FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

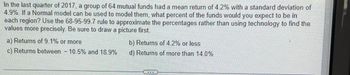

Transcribed Image Text:In the last quarter of 2017, a group of 64 mutual funds had a mean return of 4.2% with a standard deviation of

4.9%. If a Normal model can be used to model them, what percent of the funds would you expect to be in

each region? Use the 68-95-99.7 rule to approximate the percentages rather than using technology to find the

values more precisely. Be sure to draw a picture first.

a) Returns of 9.1% or more

c) Returns between - 10.5% and 18.9%

b) Returns of 4.2% or less

d) Returns of more than 14.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. Year 2018 2019 2020 2021 2022 Fund -14.85% 25.1 12.9 7.2 -1.5 Market -29.5% 20.0 10.9 8.0 -3.2 Risk-Free 3% 5 2 5 What are the Sharpe and Treynor ratios for the fund? Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Answer is complete but not entirely correct. Sharpe ratio Treynor ratio 0.1613 2.8377arrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is .97. Year 2015 2016 2017 2018 2019 Fund -17.0% Sharpe ratio Treynor ratio 25.1 13.3 6.4 -1.74 Market -33.5% 20.4 12.1 8.0 -3.2 Risk-Free 2% 6 2 5 3 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.)arrow_forwardConsider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation Beta A 6.95% 15% 0.7 B 8.35 15 1.1 C 10.45 15 1.7 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 4.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) What is the market risk premium (rM - rRF)? Round your answer to one decimal place. % What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. % What would you expect the standard deviation of Fund P to be? Less than 15% Greater than 15% Equal to 15%arrow_forward

- Last year, two mutual funds, OHH and FLL, reported the same return and standard deviation, but OHH's beta was higher than FLL's beta. Based on the Sharpe measure, which mutual fund performed better last year? A. FLL B. OHH C. They had the same performance. D. Undetermined because their alphas are unknown.arrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.87. Year 2018 2019 2020 2021 2022 Fund -14.85% 25,10 12.90 7.20 -1.50 Jensen's alpha Information ratio Market -29.50% 20.00 10.90 8.00 -3.20 Risk-Free 3% Calculate Jensen's alpha for the fund, as well as its information ratio. Note: Do not round intermediate calculations. Enter the alpha as a percent rounded to 2 decimal places. Round the ratio to 4 decimal places. 5 2 5 3 %arrow_forward17. Average Return and Standard Deviation. In a recent five-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Calculate (a) the average return on both the fund and the index and (b) the standard deviation of the returns on each. Did Ms. Sauros do better or worse than the market index on these measures? (LO11-3) Fund Market index 1 -1.2 -0.9 2 +24.8 +16.0 3 +40.7 +31.7 4 +11.1 +10.9 5 +0.3 -0.7arrow_forward

- Raghubhaiarrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is .97. Year Fund Market Risk-Free 2015 −18.80 % −36.50 % 1 % 2016 25.10 20.70 6 2017 13.60 13.00 2 2018 7.00 8.40 6 2019 −1.92 −4.20 2 Calculate Jensen’s alpha for the fund, as well as its information ratio. (Do not round intermediate calculations. Enter the alpha as a percent rounded to 2 decimal places. Round the ratio to 4 decimal places.)arrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.89. Year 2018 Fund -21.20% Market -40.50% Risk-Free 2% 2019 25.10 21.10 4 2020 14.00 14.20 2 2021 6.20 2022 -2.16 8.80 -5.20 4 3 Calculate Jensen's alpha for the fund, as well as its information ratio. Note: Do not round intermediate calculations. Enter the alpha as a percent rounded to 2 decimal places. Round the ratio to 4 decimal places. Jensen's alpha Information ratio %arrow_forward

- Investor has had the following returns in the Magic Fund for the past 4 years: 15%, 25%, -30%, 18%. c) State whether the annual geometric return (assume positive) should be higher, lower, or the same as the annual arithmetic return. Neither calculation nor explanation is necessary. d) State which measure, annual arithmetic return or annual geometric return, better represents how an investment performed over time. Neither calculation nor explanation is necessary.arrow_forwardThe 10-year historical return of your new mutual fund investment is 9.64%. During that same 10-year period the Standard Deviation (SDEV) of returns for that fund has been 7.73%. What are the possible future ranges of returns given the following confidence levels: 67% Confidence: Returns between ________ and ________; 95% Confidence: Returns between ________ and _______arrow_forwardit's not .80, .75, .35 or any number .10 - 1.0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education