Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

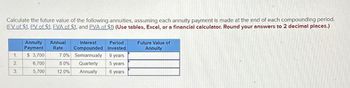

Transcribed Image Text:Calculate the future value of the following annuities, assuming each annuity payment is made at the end of each compounding period.

(FV of $1. PV of $1, EVA of $1, and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.)

1.

Annuity

Payment

$ 3,700

Annual

Rate

Interest

Period

Compounded Invested

Future Value of

Annuity

7.0%

Semiannually 9 years

2.

6,700

8.0%

Quarterly

5 years

3.

5,700

12.0%

Annually

6 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the following time value of money tables for Questions 1-4. Round answers to the nearest dollar. (The annual interest rate for all problems is 6%.) n = 3; i = 6% n = 6; i = 3% Future value of 1 1.19102 1.19405 Present value of 1 .83962 .83748 Future value of an annuity 3.18360 6.46841 Present value of an annuity 2.67301 5.41719 Redlands Inc. wishes to make a series of $1,000 cash withdrawals semiannually, beginning on June 30, 2020. Redlands plans to make its sixth and final withdrawal on December 31, 2022. The amount of money Redlands must place into a savings account to meet this objective on January 1, 2020 is $arrow_forwardAn annuity pays a fixed amount of $3,000 at the end of each of the next 5 years. Assume the interest rate is 8%. Use Excel, and list the time period (0, 1, 2, 3, 4, 5) and the amount $3,000. Then, Use Excel function to calculate the present value of the annuity.Use Excel function to calculate the future value of the annuity 5 years (enf of 5th year) from now.Submit the Excel file with all the details of time periods, amount of payment, and the Excel functions used to calculate the answers.arrow_forwardUse Table 12-2 to calculate the present value (in $) of the annuity due. (Enter a number. Round your answer to the nearest cent.) Annuity Payment Payment Frequency Time Nominal Interest Period (years) Rate (%) Compounded Present Value of the Annuity $300 every month (2 1/4) 6 monthly $ Need Help? Read Itarrow_forward

- Use Table 12-1 to calculate the future value (in $) of the annuity due. (Round your answer to the nearest cent.) Annuity Payment Time Nominal Interest Future Value Payment Frequency Rate (%) Compounded Period (years) of the Annuity $40 every month monthly $ 2960.67arrow_forwardImage attached of questionarrow_forwardSuppose the interest rate is 6.9 APR with monthly compounding. What is the present value of an annuity that pays $110 every three months for five years? (Note: Be careful not to round any intermediate steps less than six decimal places.) Question content area bottom Part 1 The present value of the annuity is $ enter your response here. (Round to the nearest cent.)arrow_forward

- For each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i = interest rate, and n = number of years) (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answers to nearest whole dollar amount.) Present Value Annuity Amount i = n = 1. ? $2,400 8% 5 2. 533,082 140,000 ? 4 3. 583,150 180,000 9% ? 4. 530,000 75,502 ? 8 5. 235,000 ? 10% 4arrow_forwardFor each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i=interest rate, and n=number of years)(FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of 1$ and PVAD of $1) (Use appropriate factor (s) from the tables provided. Round your final answers to nearest whole dollar amount.) Present Value Annuity Amount i= n= ______________ $ 2,600 8% 5 507,866 135,000 _____ 4 661,241 170,000 9% ____ 540,000 78,557 _____ 8 230,000 _____________ 10% 4arrow_forwardFind the amount accumulated FV in the given annuity account. HINT [See Quick Example 1 and Example 1.] (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $2,300 is deposited quarterly for 10 years at 7% per year FV = $arrow_forward

- Solve by using formulas. (Round your answer to the nearest cent.) Ordinary Annuity AnnuityPayment PaymentFrequency TimePeriod (years) NominalRate (%) InterestCompounded Future Valueof the Annuity (in $) $5,000 every 6 months 9 9.0 semiannually $arrow_forwardcalculate the present value (in $) of the ordinary annuity. (Round your answer to the nearest cent.) AnnuityPayment PaymentFrequency TimePeriod (years) NominalRate (%) InterestCompounded Present Valueof the Annuity $3,000 every year 20 5 annually $arrow_forwardTABLE 13.2 Present value of an annuity of $1 ½% 8% 1% 0.9901 2% 0.9804 3% 0.9709 4% 0.9615 5% 0.9524 1.8594 6% 7% 0.9434 0.9346 0.9259 9% 10% 11% 12% 0.9174 0.9091 0.9009 0.8929 0.9950 1.9851 1.9704 1.9416 1.9135 1.8861 2.9702 2.9410 2.8839 2.8286 2.7751 2.7232 3.9505 3.9020 3.8077 3.7171 3.6299 3.5459 1.7591 1.7355 1.7125 1.6901 2.5313 2.4869 2.4437 2.4018 3.2397 3.1699 3.1024 3.0373 3.8897 3.7908 3.6959 3.6048 4.4859 4.3553 4.2305 4.1114 4.9259 4.8534 4.7134 4.5797 4.4518 1.8334 1.8080 1.7833 2.6730 2.6243 2.5771 3.4651 3.3872 3.3121 4.1002 3.9927 4.6229 5.2064 5.7466 4.3295 4.2124 5.8964 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 6.8621 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.0330 4.8684 7.8230 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 8.7791 8.5660 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 4.7122 4.5638 5.5348 5.3349 5.1461 4.9676 5.9952 5.7590 5.5370 5.3282 6.4177 6.1446 5.8892 5.6502 6.8052 7.1607 8.9826 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education