FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

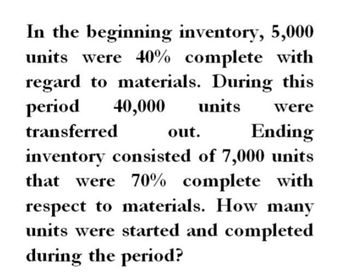

Transcribed Image Text:In the beginning inventory, 5,000

units were 40% complete with

regard to materials. During this

period 40,000 units were

transferred

out.

Ending

inventory consisted of 7,000 units

that were 70% complete with

respect to materials. How many

units were started and completed

during the period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Carmelita, Inc., has the following information available: Line Item Description Costs from Beginning Inventory Costs from Current Period Direct materials $4,200 $27,600 Conversion costs 6,700 152,200 At the beginning of the period, there were 500 units in process that were 41% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 5,400 units were started and completed. Ending inventory contained 400 units that were 27% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process costing method. The cost of completing a unit during the current period wasarrow_forwardGiven the following information, determine the equivalent units of ending work in process for materials and conversion under the weighted-average method: • beginning inventory of 2,500 units is 100% complete with regard to materials and 60% complete with regard to conversion • 18,000 units were started during the period • 17,700 units were completed and transferred • ending inventory is 100% complete with materials and 65% complete with conversionarrow_forwardProduction data show 23,185 units were transferred out of a stage of production and 9,366 units remained in ending WIP inventory that was 100% complete to material and 52% complete to conversion. The unit material cost is $2 for material and $9 for conversion. What is the amount of inventory transferred out? Round to the nearest whole dollar, no decimals.arrow_forward

- Production data show 27,626 units were transferred out of a stage of production and 7,834 units remained in ending WIP inventory that was 100% complete to material and 47% complete to conversion. The unit material cost is $8 for material and $4 for conversion. What is the amount of inventory transferred out? Round to the nearest whole dollar, no decimals.arrow_forwardA company started a new product, and in the first month started 64,735 units. The ending work in process inventory was 16,040 units that were 100% complete with materials and 67% complete with conversion costs. There were 16,040 units to account for, and the equivalent units for materials was $6 per unit while the equivalent units for conversion was $9 per unit. What is the value of the inventory transferred out, using the weighted-average inventory method?arrow_forwardProduction data for the month of September was: 13,400 units Completed and Transferred out 4,800 partially complete units in Ending Inventory, which were 70% complete as toconversion and 100% complete as to materialarrow_forward

- Loanstar had 50 units in beginning inventory before starting 900 units and completing 750 units. The beginning work in process inventory consisted of $2,000 in materials and $5,000 in conversion costs before $8,450 of materials and $9,450 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 50% complete with regard to conversion costs. Use the above information to complete a production cost report. Enter all amount as positive values. Production Cost Report Work in process completion percent 100% 50% Material Units Conversion Units Total UnitS Completed and transferred out Ending work in process Total units to account for Materials Conversion Total Costs to account for $4 $4 Beginning work in process Incurred during the period $4 Total costs to account for Equivalent units Cost per equivalent unit for department $ %24 %24 %24arrow_forwardDuring May, the number of equivalent units of materials applied to units produced by Department Q totaled 48,000, computed as follows: beginning inventory, 5,000 equivalent units; units started and completed in May, 37,000 equivalent units; and ending inventory, 6,000 equivalent units. On the basis of this information, which of the following statements is true? Multiple Choice There were more units in Department Q's ending inventory than in Department Q's beginning inventory for May. Department Q completed 48,000 units of product during May. The number of units transferred in May from Department Q to next process or department was 37,000. Department Q used enough materials during May to produce 48,000 equivalent units.arrow_forwardCompute the raw materials inventory turnover when the amount of raw materials used are 18,000 and had beginning inventory of 3,000 and ending inventory of 5,500.arrow_forward

- Subject: accountingarrow_forwardA production department's beginning inventory cost includes $490,000 of conversion costs. This department incurs an additional $1,037,500 in conversion costs in the month of March. Equivalent units of production for conversion total 925,000 for March. Calculate the cost per equivalent unit of conversion using the weighted-average method. Cost per equivalent unit of conversion Choose Numerator Choose Denominator Cost per equivalent unit of productionarrow_forwardThe following production data were taken from the records of the Finishing Department for June: Inventory in process, June 1 (36% completed) 4,600 units Completed units during June 57,700 units Ending inventory (60% complete) 3,400 units The number of conversion equivalent units of production in the June 30 Finishing Department inventory, assuming that the first-in, first-out method is used to cost inventories, isarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education