Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

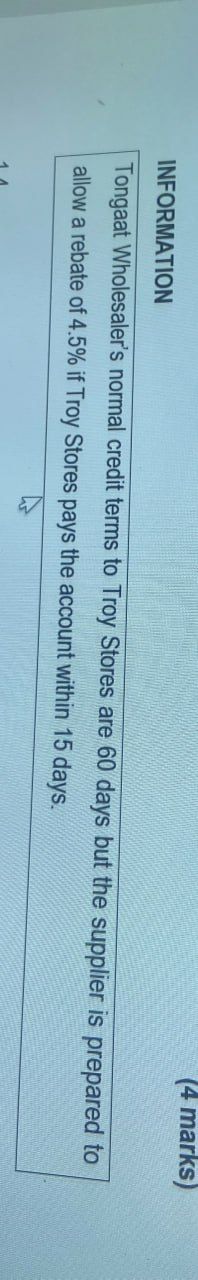

Transcribed Image Text:INFORMATION

(4 marks)

Tongaat Wholesaler's normal credit terms to Troy Stores are 60 days but the supplier is prepared to

allow a rebate of 4.5% if Troy Stores pays the account within

15

days.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which is correct ?arrow_forwardCompany X sells on a 2/15, net 60, basis. Company Y buys goods with an invoice of $4,500. a. How much can company Y deduct from the bill if it pays on day 15? (Do not round intermediate calculations.) b. How many extra days of credit can company Y receive if it passes up the cash discount? c. What is the effective annual rate of interest if Y pays on the due date rather than day 15? (Use 365 days in a year. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardLoans Scotiabank approved a $230.000.00 line of credit for Buhler Industries at prime + 1%. It requires only the repayment of accrued interest on the 24th of each month which is automatically deducted from the checking account of Buhler Industries. Buhler took out an advance on December 6 for $160,000.00 and made a payment of $130,000.00 on January 16 The prime rate was 5.25% initially and increased to 6.5% on January 7. Complete the repayment schedule below by filling in the payment and principal amounts. Payment Date Balance Annual before Interest Transaction Rate Number of Days Interest Accrued Charged Interest (+) or Principal Balance after Advance Amount Transaction (-) Dec 6 $160,000.00 Dec 24 $160.000,00 $160,000.00 Jan 7 Jan 16 $160,000.00 $30,000.00 Jan 24 6.25% 18/365 7.5% 8/365 6.25% 14/365 $383.56 7.5% 9/365 $295.89 $679.45 $49.32 $728.77 $493.15 $493.15 $383.56 $160,000.00 $160,000.00 $30,000.00 $30,000.00 Notes You con can partial credit on this problemarrow_forward

- 4. The total current amount due to a purchase made by using credit card is P54,245.50, Based on the agreement the minimum required payment is 8.5% of the total amount due, If the client pays only the minimum requlred payment, a charge 2.5% of the remaining balance will be carried on to the next bill. If there are no purchases made for the next two manths and a charge of 2.5% is added every billing period, what is the required monthly bill for the next months? TIME/MONTH TOTAL AMOUNT DUE FOR MINIMUM REQUIRED THE MONTH PAYMENT FOR THE MONTHarrow_forwardFor the credit card account below, compute the average daily balance, the finance charge, and the account balance for the next billing. Assume the account is billed on the same date each month and that the annual interest rate is 18%. This credit card company calculates the finance charge on the average daily balance, but they consider each month of a year instead of using the number of days in the month. 12 Previous Balance: $1045 March 15 Billing Date March 23 Flowers $106 March 30 Payment $81 April 1 Groceries $86 April 8 Returns $50 April 11 Concert Tickets $138 Average Daily Balance: Finance Charge: Account Balance for the Next Billing:arrow_forwardA store will give you a 5.00% discount on the cost of your purchase if you pay cash today. Otherwise, you will be billed the full price with payment due in 1 month. What is the implicit borrowing rate being paid by customers who choose to defer payment for the month?arrow_forward

- A company has issued commercial paper at 2.5% discount for 45 days. What is the price of the commercial paper and how much will be the effective rate of interest on this paper. Should this company issue this paper if the prime rate is 3.5%.arrow_forwardThe credit terms offered to a customer by a business firm are 2/10, n/30, which means that the customer must pay the bill within 10 days. the customer can deduct a 2% discount if the bill is paid within 10 days of the invoice date. the customer can deduct a 2% discount if the bill is paid between the 10th and 30th day from the invoice date. two sales returns can be made within 10 days of the invoice date and no returns thereafter.arrow_forwardLoans Scotiabank approved a $230,000.00 line of credit for Buhler Industries at prime + 1%. It requires only the repayment of accrued interest on the 24th of each month, which is automatically deducted from the checking account of Buhler Industries. Buhler took out an advance on December 6 for $160,000.00 and made a payment of $130,000.00 on January 16. The prime rate was 5.25% initially and increased to 6.5% on January 7. Complete the repayment schedule below by filling in the payment and principal amounts. Date Balance Annual before Interest Transaction Rate Number Interest of Days Charged Accrued Interest Payment (+) or Advance (-) Principal Balance after Amount Transaction Dec 6 Dec 24 $160,000.00 $160,000.00 6.25% 18/365 $493.15 $493.15 $160,000.00 Jan 7 6.25% $160,000.00 14/365 $383.56 $383.56 $160,000.00 Jan 16 $160,000.00 7.5% 9/365 $295.89 $679.45 $30,000.00 Jan 24 $30,000.00 7.5% 8/365 $49.32 $728.77 $30,000.00 You can earn partial credit on this problem.arrow_forward

- Best Credit offer a credit card with an annual percentage rate of 14.98%, a 30 day statement period and a further 25 days interest free. Calculate the amount of interest charged on an outstanding balance of $625, given that the first purchase was made on the first day of the 30-day period and the balance was paid on day 69. Assume that no other purchases were made. (No dollar sign required) Answer:arrow_forwardA machine shop has a credit card that offers rebates on purchases. At the end of May, the company had a credit card bill of $19,474.38. If the company must make a minimum payment that is the greater of $500 or 4.5% of the credit card bill, what is the minimum monthly payment for May? (Round your answer to the nearest cent.) $?arrow_forwardA machine shop has a credit card that offers rebates on purchases. At the end of May, the company had a credit card bill of $19,462.41. The company must make a minimum payment that is the greater of $500 or 4.5% of the credit card bill. (a) What is 4.5% of the credit card bill? (Round your answer to the nearest cent.) (b) What is the minimum monthly payment for May? (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education