FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

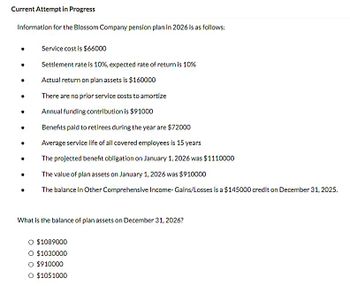

Transcribed Image Text:Current Attempt in Progress

Information for the Blossom Company pension plan in 2026 is as follows:

Service cost is $66000

Settlement rate is 10%, expected rate of return is 10%

Actual return on plan assets is $160000

There are no prior service costs to amortize

Annual funding contribution is $91000

Benefits paid to retirees during the year are $72000

Average service life of all covered employees is 15 years

The projected benefit obligation on January 1, 2026 was $1110000

The value of plan assets on January 1, 2026 was $910000

The balance in Other Comprehensive Income- Gains/Losses is a $145000 credit on December 31, 2025.

What is the balance of plan assets on December 31, 2026?

O $1089000

O $1030000

O $910000

O $1051000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pension data for the Denver Company include the following for the current calendar year:Discount rate, 8%Expected return on plan assets, 10%Actual return on plan assets, 9%Service cost, $200,000January 1:PBO $1,400,000ABO 1,000,000Plan assets 1,500,000Amortization of prior service cost 20,000Amortization of net gain 4,000December 31:Cash contributions to pension fund $220,000Benefit payments to retirees 240,000a) Determine pension expense for the year.b) Prepare the journal entries to record pension expense and funding for the year.arrow_forwardSunland Inc. provides the following information related to its post-retirement health-care benefits for the year 2020: Defined post–retirement benefit obligation at January 1, 2020 $114,000 Plan assets, January 1, 2020 45,800 Actual return on plan assets, 2020 4,000 Discount rate 11% Service cost, 2020 56,200 Plan funding during 2020 22,200 Payments from plan to retirees during 2020 6,200 Actuarial loss on defined post-retirement benefit obligation, 2020 (end of year) 26,300 Sunland Inc. follows IFRS. Calculate the post–retirement benefit expense for 2020. Post–retirement benefit expense 2020 $enter the Post–retirement benefit expense in dollars eTextbook and Media Calculate the post-retirement benefit remeasurement gain or loss—other comprehensive income (OCI) for 2020. Post-retirement benefit remeasurement select an option…arrow_forwardThe following information relates to the defined benefit pension plan of Nelson, Inc. Projected benefit obligation Fair value of plan assets Accumulated OCI-net actuarial gain Settlement rate (for year) Expected rate of return (for year) The interest cost for 2020 is $158,640 $211,520 12/31/19 2,644,000 3,118,000 432,000 O $240,120 O $280,140 O None of the above 6% 8% 12/31/20 4,002,000 3,328,000 480,000 For 2020, Nelson estimates that the average remaining service life of its current employees is 8 years. Nelson's contribution to the plan was $364,000 in 2020 and benefits paid to retirees were $276,000, 6% 7%arrow_forward

- Pension data for Sterling Properties include the following: Service cost, 2024 Projected benefit obligation, January 1, 2024 Plan assets (fair value), January 1, 2024 Prior service cost-AOCI (2024 amortization, $8) Net loss-AOCI (2024 amortization, $2) Interest rate, 5% Expected return on plan assets, 9% Actual return on plan assets, 10% Required: ($ in thousands) $ 125 660 700 90 111 Assume Sterling Properties prepares its financial statements according to International Financial Reporting Standards (IFRS). The interest rate on high-grade corporate bonds is 5%. Determine the net pension cost. Note: Enter your answer in thousands (i.e., 10,000 should be entered as 10). Answer is complete but not entirely correct. Net pension cost $ 105 thousand Assessment Tool iFramearrow_forwardValaarrow_forwardSmith, Inc. has a pension plan with the following data available for 20X1 and 20X2: 20X1 20X2 Service cost $ 30,000 $ 34,000 Interest cost $ 18,000 $ 20,000 Actual return on plan assets $ 15,000 $ 21,600 Beginning of year plan assets $ 200,000 $ 240,000 Discount rate 8 % 8 % Expected return on plan assets 8 % 8 % The adjustment to OCI for gain or loss from the return on plan assets for 20X2 is: Multiple Choice $0. $2,400 gain. $2,400 loss. unknown from information provided.arrow_forward

- Current Attempt in Progress Headland Importers provides the following pension plan information. Fair value of pension plan assets, January 1, 2020 $2,463,000 Fair value of pension plan assets, December 31, 2020 2,815,000 Contributions to the plan in 2020 262,000 Benefits paid retirees in 2020 328,000 From the data above, compute the actual return on the plan assets for 2020. Actual return on plan assets for 2020 %24arrow_forwardHappy Woolly Inc. provides the following information about its postretirement benefit plan for the year 2019. (In Euros) Service cost €90,000 Contribution to the plan €56,000 Actual return on plan assets €2,000 Benefits paid € 40,000 Plan assets at January 1, 2019 €710,000 Defined postretirement benefit obligation at January 1, 2019 €760,000 Accumulated OCI (Loss) at January 1, 2019 100 (Dr-Loss) Discount (interest) rate 9% Required: Compute the postretirement benefit expense for 2019 and give your explanation!arrow_forwardElectronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows: ($ millions) $470 300 PBO balance, January 1 Plan assets balance, January 1 Service cost Interest cost Gain from change in actuarial assumption Benefits paid Actual return on plan assets Contributions 2024 The expected long-term rate of return on plan assets was 6%. There were no AOCI balances related to pensions on January 1, 2024, but at the end of 2024, the company amended the pension formula, creating a prior service cost of $12 million. Required: 1. Calculate the pension expense for 2024. 2. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. 3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3…arrow_forward

- Don't use ai i will report you answer solve it as soon as possible with proper explanationarrow_forwardPlease provide answer with calculation and Explain the correct and incorrect optionarrow_forwardPresented below is information related to Mikell Department Stores, Inc. pension plan for 2022. Service cost 375,000 Funding contribution for 2022 300,000 Settlement rate used in actuarial computation 8% Expected and actual return on plan assets 7% Amortization of Prior Service Costs 70,000 Amortization of net gains 35,000 Projected benefit obligation (at beginning of year) 420,000 Market-related (and fair) value of plan assets (at beginning of year) 380,000 No benefits were paid during 2022. Required: (a) Compute the amount of pension expense to be reported for 2022. (b) Prepare the journal entry to record pension expense for 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education