ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Jiger meoun Hand written solution is not allowed.

Transcribed Image Text:Incorrect

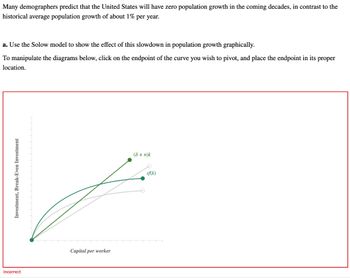

Many demographers predict that the United States will have zero population growth in the coming decades, in contrast to the

historical average population growth of about 1% per year.

a. Use the Solow model to show the effect of this slowdown in population growth graphically.

To manipulate the diagrams below, click on the endpoint of the curve you wish to pivot, and place the endpoint in its proper

location.

Investment, Break-Even Investment

Capital per worker

(6+ n)k

sf(k)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 11arrow_forwardIf the details of the quantity to be produced for a period are as follows, how many units are produced? The opening inventory is 160 units; units sold are estimated to be 200 units; the desired closing stock is 100 units. a. 200 units b. 260 units c. 460 units d. 140 unitsarrow_forwardMethod of full coating is taking into account a. Only direct costs and respective contribution margin b. All costs including fixed and variable costs c. Only direct costs and respective gross margin d. Total sum of fixed costs,but only a paid amount of variable cosarrow_forward

- BVM manufactured and sold 25,000 small statues this past year. At that volume, the firm was exactly in a breakeven situation in terms of profitability. BVM’s unit costs are expected to increase by 30% next year. What additional information is needed to determine how much the production volume/sales would have to increase next year to just break even in terms of profitability? (a) Costs per unit (b) Sales price per unit and costs per unit (c) Total fixed costs, sales price per unit, and costs per unit (d) No data is needed, the volume increase is 25, 000 + 25, 000(0.30) = 32, 500 units.arrow_forwardCosts and revenues (in thousands) 99 15 30 45 60 75 901052013550165 80195 Quantity per period (in thousands) Tools 1 O Aarrow_forwardNonearrow_forward

- The future value of 1000 Rand for 8% interest rate over 6 years is a certain value. At what interest rate will you get the same future value when you change the period to 3 years for the same 1000 Rand? Hint use goal seekarrow_forwardI will split this question into two parts per the Q&A guidlines and leave a like for your assistance, thank you.Background:New Pumper system equipment is under consideration by a gulf coast chemical processing plant. One crucial pump moves highly corrosive liquids from specially lined tanks on intercoastal barges into storage and preliminary refining facilities dockside. Beacuse of the variable quality of the raw chemical and the igh pressures imposed on the pump chassis and impellers, a close log is maintained on the number of hours per year that the pump operates safety records and pump componenet deterioration are considered critical control points for this system. As currently planned, rebuild and M&O cost estimates are increased accordingly when cummulative operating time reaches the 6000-hour mark. Information:- First cost: $800,000- Rebuild Cost: $150,000 whenever 6000 cumulative hours are logged. Each rework will cost 20% more than the previous one. A maximum of three…arrow_forwardGiven the following information for an insurance company that writes 24-month term policies: Number of Vehicles 50 100 Policy Group A B Effective Date January 1, 2010 Expiration Date December 31, 2011 July 1, 2010 June 30, 2012 All policies within each group have the same effective date. (a) Calculate the earned car-years for calendar year 2011. (b) Calculate the earned car-years for policy year 2010 evaluated as of December 31, 2010 and as of December 31, 2011. (c) Assume Policy Group B cancels on January 1, 2011. Calculate the 2010 policy year written car- years evaluated as of December 31, 2010 and as of December 31, 2011 for Policy Group B. (d) Assume Policy Group B cancels on July 1, 2011. Calculate the 2010 and 2011 calendar year written car-years for Policy Group B.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education