table provided.) Required: a-1. Use the horizontal model to record the effects of subscription fees received in advance during August 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to Indicate a negative financial statement effect.) Assets Balance Sheet Assets Liabilities a-2. Use the horizontal model to record the effects of subscription revenue earned during August 2019.…arrow_forwardPlease read the questions carefully the First question is asking for journal entry.arrow_forwardPlease provide the following journal entries for these transactions, you can draw the T- Accounts or journal entries; A) Mortgage Company funded a loan for $100,000 and the company only advance 98% of the loan through financing (Warehouse Line). Remaining 2% is gathered from Companys funds. B) The same loan was sold to investor at 102 % 15 days later, please prepare the journal entries. C) The Company has expenses at the end of the month in the amount of $20,000 but has not paid until 30 days later. Please prepare journal entries at the end of the month and 30 days payment. D) The company received funds and has a trust liability account for borrowers in the amount of $10,000. 30 days later the trust liability is being transferred to the final investors. E) Company Prepaid Insurance for 12 months and paid in January for $1,200. You are now in the March 31 st of the year.arrow_forward

- Please help me. Thankyou.arrow_forwardCrane Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $15 per year. During November 2022, Crane sells 12,480 subscriptions for cash, beginning with the December issue. Crane prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end. Prepare a tabular summary to record the following events. (a) Receipt of the subscriptions in November. (b) Adjustment at December 31, 2022, to record subscription revenue in December 2022. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Pd. in Cap. Cash Unearned Subscrip.…arrow_forwardIn December, Northern Kiteboarding magazine collected $80,000 for subscriptions for the next calendar year. The company collects cash in advance and then downloads the magazines to subscribers each month Apply the recognition criteria for revenues to determine (a) when the company should record revenue for this situation and (b) the amount of revenue the company should record for the January through March downloads a Northern Kiteboarding should record revenue after b. The amount of revenue equals nof whenarrow_forward

- Help me selecting the right answer. Thank youarrow_forwardPrepare journal entries for each of the following sales transactions by Elegant Electronics, including a 3.5% sales tax, and the remittance of all sales tax to the tax board on October 23. Accounts Payable Merchandise Inventory Sales Discount Cash Sales Sale Tax Payable PLEASE NOTE: You must follow the format in the textbook and enter the account names exactly as written above and all dollar amounts will be rounded to two decimal places with "$" and commas as needed (i.e. $12,345.67). Elegant Electronics sells a cellular phone on September 2 for $450: DR DR or CR? CR On September 6, Elegant sells another cellular phone for $500: DR DR or CR? CR The remittance of all sales tax to the tax board on October 23: DR CRarrow_forwardYour Personal Chef, Inc. prepares healthy gourmet dinners for clients on a subscription basis. Clients pay $75 per week for 3 delivered dinners. During 2019, Your Personal Chef, Inc. received advance payments of $18,000. At December 31, 2019, two-thirds of the advance payments had been earned. Make the entry for the advance payments received during the year. Make the necessary adjusting entry at December 31, 2019. What is the balance in the Unearned Revenue Account after the adjusting entry is made?arrow_forward

- Mathura publishes a monthly sports magazine, Hockey Hits. Subscriptions to the magazine cost $22 per year. During November 2021, Mathura sells 18,000 subscriptions beginning with the December issue. Mathura prepares financial statements quarterly and recognizes revenue for magazines sold at the end of the quarter. The company uses the accounts Unearned Revenue and Revenue. Prepare the entry in November for the receipt of the subscriptions. Prepare the adjusting entry at December 31, 2021, to record revenue to be recognized in December 2021. Prepare the adjusting entry at March 31, 2022, to record revenue to be recognized in the first quarter of 2022arrow_forwardOn July 10, 2020, Tamarisk Music sold CDs to retailers on account and recorded sales revenue of $657,000 (cost $538,740). Tamarisk grants the right to return CDs that do not sell in 3 months following delivery. Past experience indicates that the normal return rate is 15%. By October 11, 2020, retailers returned CDs to Tamarisk and were granted credit of $84,200.Prepare Tamarisk’s journal entries to record (a) the sale on July 10, 2020, and (b) $84,200 of returns on October 11, 2020, and on October 31, 2020. Assume that Tamarisk prepares financial statement on October 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Credit (a) enter an account title to record sales on July 10, 2017 enter a debit amount…arrow_forwardPrepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries.The company prepares annual adjusting entries.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education