SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

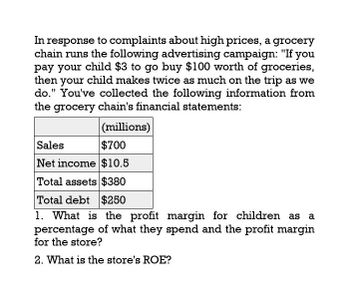

Transcribed Image Text:In response to complaints about high prices, a grocery

chain runs the following advertising campaign: "If you

pay your child $3 to go buy $100 worth of groceries,

then your child makes twice as much on the trip as we

do." You've collected the following information from

the grocery chain's financial statements:

(millions)

Sales

$700

Net income $10.5

Total assets $380

Total debt

$250

1. What is the profit margin for children as a

percentage of what they spend and the profit margin

for the store?

2. What is the store's ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In response to complaints about high prices, a grocery chain runs the following advertising campaign: “If you pay your child $1 to go buy $32 worth of groceries, then your child makes about twice as much on the trip as we do.” You’ve collected the following information from the grocery chain’s financial statements: (millions) Sales $ 764.00 Net income 11.95 Total assets 345.00 Total debt 155.00 a. What is the child’s profit margin? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the store’s profit margin? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the store's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardCan you please give correct answer?arrow_forwardM In response to complaints about high prices, a grocery chain runs the following advertising campaign:"If you pay your child $1 to go buy $31 worth of groceries, then your child makes about twice as much on the trip as we do." You've collected the following information from the grocery chain's financial statements: (in millions) Sales Net income Total assets Total debt $ 780.00 12.75 a. Child's profit margin b. Store's profit margin c. Store's ROE 385.00 159.00 a. What is the child's profit margin? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the store's profit margin? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. What is the store's ROE? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. %arrow_forward

- ?? Financial accounting questionarrow_forwardRemy is trying to decide if he should rent or buy. He is considering moving from his city in the next two years. He has about 15% saved for a down payment. Remy would like to start building equity, but the houses in the market in his budget are not what he likes. The apartments in his budget are things he liked with very nice amenities. Remy has asked for your help with his issue. Given this information, what do you think he should do rent or buy? Why?arrow_forwardPlease helparrow_forward

- A school purchasing manager is seeking to buy tablets from either Entity A or Entity B and will pay shipping costs. The purchase price is $500 each. Entity A purchases the tablets from the manufacturer, Banana Industries (for $400). Entity A has the tablets shipped to its distribution center in Denver, and then ships them to schools when a sale is made. Entity A at times offers discounts to schools in accordance with its marketing strategy. On the other hand, Entity B sells tablets from a variety of manufacturers including Banana Industries. When a sale is made, Entity B remits the proceeds to the manufacturer, and retains a 10% commission (here $50). Entity B has no discretion as to the sales price. The manufacturer then ship the equipment to the customer. For each arrangement, indicate how much revenue and gross profit should be recognized. Provide support for your answer from the ASC and cite the applicable provisions. You should cite like this: ASC 606-10-35-3(e) so we can find…arrow_forwardNeed help with this question solution general accountingarrow_forwardUrmilaarrow_forward

- Mike purchases a bicycle costing $156.90 sales taxes are 5% and local sales taxes are 3%. The store charges $20 for assembly. What is the total purchase price in dollars round your answer to the nearest cent? The answer the guy gave me before was $189 it was incorrect. arrow_forwardMike purchases a bicycle costing $152.70. State taxes are 4% and local sales taxes are 2%. The store charges $20 for assembly. What is the total purchase price (in $)? (Round your answer to the nearest cent.)_____arrow_forwardCan you please solve this accounting question ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you