Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN: 9781305506381

Author: James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

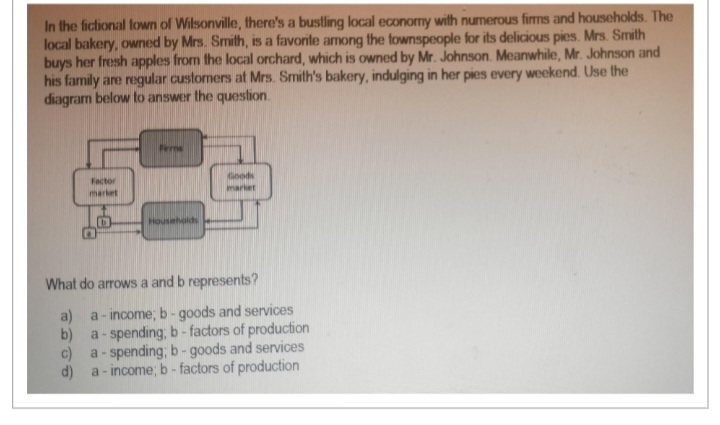

Transcribed Image Text:In the fictional town of Wilsonville, there's a bustling local economy with numerous firms and households. The

local bakery, owned by Mrs. Smith, is a favorite among the townspeople for its delicious pies. Mrs. Smith

buys her fresh apples from the local orchard, which is owned by Mr. Johnson. Meanwhile, Mr. Johnson and

his family are regular customers at Mrs. Smith's bakery, indulging in her pies every weekend. Use the

diagram below to answer the question.

Factor

market

G

Households

Good

market

What do arrows a and b represents?

a) a-income; b - goods and services

b) a-spending; b-factors of production

a-spending; b-goods and services

a-income; b - factors of production

c)

d)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Jane and Bill are apprehended for a bank robbery. They are taken into separate rooms and questioned by the police about their involvement in the crime. The police tell them each that if they confess and turn the other person in, they will receive a fighter sentence. If they both confess, they will be each be sentenced to 30 years. If neither confesses, they will each receive a 20-year sentence. If only one confesses, the they will receive 15 years and the one who stayed silent will receive 35 years. Table 10.7 below represents the choices available to Jane and Bill. If Jane trusts Bill to stay silent, what should she do? If Jane thinks that Bill will confess, what should she do? Does Jane have a dominant strategy? Does Bill have a dominant strategy? A = Confess; B = Stay Silent. (Each results entry lists Janes sentence first (in years), and Bills sentence second.)arrow_forwardSuppose the local electrical utility, a legal monopoly based on economies of scale, was split into four films of equal size, with the idea that eliminating the monopoly would promote competitive pricing of electricity. What do you anticipate would happen to prices?arrow_forwardWhat is predatory pricing?arrow_forward

- For many years, the Justice Department has tried to break up large firms like IBM, Microsoft, and most recently Google, on the grounds that their large market share made them essentially monopolies. In a global market, where U.S. films compete with firms from other countries, would this policy make the same sense as it might in a purely domestic context?arrow_forwardDoes each individual in a prisoners dilemma benefit more from cooperation or from pursuing self-interest? Explain briefly.arrow_forwardWould you rather have efficiency or variety? That is, one opportunity cost of the variety of products we have is that each product costs more per unit than if there were only one kind of product of a given type, like shoes. Perhaps a better question is, What is the right amount of variety? Can there be too many varieties of shoes, for example?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Principles of Microeconomics

Economics

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:Cengage Learning