FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

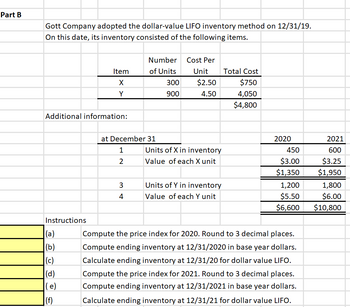

Transcribed Image Text:Part B

Gott Company adopted the dollar-value LIFO inventory method on 12/31/19.

On this date, its inventory consisted of the following items.

Additional information:

Instructions

Item

X

Y

(a)

(b)

(c)

(d)

(e)

(f)

at December 31

1

2

Number

of Units

3

4

300

900

Cost Per

Unit

$2.50

4.50

Units of X in inventory

Value of each X unit

Units of Y in inventory

Value of each Y unit

Total Cost

$750

4,050

$4,800

2020

450

$3.00

$1,350

1,200

$5.50

$6,600

Compute the price index for 2020. Round to 3 decimal places.

Compute ending inventory at 12/31/2020 in base year dollars.

Calculate ending inventory at 12/31/20 for dollar value LIFO.

Compute the price index for 2021. Round to 3 decimal places.

Compute ending inventory at 12/31/2021 in base year dollars.

Calculate ending inventory at 12/31/21 for dollar value LIFO.

2021

600

$3.25

$1,950

1,800

$6.00

$10,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, the Brunswick Hat Company adopted the dollar-value LIFO retail method. The following data are available for 2024: Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, 12/31/2024 Cost $ 72,420 107, 100 Ending inventory at retail Ending inventory at cost Cost of goods sold Retail $ 142,000 264,000 6,000 15,000 229,000 1.05 Required: Calculate the estimated ending inventory and cost of goods sold for 2024 using the information provided. Note: Do not round intermediate calculations.arrow_forwardDollar-Value LIFO On January 1, 2018, Sato Company adopted the dollar-value LIFO method of inventory costing. Sato's ending inventory records appear as follows: Current Cost Year 2018 2019 2020 2021 2018 2019 2020 2021 $39,700 55,500 58,760 69,440 $ Index Required: Compute the ending inventory for the years 2018, 2019, 2020, and 2021, using the dollar-value LIFO method. Year Ending inventory 39,700 100 120 130 140arrow_forwardOn January 1, 2018, the Haskins Company adopted the dollar-value LIFO method for its one inventory pool.The pool’s value on this date was $660,000. The 2018 and 2019 ending inventory valued at year-end costs were$690,000 and $760,000, respectively. The appropriate cost indexes are 1.04 for 2018 and 1.08 for 2019.Required:Calculate the inventory value at the end of 2018 and 2019 using the dollar-value LIFO method.arrow_forward

- 9. The Tam Company uses the retail inventory method and the average cost flow assumption for preparation of its interim reports. Information about Tam's inventory in the second quarter of 2020 is shown below: Cost Retail $ 600 Beginning inventory Purchases $400 800 1,480 Net markups Net markdowns 160 (240) Sales 1,200 What is the estimated cost of Tam's inventory on June 30, 2020? a. $464 b. $480 c. $428 d. $520arrow_forwardA company uses the dollar-value LIFO method of computing inventory. An external price index is used to convert ending inventory to base year. The company began operations on January 1, 2024, with an inventory of $219,000. Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows: Year Ended December 31 2024 2025 2026 2027 Date 01/01/2024 12/31/2024 Required: Calculate inventory amounts at the end of each year. Note: Round intermediate calculations and final answers to the nearest whole dollars. 12/31/2025 12/31/2026 Ending Inventory at Cost Index (Relative to Year-End Costs Base Year) $333,500 426, 250 403, 820 395,300 12/31/2027 Inventory Layers Converted to Base Year Cost Inventory at Year-End Cost Inventory Layers at Base Year Cost $ 219,000 $ $ 333,500 $ $ 426,250 $ $ 403,820 $ $ 395,300 $ 219,000 290,000 341,000 335,000 331,000 Base Inventory Layers Converted to Cost Inventory Layers Converted to Cost Base $ Base $ 2024 $ Base $ 2024 $ 2025…arrow_forwardPresented below is information related to Crane Company. Date Ending Inventory(End-of-Year Prices) PriceIndex December 31, 2017 $ 72,600 100 December 31, 2018 122,100 110 December 31, 2019 119,952 126 December 31, 2020 135,630 137 December 31, 2021 160,230 147 December 31, 2022 190,608 152 Compute the ending inventory for Crane Company for 2017 through 2022 using the dollar-value LIFO method. Ending Inventory 2017 $enter a dollar amount 2018 $enter a dollar amount 2019 $enter a dollar amount 2020 $enter a dollar amount 2021 $enter a dollar amount 2022 $enter a dollar amountarrow_forward

- Midori Company had ending inventory at end-of-year prices of $100,000 at December 31, 2019; $119,900 at December 31, 2020; and $134,560 at December 31, 2021. The year-end price indexes were 100 at 12/31/19, 110 at 12/31/20, and 116 at 12/31/21. Compute the ending inventory for Midori Company for 2019 through 2021 using the dollar-value LIFO method.arrow_forwardHOW DO I CACULATE ENDING INVENTORY , COST OF GOODS SOLD, GROSS PROFIT ?arrow_forwardPresented below is information related to Dino Radja Company. Date Ending Inventory(End-of-Year Prices) PriceIndex December 31, 2017 $ 80,000 100 December 31, 2018 115,500 105 December 31, 2019 108,000 120 December 31, 2020 122,200 130 December 31, 2021 154,000 140 December 31, 2022 176,900 145 Instructions Compute the ending inventory for Dino Radja Company for 2017 through 2022 using the dollar-value LIFO method.arrow_forward

- Data table Net Sales Revenue Cost of Goods Sold: New Home Income Statement Year Ended December 31, 2019 Beginning Merchandise Inventory Net Cost of Purchases Cost of Goods Available for Sale Less: Ending Merchandise Inventory Cost of Goods Sold Gross Profit Operating Expenses Net Income Drint $ Dono 9,200 78,000 87,200 14,400 $ 162,000 $ 72,800 89,200 56,400 32,800 Xarrow_forwardPresented below is information related to Bonita Company. Price Index Date December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 2024 2025 2026 2027 $ $ Ending Inventory (End-of-Year Prices) $ $78,300 115,154 114,696 Compute the ending inventory for Bonita Company for 2022 through 2027 using the dollar-value LIFO method. 128,651 152,755 182,044 Ending Inventory 78300 112805 112800 118012 131986 100 155700 103 118 127 137 142arrow_forwardPresented below is information related to Riverbed Corporation. Inventory on December 31, 2025, when dollar-value LIFO is adopted Inventory, December 31, 2026 Price Index 100 105 LIFO Cost $45,600 ? Retail $82,100 97.755 Compute the ending inventory under the dollar-value LIFO method at December 31, 2026. The cost-to-retail ratio for 2026 was 50% Ending inventory under the dollar-value LIFO method at December 31, 2026 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education