Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:10:40

Back

G

Finance Millionaire.docx

for-smarter-investing

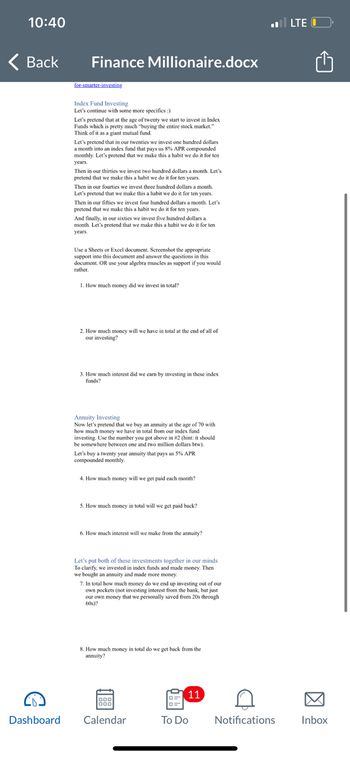

Index Fund Investing

Let's continue with some more specifics :)

Let's pretend that at the age of twenty we start to invest in Index

Funds which is pretty much "buying the entire stock market."

Think of it as a giant mutual fund.

Let's pretend that in our twenties we invest one hundred dollars

a month into an index fund that pays us 8% APR compounded

monthly. Let's pretend that we make this a habit we do it for ten

years.

Then in our thirties we invest two hundred dollars a month. Let's

pretend that we make this a habit we do it for ten years.

Then in our fourties we invest three hundred dollars a month.

Let's pretend that we make this a habit we do it for ten years.

Then in our fifties we invest four hundred dollars a month. Let's

pretend that we make this a habit we do it for ten years.

And finally, in our sixties we invest five hundred dollars a

month. Let's pretend that we make this a habit we do it for ten

years.

Use a Sheets or Excel document. Screenshot the appropriate

support into this document and answer the questions in this

document. OR use your algebra muscles as support if you would

rather.

1. How much money did we invest in total?

2. How much money will we have in total at the end of all of

our investing?

3. How much interest did we earn by investing in these index

funds?

Annuity Investing

Now let's pretend that we buy an annuity at the age of 70 with

how much money we have in total from our index fund

investing. Use the number you got above in #2 (hint: it should

be somewhere between one and two million dollars btw).

Let's buy a twenty year annuity that pays us 5% APR

compounded monthly,

4. How much money will we get paid each month?

5. How much money in total will we get paid back?

6. How much interest will we make from the annuity?

Let's put both of these investments together in our minds

To clarify, we invested in index funds and made money. Then

we bought an annuity and made more money.

7. In total how much money do we end up investing out of our

own pockets (not investing interest from the bank, but just

our own money that we personally saved from 20s through

60s)?

8. How much money in total do we get back from the

annuity?

998

Dashboard Calendar

DE

11

To Do

A

.. LTE

Notifications

Inbox

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following table shows the average returns for some of the largest mutual funds commonly found in retirement plans. (Assume end-of-month deposits and withdrawals and monthly compounding, and assume that the quoted rate of return continues indefinitely.) Mutual Fund $ Rate of Return Fidelity Growth Company 14.83% Vanguard 500 Index 13.25% PIMCO Total Return Stock fund 2.77% Type Stock fund For the past 15 years you have been depositing $600 per month in the PIMCO bond fund, and you have now transferred your current balance to the Vanguard bond fund, where you plan to continue depositing $600 per month until you retire in 20 years. How much can you anticipate having in the investment when you retire? HINT [See Example 1.] (Round your answer to the nearest cent.) Vanguard Total Bond Market Index Bond fund 2.67% Bond fundarrow_forwardA mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10 %.Required:(i) What is the rate of return in the fund?arrow_forwardMutual funds can be classified basing on execution and operations or basing on yield and investment pattern, briefly describe the classification of mutual funds from these two basis 28. With examples, briefly discuss the importance of mutual funds to an economy 29. Akiba Unit Trust Fund has a prospective average annual return of 8% over the next 20 years. Estimate the value of a Tshs 20,000,000 investment after 20 years when the returns are i. Tax-free, (3 Marks) ii. Subject to a deferred tax of 30% iii. Subject to an annual tax of 25% 30. Briefly analyze the difference between defined benefit plan and defined contribution plan as applied in the pension funds 31. Mr Domokaya works as Director of finance in TPL Ltd a publicly owned institution where He earns a salary of Tshs 6,000,000 per month. Mr Domokaya expects to hold that position for the next 40 years before retirements. After retirement, Mr Domokaya expects to live for further 30 years. Mr Domokaya wishes to…arrow_forward

- Suppose you own a mutual fund which has 13,000,000 shares outstanding. If its total assets are $36,000,0000 and its liabilities are $5,000,000, find the net asset value (in $) of the fund. Round to the nearest cent. 2$ Need Help? Read It Watch It Master Itarrow_forwardConsider a mutual fund that manages a portfolio of securities worth $120 million.Suppose the fund owes $4 million to its investment advisers and owes another $1million for rent, wages due, and miscellaneous expenses.The fund has 5 million shareholders.What is the Net Asset Value?arrow_forwardman.2arrow_forward

- Bhaarrow_forwardOne year ago you bought 100 shares of a mutual fund for $14.50 per share, and you received a $0.52 per - share capital gain distribution during the past 12 months. The fund has an annual 12b-1 fee of 0.35 percent and an expense ratio of 1.65 percent. The market value of the fund is now $18. Calculate the total dollar return for this investment if you were to sell it now. (Convert and round to 2 decimals) Calculate the total percentage return for this investment if you were to sell it now. (Convert and round to 1 decimal)arrow_forwardYou are considering investing in a mutual fund. The fund is expected to earn a return of 13 percent in the next year. If its annual return is normally distributed with a standard deviation of 17 percent, what return can you expect the fund to beat 95 percent of the time? (Note: Write your answer as decimals with three decimal places. For example, if you answer is -8.7%, you should write -0.087 in the answer box. DO NOT write -8.7 in the box as you will be marked wrong).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education