FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

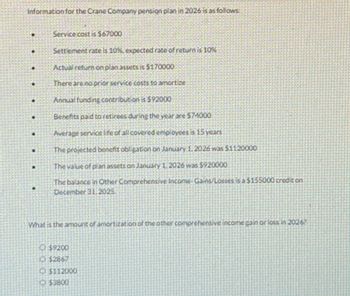

Transcribed Image Text:Information for the Crane Company pension plan in 2026 is as follows:

Service cost is $67000

Settlement rate is 10% expected rate of return is 10%

Actual return on plan assets is $170000

There are no prior service costs to amortize

Annual funding contribution is $92000

Benefits paid to retirees during the year are 574000

Average service life of all covered employees is 15 years

The projected benefit obligation on January 1, 2026 was $1120000

The value of plan assets on January 1 2026 was $920000

The balance in Other Comprehensive Income-Gains/Losses is a $155000 credit on

December 31,2025.

What is the amount of amortization of the other comprehensive income gain or loss in 20267

$9200

$2867

C$112000

$3800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information relates to the pension plan for the employees of Cullumber Company: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) The corridor for 2026 is 1/1/25 $1102000. $1073600. $1410700. $1212200. $9340000 9865000 9025000 0 12/31/25 $9760000 10558000 11020000 (1522000) 11% 8% 12/31/26 $12700000 14107000 12154000 (1690000) 11% Cullumber estimates that the average remaining service life is 16 years. Cullumber's contribution was $1323000 in 2026 and benefits paid were $987000. 7%arrow_forwardFlint Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $200,700; projected benefit obligation $253,000. Other data relating to 3 years' operation of the plan are as follows. 2019 2020 2021 Annual service cost $16,000 $19,100 $25,900 Settlement rate and expected rate of return 10 % 10 % 10 % Actual return on plan assets 18,300 22,120 23,500 Annual funding (contributions) 16,000 39,700 48.700 Benefits paid 13,800 16,600 20,700 Prior service cost (plan amended, 1/1/20) 160,500 Amortization of prior service cost 55,000 41,600 Change in actuarial assumptions establishes a December 31. 2021, projected benefit obligation of 519,300 Dec. 31, Pension Expense 89618 2021 Pension Asset/Liability 19800 Other Comprehensive Income (G/L) 19118 Other Comprehensive Income (PSC) 41600 Cash 48700arrow_forwardThe following information is available for the pension plan of Sunland Company for the year 2020. Actual and expected return on plan assets $ 14,700 Benefits paid to retirees 40,800 Contributions (funding) 81,100 Interest/discount rate 10 % Prior service cost amortization 7,600 Projected benefit obligation, January 1, 2020 458,000 Service cost 63,900arrow_forward

- At January 1, 2020, Windsor Company had plan assets of $303,400 and a projected benefit obligation of the same amount. During 2020, service cost was $26,700, the settlement rate was 10%, actual and expected return on plan assets were $24,500, contributions were $19,700, and benefits paid were $16,900.Prepare a pension worksheet for Windsor Company for 2020. WINDSOR COMPANY General Journal Entries Memo Record Items PensionExpense Cash PensionAsset/Liability ProjectedBenefitObligation PlanAssets 1/1/20 $enter a dollar amount select a debit or credit $enter a dollar amount select a debit or credit $enter a dollar amount select a debit or credit $enter a dollar amount select a debit or credit…arrow_forwardThe following data are for the pension plan for the employees of Oriole Company. 1/1/20 12/31/20 12/31/21 Accumulated benefit obligation $ 5300000 $ 5500000 $ 7100000 Projected benefit obligation 5700000 5900000 7700000 Plan assets (at fair value) 4900000 6300000 6900000 AOCL - net loss 987000 1030000 Settlement rate (for year) 10% 10% Expected rate of return (for year) 7% 7% Oriole's contribution was $870000 in 2021 and benefits paid were $780000. Oriole estimates that the average remaining service life is 15 years. Assume that the actual return on plan assets in 2021 was $560000. The unexpected gain on plan assets in 2021 was $70000. $77000. $119000. O $130000.arrow_forwardCalculating Pension Expense Stars Inc. has a noncontributory defined pension plan for its employees. During 2020, the company had service cost of $90,000, an expected return on plan assets of $13,920, amortization of prior service cost of $3,000, amortization of net pension loss of $3,333, and benefits paid to employees of $60,000. The January 1, 2020, balance in its projected benefit obligation was $291,000. The discount rate is 10%. Required Calculate pension expense for 2020. $Answerarrow_forward

- Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows: ($ millions) $470 300 PBO balance, January 1 Plan assets balance, January 1 Service cost Interest cost Gain from change in actuarial assumption Benefits paid Actual return on plan assets Contributions 2024 The expected long-term rate of return on plan assets was 6%. There were no AOCI balances related to pensions on January 1, 2024, but at the end of 2024, the company amended the pension formula, creating a prior service cost of $12 million. Required: 1. Calculate the pension expense for 2024. 2. Prepare the journal entries to record (a) pension expense, (b) gains or losses, (c) prior service cost, (d) funding, and (e) payment of benefits for 2024. 3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3…arrow_forwardJackson Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $200,000; projected benefit obligation $250,000. Other data relating to 3 years’ operation of the plan are as follows. 2019 2020 2021 Annual service cost $16,000 $19,000 $26,000 Settlement rate and expected rate of return 10 % 10 % 10 % Actual return on plan assets 18,000 22,000 24,000 Annual funding (contributions) 16,000 40,000 48,000 Benefits paid 14,000 16,400 21,000 Prior service cost (plan amended, 1/1/20) 160,000 Amortization of prior service cost 54,400 41,600 Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 520,000 Prepare a pension worksheet presenting all 3 years’ pension balances and activities. (Enter all amounts as positive.) Prepare the…arrow_forwardOn January 1, 2021, Cullumber Co. has the following balances: Projected benefit obligation Fair value of plan assets Service cost The settlement rate is 11%. Other data related to the pension plan for 2021 are: $3550000 Benefits paid Actual return on plan assets Amortization of net gain 3050000 Amortization of prior service costs due to increase in benefits Contributions O $3987500. O $3940500. O $4241500. O $4015500. $301000 101000 501000 226000 The balance of the projected benefit obligation at December 31, 2021 is 396000 30100arrow_forward

- The accountant for Bramble Corporation has developed the following information for the company's defined-benefit pension plan for 2026: Service cost Actual return on plan assets $570,000 278,000 Annual contribution to the plan 948,000 Amortization of prior service cost 127,800 Benefits paid to retirees 74,000 Settlement rate 10% Expected rate of return on plan assets 8% The accumulated benefit obligation at December 31, 2026, amounted to $3,390,000. (a) Using the above information for Bramble Corporation, complete the pension worksheet for 2026.arrow_forwardCitroen Company provides the following information about its defined benefit pension plan for the year 2021. Service cost $79,000 Contribution to the plan 92,000 Prior service cost amortization 9,500 Actual and expected return on plan assets 61,000 Benefits paid 50,000 Plan assets at January 1, 2021 720,000 Projected benefit obligation on January 1, 2021 770,000 Accumulated OCI (PSC) on January 1, 2021 120,000 Interest/discount (settlement) rate 9% Prepare a pension worksheet. Prepare the journal entry recording pension expense.arrow_forwardAt January 1, 2020, Hennein Company had plan assets of $280,000 and a projected benefit obligation of the same amount. During 2020, service cost was $27,500, the settlement rate was 10%, actual and expected return on plan assets were $25,000, contributions were $20,000, and benefits paid were $17,500. Prepare a pension worksheet for Hennein Company for 2020. HENNEIN COMPA General Journal Entries Pension Items Expense Cash 1/1/20 Service cost Interest cost Actual return Contributions Benefits $ Journal entry, 12/31/20 Balance, 12/31/20 %24 %24 %24 %24 %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education