Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

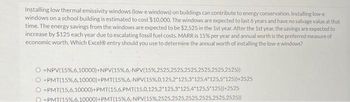

Transcribed Image Text:Installing low thermal emissivity windows (low-e windows) on buildings can contribute to energy conservation. Installing low-e

windows on a school building is estimated to cost $10,000. The windows are expected to last 6 years and have no salvage value at that

time. The energy savings from the windows are expected to be $2,525 in the 1st year. After the 1st year, the savings are expected to

increase by $125 each year due to escalating fossil fuel costs. MARR is 15% per year and annual worth is the preferred measure of

economic worth. Which Excel® entry should you use to determine the annual worth of installing the low-e windows?

-NPV (15 %,6,10000)+NPV( 15%,6,- NPV ( 15%,2525,25252525,2525,25252525))

O-PMT( 15%,6,10000) + PMT( 15 %,6,- NPV ( 15%, 0,125,2 125,3 125,4 125,5*125))+2525

O-PMT(15,6,10000)+PMT(15,6,PMT(15,0,125,2 125,3 125,4*125,5*125))+2525

-PMT(15%.6.10000)+PMT (15% , 6 , NPV ( 15%, 2525,2 2525,2525,2525,2525))

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Street lighting fixtures and their sodium vapor bulbs for a two-block area of a large city need to be installed at a first cost (investment cost) of $100,000. Annual maintenance expenses are expected to be $6,650 for the first 9 years and $9,500 each year thereafter upto 30 years. With an interest rate of 8% per year, what is the present worth cost of this project? Choose the closest answer below OA. The present worth cost of the project is $236,701. OB. The present worth cost of the project is $248,491. OC. The present worth cost of the project is $189,145 OD. The present worth cost of the project is $281,813 27arrow_forwardSuppose we are thinking about replacing an old computer with a new one. The old one cost us $1,620,000; the new one will cost, $1,949,000. The new machine will be depreciated straight-line to zero over its five-year life. It will probably be worth about $405,000 after five years. The old computer is being depreciated at a rate of $336,000 per year. It will be completely written off in three years. If we don't replace it now, we will have to replace it in two years. We can sell it now for $531,000; in two years, it will probably be worth $153,000. The new machine will save us $363,000 per year in operating costs. The tax rate is 23 percent, and the discount rate is 10 percent. a-1. Calculate the EAC for the the old computer and the new computer. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. What is the NPV of the decision to replace the computer now? (A negative answer should…arrow_forward10. Triple Crown is considering installing a new cooler (equipment) in order to increase the volume and variety of beverages they can offer. The new cooler will cost $26,000. It is expected to last 7 years but only if the cooler is overhauled (REPAIRED) at a cost of $4,000 at the end of year 4. The new cooler is expected to have a $2,000 salvage value at the end of 7 years. The new cooler is expected to generate additional revenues of $15,000 per year with an increase in expenses of $9,000 per year. Triple Crown's discount rate is 12%. What is the net present value of this investment opportunity? Should they invest in the cooler? Hint: determine the PV of each item. Be careful if the item is an annuity (anmual) or one time only event. PV of an annuity of S1 PV of S1 Time 10% 12% 14% Time 10% 12% 14% period 1 period 0.909 0.893 0.877 1 0.909 0.893 0.877 1.736 1.690 1.647 2 0.826 0.797 0.769 3 2.487 2.402 2.322 3 0.751 0.712 0.675 4 3.170 3.037 2.914 4 0.683 0.636 0.592 5 3.791 3.605…arrow_forward

- An airline is considering a project of replacement and upgrading of machinery that would improve efficiency. The new machinery costs $500 today and is expected to last for 5 years with no salvage value. Straight line depreciation will be used. Project inflows connected with the new machinery will begin in one year and are expected to be $300 each year for 5 consecutive years and project outflows will also begin in one year and are expected to be $150.00 each year for 5 consecutive years. The corporate tax rate is 30% and the required rate of retum is 7% Calculate the project's net present value. Place your answer in dollars and cents. Do not include a dollar sign or comma in your answer. Work your analysis with at least four decimal places of accuracy YOU ARE NOT FINISHED. NOW GO ON TO THE SECOND PARTI PART 2. Given your estimate of the NPV, should you accept or reject the project? Type the word "accept" if you believe you should go ahead with the project of the word "reject" if you…arrow_forwardLumberjack Power, operator of a nuclear power plant, is planning to replace its current equipment with some that is more environmentally friendly. The old equipment has annual operating expenses of $6750 and can be kept for 8 more years. The equipment will have a salvage value of $4000, if sold 8 years from now, and has a current market value of $24,000, if it is sold now. The new equipment has an initial cost of $62,000 and has estimated annual operating expenses of $6250 each year. The estimated market value of the new equipment is $19,000 after 8 years of operation. If the company's MARR is 16% per year, should the equipment be replaced? Use a study period of 8 years and the present worth method.arrow_forwardThe Oviedo Company is considering the purchase of a new machine to replace an obsolete one. The machine being used for the operation has a book value and a market value of zero. However, the machine is in good working order and will last at least another 10 years. The proposed replacement machine will perform the operation so much more efficiently that Oviedo's engineers estimate that it will produce after-tax cash flows (labor savings) of $6,000 per year. The after-tax cost of the new machine is $30,000, and its economic life is estimated to be 10 years. It has zero salvage value. The firm's WACC is 10%, and its marginal tax rate is 25%. Should Oviedo buy the new machine? Oviedo (should or Should not) purchase the new machine.arrow_forward

- Cor's Dog House is considering the installation of a new computerized pressure cooker for hot dogs. The cooker will increase sales by $10,100 per year and will cut annual operating costs by $11,750. The new system will also prompt a $4,900 increase in net working capital. The system will cost $60,200 to purchase and install. This system is expected to have a 4-year life and will be depreciated to zero using straight-line depreciation and have no salvage value. The tax rate is 21 percent and the required return is 10.5 percent. What is the NPV of purchasing the pressure cooker? OCF = $ CFO = S CF4=$ NPV = It It It It It 11 11arrow_forwardSuppose we are thinking about replacing an old computer with a new one. The old one cost us $1,960,000; the new one will cost, $2,531,000. The new machine will be depreciated straight-line to zero over its five-year life. It will probably be worth about $660,000 after five years. The old computer is being depreciated at a rate of $472,000 per year. It will be completely written off in three years. If we don't replace it now, we will have to replace it in two years. We can sell it now for $684,000; in two years, it will probably be worth $204,000. The new machine will save us $413,000 per year in operating costs. The tax rate is 25 percent, and the discount rate is 8 percent. a-1. Calculate the EAC for the the old computer and the new computer. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a - What is the NPV of the decision to replace the computer now? (A negative answer should be…arrow_forwardHappy Trails Senior Living Community is considering investing in solar panels to save on utility costs. The initial cost of the panels, including installation, is $250,000. The expected reduction in utility costs are noted below. Utility costs savings for the next five years are: Year 1: $65,000 Year 2: $68,250 Year 3: $71,663 Year 4: $75,246 Year 5: $79,008 The current interest rate used to evaluate investment decisions is 6%. The inflation rate is expected to remain constant at 3% for the entire period. Instructions (a) Compute the present value of the expected cash flows (savings). (b) Should Happy Trails move forward with the investment?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education