Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

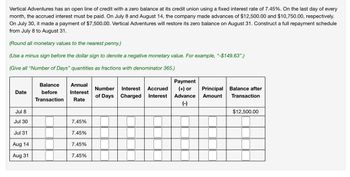

Transcribed Image Text:Vertical Adventures has an open line of credit with a zero balance at its credit union using a fixed interest rate of 7.45%. On the last day of every

month, the accrued interest must be paid. On July 8 and August 14, the company made advances of $12,500.00 and $10,750.00, respectively.

On July 30, it made a payment of $7,500.00. Vertical Adventures will restore its zero balance on August 31. Construct a full repayment schedule

from July 8 to August 31.

(Round all monetary values to the nearest penny.)

(Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63".)

(Give all "Number of Days" quantities as fractions with denominator 365.)

Date

Balance Annual

before Interest

Transaction Rate

Number Interest Accrued

of Days Charged Interest

Payment

(+) or

Advance

(-)

Principal Balance after

Amount Transaction

Jul 8

$12,500.00

Jul 30

7.45%

Jul 31

7.45%

Aug 14

7.45%

Aug 31

7.45%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Complete the following: (Do not round intermediate calculations. Round your final answers to the nearest cent.). Amount of invoice $ 705 Terms 5/10, n/60 Invoice date 7/25 Actual partial payment made $ 505 Date of partial payment 7/29 Amount of payment to be credited Balance. outstandingarrow_forwardCalculate the monthly finance charge for the credit card transaction. Assume that it takes 10 days for a payment to be received and recorded, and that the month is 30 days long. (Round your answers to the nearest cent.) $3,000 balance, 11%, $90 payment (a) previous balance method $ Correct: Your answer is correct. (b) adjusted balance method $ Incorrect: Your answer is incorrect. (c) average daily balance method $ Incorrect: Your answer is incorrect.arrow_forwardAnswer full question. Round the final answer to 2 decimal points.arrow_forward

- Journalize the transactions. Assume 360 days for interest calculations and record two entries for transactions on January 5th, April 1st and June 20th. Record one entry on December 1. If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blank. June 1 Received a $1,700, 120-day, 8% note from Heidi Kruczkiewicz to settle an account receivable. July 1 Heidi Kruczkiewicz’s note (see June 1) is discounted at Marshall Bank at a discount rate of 12%. 29 Received notification from Marshall Bank that Heidi Kruczkiewicz’s note was dishonored. (See June 1 and July 1.) A check is issued to cover the maturity value plus a $50 bank fee that must be paid to the bank.arrow_forwardSuppose that on the statement for a money market account, the initial balance was $7744.70, the statement was for 34 days, the final balance was $7770.84, and there were no deposits or withdrawals. Calculate the APY. Give your answer in percent to 2 decimal places.arrow_forwardA credit card bill for $655 was due on April 14. Purchases of $155.56 were made on April 19. The amount $22.45 was charged on April 21 and $203.36 was charged on April 28. A payment of $500 was made on April 25. Find the average daily balance (in dollars) if the next due date is May 14. (Round your answer to the nearest cent.) $?arrow_forward

- Suppose you have a revolving credit account at an annual percentage rate of 12%, and your previous monthly balance is $383.79. Find your new balance (in $) if your account showed the following activity. Use the unpaid balance method. (Round your answer to the nearest cent.)arrow_forwardOn the April 5 billing date, Michaelle Chappell had a balance due of $978.09 on her credit card. From April 5 through May 4, Michaelle charged an additional $454.12 and made a payment of $600. a) Find the finance charge on May 5, using the previous balance method. Assume that the interest rate is 1.5% per month. b) Find the new balance on May 5.arrow_forwardOne of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $580 per month. You will charge .98 percent per month interest on the overdue balance. If the current balance is $14,800, how long will it take for the account to be paid off? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Number of monthsarrow_forward

- On august 10, a credit card account had a balance of $345. A purchase of $64 was made on august 15, and $165 was charged on august 27. A payment of $71 was made on august 15. The interest on the average daily balance is 1.35% per month. Find the finance charge on September 10 bill. (Round your answer to two decimal places)arrow_forwardOn August 10, a credit card account had a balance of $345. A purchase of $52 was made on August 15, and $161 was charged on August 27. A payment of $71 was made on August 15. The interest on the average daily balance is 1.35% per month. Find the finance charge on the September 10 bill. (Round your answer to two decimal places.)arrow_forwardVishuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education