Concept explainers

(Amortization of Accumulated OCI (G/L), Corridor Approach, Pension Expense Computation) The actuary for the pension plan of Gustafson Inc. calculated the following net gains and losses.

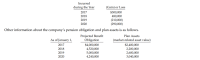

Check the below image for net gains and losses , pension obligation and plan assets .

Gustafson Inc. has a stable labor force of 400 employees who are expected to receive benefits under the plan. The total serviceyears for all participating employees is 5,600. The beginning balance of accumulated OCI (G/L) is zero on January 1, 2017. The market-related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization.

Instructions

(Round to the nearest dollar.)

Prepare a schedule which reflects the minimum amount of accumulated OCI (G/L) amortized as a component of net periodic pension expense for each of the years 2017, 2018, 2019, and 2020. Apply the “corridor” approach in determining the amount to be amortized each year.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

- Blossom Corp. sponsors a defined benefit pension plan for its employees. On January I, 2025, the following balances relate to this plan. Plan assets: $460,000 Projected benefit obligation: $606,500 Pension asset/liability: $146,500 Accumulated OCI (PSC): 104,200 Dr. As a result of the operation of the plan during 2025, the following additional data are provided by the actuary. Service cost: $93,500 Settlement rate, 10% Actual return on plan assets: $54,600 Amortization of prior service cost: $18,100 Expected return on plan assets: $51,600 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions: $76,600 Contributions: $100,500 Benefits paid retirees: $84,300 Using the data above, compute pension expense for Blossom for the year 2025 by preparing a pension worksheet. (Enter all amounts as positive.)arrow_forwardThe following data relate to Ramesh Company's defined benefit pension plan: ($ in millions) $690 69 55 118 13 20 90 Plan assets at fair value, January 1 Expected return on plan assets Actual return on plan assets Contributions to the pension fund (end of year) Amortization of net loss Pension benefits paid (end of year) Pension expense Required: Determine the amount of pension plan assets at fair value on December 31. (Enter your answers in millions. Amounts to be deducted should be indicated with a minus sign.) Pension Plan Assets Beginning of the year End of the yeararrow_forwardThe following data relate to Ramesh Company's defined benefit pension plan: ($ in millions) Plan assets at fair value, January 1 $720 Expected return on plan assets 72 Actual return on plan assets 58 Contributions to the pension fund (end of year) 124 Amortization of net loss 14 Pension benefits paid (end of year) 17 Pension expense 96 Required: Determine the amount of pension plan assets at fair…arrow_forward

- Brooks Co. had pension plan assets and PBO of $150,000 on 1/1/24. Service cost for the year was $30,000. It contributed $28,000 during the year and paid benefits of $20,000. The interest rate was 10%. The actual return was $14,000. Compute pension expense. Show computations'arrow_forwardHarrison Forklift's pension expense includes a service cost of $12 million. Harrison began the year with a pension liability of $32 million (underfunded pension plan). 1. Interest cost, $8; expected return on assets, $6; amortization of net loss, $2. 2. Interest cost, $8; expected return on assets, $6; amortization of net gain, $2. 3. Interest cost, $8; expected return on assets, $6; amortization of net loss, $2; amortization of prior service cost, $3 million. Required: Prepare the appropriate general journal entries to record Harrison's pension expense in each of the above independent situations regarding the other (non-service cost) components of pension expense ($ in millions): (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) Journal entry worksheet 1. Prepare the appropriate journal entry to record pension expense in situation 1 above. 2.…arrow_forwardThe following incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). ($ in millions)Debit(Credit)PBO Plan Assets Prior Service Cost Net(Gain)/Loss Pension Expense Cash Net Pension (Liability)/Asset Beginning balance (740) 32 (94) Service cost 66 Interest cost 37 Expected return on assets 72 Gain/loss on assets (4) Amortization of: Prior service cost (10) Net gain/loss 5 Loss on PBO (12) Contributions to fund (49) Retiree benefits paid (69) Ending balance 745 (85) What was the net pension asset/liability reported in the balance sheet at the end of the year? Multiple Choice Net pension liability of $41 million. Net pension asset of $58 million. Net pension…arrow_forward

- Harrison Forklift's pension expense includes a service cost of $24 million. Harrison began the year with a pension liability of $44 million (underfunded pension plan). ($ in millions) 1. Interest cost, $12; expected return on assets, $18; amortization of net loss, $5. 2. Interest cost, $20; expected return on assets, $15; amortization of net gain, $5. 3. Interest cost, $20; expected return on assets, $15; amortization of net loss, $5; amortization of prior service cost, $6. Required: Prepare the appropriate general journal entries to record Harrison's pension expense in each of the following independent situations regarding the other (non-service cost) components of pension expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet 1 2 3 Prepare the appropriate journal entry to record pension expense…arrow_forwardThe following information relates to the pension plan for the employees of Cullumber Co.: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) O $665200 gain. O $282200 loss. 1/1/20 $110600 gain. $272400 gain. $8140000 8665000 7825000 -0- $ 12/31/20 8560000 9358000 9820000 (1402000 ) 11% 8% 12/31/21 $ 11500000 12907000 10954000 (1570000 ) 11% Cullumber estimates that the average remaining service life is 16 years. Cullumber's contribution was $1213000 in 2021 and benefits paid were $877000. The unexpected gain or loss on plan assets in 2021 is 7%arrow_forwardThe following information relates to the pension plan for the employees of Blossom Company: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) 1/1/25 $7940000 8465000 7625000 O $26250. O $17456. O $20238. O $14188. 0 12/31/25 $8360000 9158000 9620000 (1382000) 11% 8% 12/31/26 $11300000 12707000 10754000 (1550000) 11% 7% Blossom estimates that the average remaining service life is 16 years. Blossom's contribution was $1323000 in 2026 and benefits paid were $987000. The amount of AOCI (net gain) amortized in 2026 isarrow_forward

- How do I go about calculating pension payouts to determine a company's financial obligation? Additional info is below: Postretirement BenefitsPeyton Approved has revised its postretirement plan. It will now provide health insurance to retired employees. Management has requested that you report the short- and long-term financial implications of this. The company is currently employing 60, and actuaries estimate that the company has a pension liability of $107,041.70. The estimated cost of retired employees’ health insurance is $43,718.91. Prepare adjusting entries for the pension liability and the health insurance liabilityarrow_forwardThe following data are for the pension plan for the employees of Carla Vista Company. Accumulated benefit obligation Projected benefit obligation Plan assets (at fair value) AOCL - net loss Settlement rate (for year) Expected rate of return (for year) 1/1/20 $5700000 $107000. $35300. $41300. $102300. 6100000 5300000 0 12/31/20 $ 5900000 6300000 6700000 1023000 11% 9% 12/31/21 $ 7500000 8100000 7300000 1070000 10% Carla Vista's contribution was $910000 in 2021 and benefits paid were $820000. Carla Vista estimates that the average remaining service life is 10 years. The corridor for 2021 was $670000. The amount of AOCI-net loss amortized in 2021 was 7%arrow_forwardThe following Incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). ($ in millions) Debit (Credit) Beginning balance Service cost Interest cost Expected return on assets Gain/loss on assets Amortization of: Prior service cost Net gain/loss Loss on PBO Contributions to fund Retiree benefits paid Ending balance What was the actuary's Interest (discount) rate? Multiple Choice O 17% PBO (300) (12) Prior Plan Service Net Pension Net Pension Assets Cost (Gain)/Loss Expense Cash (Liability)/Asset 43 (185) 83 (88) 866 (11) (5) 6 (96) 77 51 (60)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education