FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

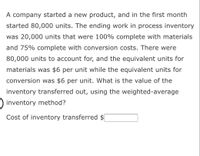

Transcribed Image Text:A company started a new product, and in the first month

started 80,000 units. The ending work in process inventory

was 20,000 units that were 100% complete with materials

and 75% complete with conversion costs. There were

80,000 units to account for, and the equivalent units for

materials was $6 per unit while the equivalent units for

conversion was $6 per unit. What is the value of the

inventory transferred out, using the weighted-average

inventory method?

Cost of inventory transferred $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carmelita, Inc., has the following information available: Line Item Description Costs from Beginning Inventory Costs from Current Period Direct materials $4,200 $27,600 Conversion costs 6,700 152,200 At the beginning of the period, there were 500 units in process that were 41% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 5,400 units were started and completed. Ending inventory contained 400 units that were 27% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process costing method. The cost of completing a unit during the current period wasarrow_forwardProduction data show 23,185 units were transferred out of a stage of production and 9,366 units remained in ending WIP inventory that was 100% complete to material and 52% complete to conversion. The unit material cost is $2 for material and $9 for conversion. What is the amount of inventory transferred out? Round to the nearest whole dollar, no decimals.arrow_forwardProduction data show 27,626 units were transferred out of a stage of production and 7,834 units remained in ending WIP inventory that was 100% complete to material and 47% complete to conversion. The unit material cost is $8 for material and $4 for conversion. What is the amount of inventory transferred out? Round to the nearest whole dollar, no decimals.arrow_forward

- A company started a new product, and in the first month started 64,735 units. The ending work in process inventory was 16,040 units that were 100% complete with materials and 67% complete with conversion costs. There were 16,040 units to account for, and the equivalent units for materials was $6 per unit while the equivalent units for conversion was $9 per unit. What is the value of the inventory transferred out, using the weighted-average inventory method?arrow_forwardA company uses the weighted average method for inventory at the end of the period 20,000 units were in the end he work in process inventory in or 100% complete for materials and 85% complete for conversion the quality cost per unit or materials $2.75 in conversion $2.26 computer cost would be assigned to the end he work in process inventory for the.arrow_forwardLoanstar had 50 units in beginning inventory before starting 900 units and completing 750 units. The beginning work in process inventory consisted of $2,000 in materials and $5,000 in conversion costs before $8,450 of materials and $9,450 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 50% complete with regard to conversion costs. Use the above information to complete a production cost report. Enter all amount as positive values. Production Cost Report Work in process completion percent 100% 50% Material Units Conversion Units Total UnitS Completed and transferred out Ending work in process Total units to account for Materials Conversion Total Costs to account for $4 $4 Beginning work in process Incurred during the period $4 Total costs to account for Equivalent units Cost per equivalent unit for department $ %24 %24 %24arrow_forward

- Carmelita, Inc., has the following information available: Costs from Beginning Inventory Direct materials. Conversion costs $5,000 5,200 Costs from Current Period The cost of completing a unit during the current period was Oa. $45.95 Ob. $36.76 Oc. $30.63 Od. $25.62 $29,600 149,800 At the beginning of the period, there were 400 units in process that were 40% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 5,500 units were started and completed. Ending inventory contained 400 units that were 27% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process costing method.arrow_forwardSubject: accountingarrow_forwardThe records of Fremont Corporation’s initial and unaudited accounts show the following ending inventory balances, which must be adjusted to actual costs. Units Unaudited Costs Work-in-process inventory 145,000 $ 799,927 Finished goods inventory 20,000 345,110 As the auditor, you have learned the following information. Ending work-in-process inventory is 40 percent complete with respect to conversion costs. Materials are added at the beginning of the manufacturing process, and overhead is applied at the rate of 80 percent of the direct labor costs. There was no finished goods inventory at the start of the period. The following additional information is also available. Costs Units Direct Materials Direct Labor Beginning inventory (80% complete as to labor) 79,000 $ 453,100 $ 655,000 Units started 450,000 Current costs 1,610,000 2,218,000 Units completed and transferred to finished goods inventory 384,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education