FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

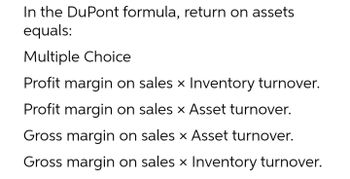

Transcribed Image Text:In the DuPont formula, return on assets

equals:

Multiple Choice

Profit margin on sales x Inventory turnover.

Profit margin on sales x Asset turnover.

Gross margin on sales x Asset turnover.

Gross margin on sales x Inventory turnover.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The gross profit percentage is equal to: A. Net operating income/Sales B. Cost of goods sold/Sales C. Cost of goods sold/Net income D. (Net operating income + Operating expenses)/Sales E. (Net operating income - Operating expenses) /Salesarrow_forwardWhich of the statements below is TRUE? a. Receivables turnover is accounts receivable divided by sales. b. Inventory turnover is cost of goods sold divided by accounts receivables. c. Total asset turnover is profits divided by total assets. d. A higher inventory turnover ratio signifies that inventory is moving faster.arrow_forwardThe equation for Gross Profit is "Gross Profit = Revenues - Cost of Goods." Which of the following would increase the Gross Profit?arrow_forward

- How do you calculate gross profit as a percentage of sales?arrow_forwardThe gross margin estimation method estimates the cost of goods sold by multiplying the costs to sales ratio by purchases. O multiplying the sales revenue by the inventory turnover ratio. multiplying the cost of goods available by the gross margin percentage. O multiplying the sales revenue by cost-to-sales ratio.arrow_forwardHow should you compute the number that appears as "cost of good sold" in a common-size income statement?arrow_forward

- Concept introduction Gross profit ratio: Gross profit ratio calculated by dividng the gross profit by sales.The formula to calculate the gross profit ratio is as follows: Gross profit = Gross profit/sales Gross profit is calculated using the following formula: Gross profit= Sales-Cost of Goods Sold To choose: The correct term for excess of sales over the cost of goods sold.arrow_forwardThe difference, (Total Revenue - Total Cost) or [(Unit Price x Quantity Sold) - (Fixed Cost + Variable Cost)], represents, O the break-even point O the profit equation O the sales ratio O the market share O the value equationarrow_forwardWhat is economic surplus defined as? A) The total revenue earned by a firm B) The difference between total revenue and total costs C) The total amount of money available for investment D) The value of goods produced in excess of demand Correct Answer: B) The difference between total revenue and total costsarrow_forward

- Gross profit will result if: O Sales revenues are greater than operating expenses. Operating expenses are greater than cost of goods sold. Sales revenues are greater than cost of goods sold. O Operating expenses are less than net income.arrow_forwardCost-volume-profit-analysis can be used to determine expected income from predicted sales and cost levels True Falsearrow_forward1. Which of the following shows the degree of operating leverage? The percentage change in the sales volume as the result of the percentage change in cost of the goods sold The percentage change in the net income as the result of the percentage change in the variable costs The percentage change in the sales volume as the result of the percentage change in the sales price The percentage change in the net inome as the result of the percentage change in the sales volume The percentage change in the operating income as the result of the percentage change in the sales volumearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education