FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

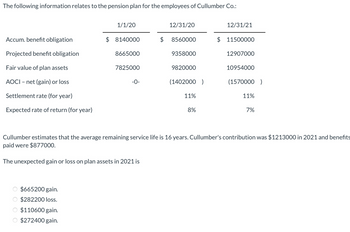

Transcribed Image Text:The following information relates to the pension plan for the employees of Cullumber Co.:

Accum. benefit obligation

Projected benefit obligation

Fair value of plan assets

AOCI - net (gain) or loss

Settlement rate (for year)

Expected rate of return (for year)

O $665200 gain.

O $282200 loss.

1/1/20

$110600 gain.

$272400 gain.

$8140000

8665000

7825000

-0-

$

12/31/20

8560000

9358000

9820000

(1402000 )

11%

8%

12/31/21

$ 11500000

12907000

10954000

(1570000 )

11%

Cullumber estimates that the average remaining service life is 16 years. Cullumber's contribution was $1213000 in 2021 and benefits

paid were $877000.

The unexpected gain or loss on plan assets in 2021 is

7%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information relates to the pension plan for the employees of Blossom Company: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) 1/1/25 $7940000 8465000 7625000 O $26250. O $17456. O $20238. O $14188. 0 12/31/25 $8360000 9158000 9620000 (1382000) 11% 8% 12/31/26 $11300000 12707000 10754000 (1550000) 11% 7% Blossom estimates that the average remaining service life is 16 years. Blossom's contribution was $1323000 in 2026 and benefits paid were $987000. The amount of AOCI (net gain) amortized in 2026 isarrow_forwardSandhill Co. had the following selected balances at December 31, 2021: Projected benefit obligation $4,640,000 Accumulated benefit obligation 4,540,000 Fair value of plan assets 4,285,000 Accumulated OCI (PSC) 165,000 Calculate the pension asset/liability to be recorded at December 31, 2021. Pension $arrow_forwardThe actuary for the pension plan of Sheridan Inc, calculated the following net gains and losses. Incurred during the Year 2020 2021 2022 2023 As of January 1, 2020 2021 Other information about the company's pension obligation and plan assets is as follows. 2022 2023 2020 2021 2022 2023 (Gain) or Loss $301,200 $ 477,600 Projected Benefit Obligation $ (211,500) (290,200) $ $ Year Minimum Amortization of (Gain) Loss Sheridan Inc. has a stable labor force of 400 employees who are expected to receive benefits under the plan. The total service-years for all participating employees is 4,800. The beginning balance of accumulated OCI (G/L) is zero on January 1, 2020. The market- related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization. $3,996,200 Compute the minimum amount of accumulated OCI (G/L) amortized as a component of net periodic pension expense for each of the years 2020, 2021,…arrow_forward

- * Your answer is incorrect. The following data are for the pension plan for the employees of Cullumber Company. Accumulated benefit obligation Projected benefit obligation Plan assets (at fair value) AOCL - net loss Settlement rate (for year) Expected rate of return (for year) 1/1/25 $5034000 O $624000. $424000. • $334000. $534000. 5434000 4634000 0 12/31/25 $5234000 5658000 6034000 994000 9% 7% 12/31/26 $6834000 7434000 6658000 1034000 8% 6% Cullumber's contribution was $874000 in 2026 and benefits paid were $784000. Cullumber estimates that the average remaining service life is 15 years. The actual return on plan assets in 2026 wasarrow_forwardThe following information relates to the pension plan for the employees of Blossom Co.: Accum, beneht obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) 1/1/20 The corridor for 2021 is $10240000 10765000 9925000 -0- 12/31/20 $10660000 11458000 11920000 (1612000) 9% 9% 12/31/21 $ 13600000 15007000 13054000 (1780000) 9% 8% Blossom estimates that the average remaining service life is 16 years. Blossom's contribution was $1423000 in 2021 and benefits paid were $1087000.arrow_forwardThe following data are for the pension plan for the employees of Cullumber Company. 1/1/21 12/31/21 12/31/22 Accumulated benefit obligation $7350700 $7645600 $9968000 Projected benefit obligation 7998200 8232800 10689500 Market-related asset value 7468400 8350600 9015100 Plan assets (at fair value) 7762800 8824400 9904500 Unrecognized net loss Settlement rate (for year) 0 1453000 1492600 10% 9% Expected rate of return (for year) 9% 8% Cullumber's contribution was $1248800 in 2022 and benefits paid were $1104800. Cullumber estimates that the average remaining service life is 15 years. The actual return on plan assets in 2022 was $752700. The unexpected gain on plan assets in 2022 was O $37904. O $138396. $84652. O $46748.arrow_forward

- The following data are for the pension plan for the employees of Oriole Company. 1/1/20 12/31/20 12/31/21 Accumulated benefit obligation $ 5300000 $ 5500000 $ 7100000 Projected benefit obligation 5700000 5900000 7700000 Plan assets (at fair value) 4900000 6300000 6900000 AOCL - net loss 987000 1030000 Settlement rate (for year) 10% 10% Expected rate of return (for year) 7% 7% Oriole's contribution was $870000 in 2021 and benefits paid were $780000. Oriole estimates that the average remaining service life is 15 years. Assume that the actual return on plan assets in 2021 was $560000. The unexpected gain on plan assets in 2021 was $70000. $77000. $119000. O $130000.arrow_forwardThe following information relates to the pension plan for the employees of Oriole Co.: 1/1/20 12/31/20 12/31/21 Accum. benefit obligation $ 9540000 $ 9960000 $ 12900000 Projected benefit obligation 10065000 10758000 14307000 Fair value of plan assets 9225000 11220000 12354000 AOCI – net (gain) or loss -0- (1542000 ) (1710000 ) Settlement rate (for year) 10% 10% Expected rate of return (for year) 7% 6% Oriole estimates that the average remaining service life is 16 years. Oriole's contribution was $1353000 in 2021 and benefits paid were $1017000.The corridor for 2021 is $673200. $1430700. $1122000. $858420.arrow_forwardThe following information relates to the pension plan for the employees of RR Co.: 1/1/19 12/31/19 12/31/20 Defined benefit obligation P5,580,000 P5,976,000 P8,004,000 Fair value of plan assets 5,100,000 6,240,000 6,888,000 Net (gain) or loss 0 (164,000) (96,000) Discount rate (for year) 11% 11% RR estimates that the average remaining service life is 16 years. RR's contribution was P756,000 in 2020 and benefits paid were P564,000. The actual return on plan assets in 2020 is?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education