FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please explain,I don't understand.

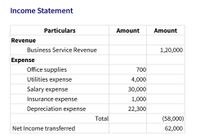

Transcribed Image Text:Income Statement

Particulars

Amount

Amount

Revenue

Business Service Revenue

1,20,000

Expense

Office supplies

700

Utilities expense

4,000

Salary expense

30,000

Insurance expense

1,000

Depreciation expense

22,300

Total

(58,000)

Net Income transferred

62,000

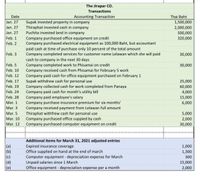

Transcribed Image Text:The Jirapar CO.

Transactions

Date

Accounting Transaction

Thai Baht

Supak invested property in company

Thiraphat invested cash in company

Puchita invested land in company

Jan. 27

1,500,000

Jan. 27

2,000,000

500,000

320,000

Jan. 27

Company purchased office equipment on credit

Company purchased electrical equipment as 100,000 Baht, but accountant

Feb. 1

Feb. 2

paid cash at time of purchase only 10 percent of the total amount

Company completed services for customer name Lelawan which she will paid

cash to company in the next 30 days

Company completed work to Phisamai on credit

Company received cash from Phisamai for February 5 work

Company paid cash for office equipment purchased on February 1

Supak withdrew cash for personal use

Company collected cash for work completed from Panaya

Company paid cash for month's utility bill

Company paid employee's salary

Company purchase insurance premium for six months'

Company received payment from Lelawan full amount

Thiraphat withfrew cash for personal use

Company purchased office suppied by cash

Company purchased computer equipment on credit

Feb. 3

30,000

Feb. 5

30,000

Feb. 10

Feb. 12

Feb. 17

25,000

Feb. 19

60,000

Feb. 24

4,000

Feb. 28

15,000

Mar. 1

6,000

Mar. 3

Mar. 5

5,000

Mar. 10

2,000

Mar. 12

30,000

Additional items for March 31, 2021 adjusted entries

Expired insurance coverage

Office supplied on hand at the end of march

Computer equipment - depreciation expense for March

Unpaid salaries since 1 March

Office equipment - depreciation expense per a month

(a)

1,000

(b)

|(c)

|(d)

|(e)

1,300

300

15,000

2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is underpricing? Why is it used? What evidence do we have to support the belief that underpricing is a regular problem?arrow_forwardWhat is Descartes's account of error? How do we make one and how can we avoid making one?arrow_forwardAre you concerned about high deficits? Why are why not?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education