FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up80%

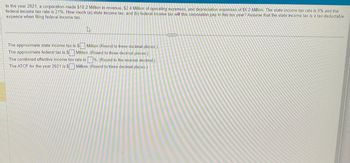

Transcribed Image Text:In the year 2021, a corporation made $18.2 Million in revenue, $2.4 Million of operating expenses, and depreciation expenses of $6.2 Million. The state income tax rate is 9% and the

federal income tax rate is 21%. How much (a) state income tax, and (b) federal income tax will this corporation pay in this tax year? Assume that the state income tax is a tax-deductable

expence when filing federal income tax.

Et

The approximate state income tax is $ Million (Round to three decimal places.)

The approximate federal tax is $ Million. (Round to three decimal places.)

The combined effective income tax rate is%. (Round to the nearest decimal.)

The ATCF for the year 2021 is $ Million. (Round to three decimal places.)

www

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- LNS Corporation reports book income of $2,940,000. Included in the $2,940,000 is $17,500 of tax-exempt interest income. LNS reports $2,560,000 in ordinary and necessary business expenses. What is LNS Corporation's taxable income for the year? Answer is complete but not entirely correct. $ 640,000 Taxable incomearrow_forwardAm.101.arrow_forwardAssume the following facts for Munoz Company in 2019. Munoz reported pretax financial income of $800,000. In addition, Munoz reported the following differences between its pretax financial income and taxable income: • Interest income of $60,000 was received during 2019 from an investment in municipal bonds. This income is exempt for tax purposes. • Rent income of $40,000 was collected in 2018 and included for tax purposes during that year. For financial statement purposes, it will be reported as earned equally in 2019 and 2020. • An asset with a 5-year life was purchased during 2019; straight-line depreciation for book purposes was $50,000. MACRS depreciation expense for 2019 was $100,000. • Warranty expense of $20,000 was recognized on the 2019 income statement, while $4,000 was recognized for tax purposes. (Assume a 1-year warranty contract.) The balance of the Deferred Tax Asset account (debit) at January 1, 2019, was $16,000 as a result of the rent income temporary…arrow_forward

- In the year 2021, a corporation made $20.4 Million in revenue, $2.1 Million of operating expenses, and depreciation expenses of $6.4 Million. The state income tax rate is 12% and the federal income tax rate is 21%. How much (a) state income tax, and (b) federal income tax will this corporation pay in this tax year? Assume that the state income tax is a tax-deductable expence when filing federal income tax. The approximate state income tax is $ Million (Round to three decimal places.) The approximate federal tax is $ Million. (Round to three decimal places.) The combined effective income tax rate is%. (Round to the nearest decimal.) The ATCF for the year 2021 is $ Million. (Round to three decimal places.)arrow_forwardOn December 31, 2023, XYZ Inc. has an account payable of $2,000 for operating expenses incurred during the year. These expenses are only tax deductible when paid. XYZ normally pays for its operating expenses one month after they are incurred. Assuming a 20% tax rate, these expenses will result in: Multiple Choice О A deferred tax liability of $2,000. A deferred tax liability of $400. A deferred tax asset of $400. A deferred tax asset of $2,000.arrow_forwardFor the 2022 tax year, llex Corporation has ordinary income of $200,000, a short-term capital loss of $30,000 and a long-term capital gain of $10,000. Calculate llex Corporation's tax liability for 2022. fill in the blank 1 of 1$.arrow_forward

- Assuming a 35% statutory tax rate applies to all years involved, which of the following situations will give rise to reporting a deferred tax liability on the balance sheet?I. A revenue is recognized for financial reporting purposes but not for tax purposes.II. An expense is deferred for financial reporting purposes but not for tax purposes.III. An expense is deferred for tax purposes but not for financial reporting purposes.IV. A revenue is deferred for tax purposes but not for financial reporting purposes. Group of answer choices items I and II only items II and III only item II only items I and IV onlyarrow_forwardEach year there is a ceiling for the amount that is subject to all of the following except a.federal income tax b.federal unemployment tax c.social security tax d.state unemployment taxarrow_forwardBudget Corporation is a personal service corporation. Its taxable income for the current year is $75,000. What is the Budget's income tax liability for the year 2023?arrow_forward

- During fiscal year 2012, Dioubate Cie earned $10,000 of interest revenue on an investment in a tax-free municipal bond. Which of the following items would be increased by the municipal bond revenue? (check all that apply) Pre-Tax Income Income Tax Expense Taxable Income Income Tax Payable Deferred Tax Liabilities Adjust Drawarrow_forwardVishnuarrow_forwardGlennelle's Boutique Incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023. Required: 1. How the amount of tax expense for calendar 2022 and the amount of taxes payable (if any) at December 31, 2022, can be determined? a. The amount is estimated based on prior year taxes. b. The amount is estimated based on future year taxes. 2. Use the horizontal model to show the effect of accruing 2022 taxes of $6,900 at December 31, 2022. Indicate the financial statement effect.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education