FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

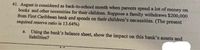

Transcribed Image Text:41. August is considered as back-to-school month when parents spend a lot of money on

books and other necessities for their children. Suppose a family withdraws $200,000

from First Caribbean bank and spends on their children's necessities. (The present

required reserve ratio is 13.64%)

a. Using the bank's balance sheet, show the impact on this bank's assets and

liabilities?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Saint Paul ne Apote n ts 0. Kyle used the equation y = 300(1.09)* , where x represents months and y represents the amount ne owes, to predict how much he has to pay on his credit card bill if he does not make any payments each month. a. What is Kyle's original credit card bill? b. What is the interest rate on his credit card? С. How much money will Kyle owe if he does not pay off his balance for 6 months? 9. The population of the deer on Walla Walla Island doubles every year. The island began with 8 deer. Write a function that models the change in the animal population: a. b. How many deer will there be after 5 years? How many deer will there be after 10 years? С.arrow_forwardWhen you were born, your grandparents put $5,000 in to a money market account to help with your college education. The bank gave them a guaranteed interest rate of 6% per year until you turned 18. How much money will be in the account on your 18th birthday if you never withdraw any money until that day? $11,417.20 $54,138.00 $1751.50 $14,271.50arrow_forwardW3.Part 2 – You have $10,000 to invest. Your Grandmother, who doesn’t trust banks, has advised you to put the money under your mattress to save for the future. Conversely, your Mother suggests you open a savings account at a bank. In your town, the banks are currently offering 3% interest. One bank (Bank A) compounds the interests each quarter (March 31, June 30, September 30, and December 31). The other bank (Bank B) compounds the interest on an annual basis (December 31). Assuming you would save your money for the next 10 years, what would your balance be in Bank A and in Bank B? Please describe your calculations within your response.arrow_forward

- 2. On April 1 Kendrick opened a savings account at a bank that paid 3.55 $1,000. On April 20 he withdrew $500. On April 30 the bank calculated the daily percent interest. His initial deposit was $3,200. On April 9 he deposited another interest. a) How much simple interest did his money earn? b) How much was in the account after the bank calculated the daily interest on April 30?arrow_forwardSuppose a family is depositing money into a bank account continuously, and the account earns interest of 4% annually (compounded continuously). The family began their first year with $23, 000 in the account. Assuming they don't make any withdrawals, how much money is in the account after 4 years? Answer should be $26,990.75arrow_forwardYou are the loan department supervisor for a bank. This installment loan is being paid off early, and it is your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round dollars to the nearest cent.) AmountFinanced Number ofPayments MonthlyPayment PaymentsMade RebateFraction FinanceChargeRebate LoanPayoff $1,900 18 $126.89 13 $ $arrow_forward

- You are the loan department supervisor for a bank. This installment loan is being paid off early, and it is your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round dollars to the nearest cent.) AmountFinanced Number ofPayments MonthlyPayment PaymentsMade RebateFraction FinanceChargeRebate LoanPayoff $4,700 36 $162.33 31 $ $arrow_forwardI need help solving the problem below in excel You can put your money in an account that earns 10.0% compounded annually or in a bank account that earns 9.75%, compounded daily? Which account should you choose?arrow_forwardSelecting a Bank. Julie wants to open a bank account with $43. Julie estimates that she will write 23 checks per month and use her ATM card at the home bank. She will maintain a monthly balance of $500. Which bank should Julie choose? Hillsboro Bank First National South Trust Bank Sun Coast Bank ATM charges: Home bank Free Free Free Free Other bank 5 free, then $1.15 per use $1.40 per use $1.40 per use $1.40 per use Checking: Minimum deposit $100 $28 $1 $1 Minimum balance required to avoid fees* N/A N/A $500 N/A Monthly fees $8.66 $10.11 $15.88 $3.61 Check-writing charges 15 free, then $0.85 per check 10 free, then $0.85 per check Unlimited Each check $0.43 * N/A means monthly fees apply irrespective of account balances. Based on the information given in the chart, which bank should Julie…arrow_forward

- Excel Skills 7. Solve the follow sections: a. Complete the following spreadsheet, showing how much will be in your bank account if you deposit an initial deposit (cell B2) today and it draws annual interest given in cell B1. Interest 2 Initial deposit 3 4 5 6 7 A 8 9 10 Year " 0 1 23 4 5 B b. Graph the results of the bank account. 8% $155 In bank account.arrow_forwardSuppose that before ATMs and credit cards, a person goes to the bank once at the beginning of each four-day period and withdraws from her savings account all the money she needs for four days. Assume that she spends $100 per day. Calculate the amount of money this person withdraws each time she goes to the bank.arrow_forwardthis is for financial mathematics, thank youuuuuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education