FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

In the first picture, it's the question to be solved by just providing the transactions and showing its affects on other factors like asset, liability etc

In the second picture, it's the example given. By following this way, we need to solve the whole question . Please help me solving this problem. I'm waiting for the response.

Thankyou!

Transcribed Image Text:Stu Axe, an architect, opened an office on April 1, 2006. During the month, he comr

pleted the following transactions connected with his professional practice:

and

a. Transferred cash from a personal bank account to an account to be used for the

business, $17,500.

b. Purchased used automobile for $17.000, paying $2,000 cash and giving a note

payable for the remainder.

c. Paid April rent for office and workroom, $2,200.

d. Paid cash for supplies, S660.

e. Purchased office and computer equipment on acCount, $5,200.

f. Paid cash for annual insurance policies on automobile and equipment, $1,200.

g. Received cash from a client for plans delivered, $3,725.

h. Paid cash to creditors on account, $1,800.

i. Paid cash for miscellaneous expenses, $235.

j. Received invoice for blueprint service, due in May, $650.

k. Recorded fee earned on plans delivered, payment lo be received in May, $3,500.

1. Paid salary of assistant, $1,300.

mm. Paid cash for miscellancous expenses, $105.

n. Paid installment due on note payable, $200.

o. Paid gas, oil, and repairs on automobile for April, $115.

Instructions

1 Record the foregoing transactions directly in the following T accounts, without

journalizing: Cash; Accounts Receivable; Supplies; Prepaid Insurance; Automo-

biles: Equipment; Notes Payable; Accounts Payable; Stu Axe, Capital; Professional

Fees: Rent Expense; Salary Expense; Blueprint Expense; Automobile Expense; Mis-

cellaneous Expense. To the left of each amount entered in the accounts., place

the appropriate letter to identify the transaction.

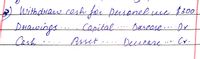

Transcribed Image Text:Wwith dyaw cash foi pusonel use $300

Derawings

Capital....Darease...Dy

Cash

Asset.

... Deucere.. Cy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The answer 417,974.94 was correct. Can you please help me solve without technology? Formulas used, etc. Thank you!arrow_forwardYou guys provided me an expert answer? Cuz the table for the part 1 of the p missing as well on volum PR what do i enter? and the part 2 has a table but c utilized.arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forward

- Can you tell me more about the role played by technology in contemporary accountancy?arrow_forwardThe goal of your research into information resources will be articulated by the question, "in the professional practice field of accounting and finance, what information needs to be encountered? What types of information resources will meet these needs? Where would the resources be located, and how would they be accessed?"arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education