FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

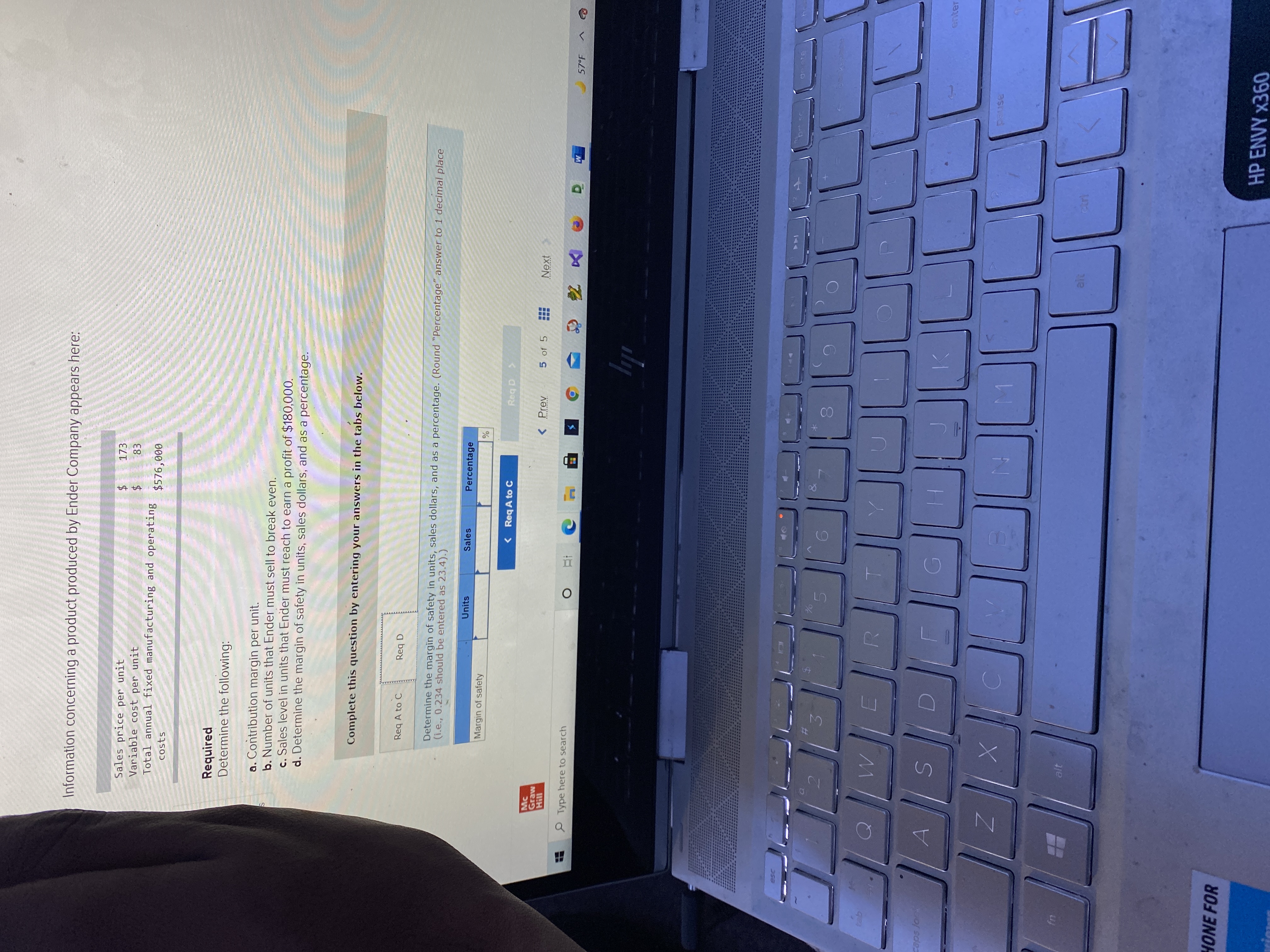

Transcribed Image Text:### Information about Ender Company's Product

**Details Provided:**

- **Sales price per unit:** $173

- **Variable cost per unit:** $83

- **Total annual fixed manufacturing and operating costs:** $576,000

---

### Required Calculations

Determine the following:

a. **Contribution margin per unit.**

b. **Number of units required to break even.**

c. **Sales level in units needed to achieve a profit of $180,000.**

d. **Margin of safety in units, sales dollars, and as a percentage.**

---

### Instructions:

- **Complete this question by entering answers in the tabs below.**

- Input the margin of safety in units, sales dollars, and as a percentage. (Round the percentage to 1 decimal place, e.g., 0.234 should be entered as 23.4.)

**Tabs for Input:**

- **Units**

- **Sales**

- **Percentage**

There are fields for answering "Req A to C" and "Req D" with navigation buttons to move between questions (prev/next).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 13,000 7,000 3,780 $ 3,220 11. What is the margin of safety in dollars? What is the margin of safety percentage? Margin of safety in dollars Margin of safety percentage %arrow_forwardplease provide the answer as per possibilityarrow_forwardAlpesharrow_forward

- ! Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income Margin of safety in dollars Margin of safety percentage 11. What is the margin of safety in dollars? What is the margin of safety percentage? $ 20 $ 20,000 12,000 % 8,000 6,000 $ 2,000arrow_forwardThornton Manufacturing Company reported the following data regarding a product it manufactures and sells. The sales price is $44. 12 Variable costs Manufacturing Selling Fixed costs Manufacturing Selling and administrative 17 per unit 6 per unit $152,000 per year $102,100 per year Required a. Use the per-unit contribution margin approach to determine the break-even point in units and dollars. b. Use the per-unit contribution margin approach to determine the level of sales in units and dollars required to obtain a profit of $178,500. c. Suppose that variable selling costs could be eliminated by employing a salaried sales force. If the company could sell 21,400 units, how much could it pay in salaries for salespeople and still have a profit of $178,500? (Hint Use the equation method.) a. Break-even point in units Break-even point in dollars b Required sales in units Required sales in dollars C Fixed cost of salariesarrow_forwardRequired information [The following information applies to the questions displayed below] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (9,700 units at $280 each) Variable costs (9,700 units at $210 each) Contribution margin Fixed costs Income 1. Amount of sales 2. Margin of safety 1. Assume Hudson has a target income of $163,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) $ 2,716,000 2,037,000 679,000 441,000 $ 238,000 %arrow_forward

- Please do not give solution in image format thankuarrow_forwardA company reports the following contribution margin income statement. Contribution Margin Income Statement For Year Ended December 31 Sales (19,200 units at $22.50 each) Variable costs (19,200 units at $18.00 each) Contribution margin. Fixed costs Income The manager believes the company can increase sales volume to 22,000 total units by increasing advertising costs by $16,200. Required A Required B Complete this question by entering your answers in the tabs below. Contribution Margin Income Statement For Year Ended December 31 $ 432,000 345,600 Prepare a contribution margin income statement assuming the company incurs the additional advertising costs and sales volume increases to 22,000 units. Sales Variable costs Contribution margin 86,400 64,800 $ 21,600 Fixed costs Incomearrow_forwardLi Company has a unit selling price of $150, unit variable costs of $45, and total fixed costs of $47,200. How much sales revenue must Li Company generate to achieve net income of $27,700. Sales revenue needed to achieve target net income $arrow_forward

- Analyzing Income under Absorption and Variable Costing Variable manufacturing costs are $99 per unit, and fixed manufacturing costs are $215,600. Sales are estimated to be 7,700 units. If an amount is zero, enter "0". Round intermediate calculations to the nearest cent and your final answers to the nearest dollar. a. How much would absorption costing operating income differ between a plan to produce 7,700 units ard a plan to produce 9,800 units? b. How much would variable costing operating income differ between the two production plans? 0 Feedback Check My Work a. Remember that under variable costing, regardless of whether 7,700 units or 9,800 units are manufactured, no fixed manufacturing costs are allocated to the units manufactured. Instead, all fixed manufacturing costs are treated as a period expense. Therefore the change in units times the per unit fixed costs for the greater production level is the difference in income between the two costing methods. b. Remember that since all…arrow_forwardCassius Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (7,000 units) Variable expenses Contribution margin Fixed expenses Net operating income The number of units that must be sold to achieve a target profit of $31,500 is closest to: 35,000 units 42,000 units 9,400 units $ 210,000 136,500 73,500 67,200 6,300 48,000 unitsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education