A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

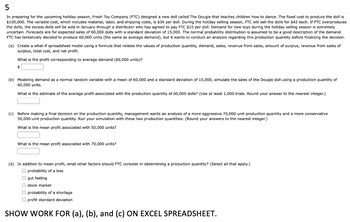

Transcribed Image Text:5

In preparing for the upcoming holiday season, Fresh Toy Company (FTC) designed new doll called The Dougie that teaches children how to dance. The fixed cost to produce the doll is

$100,000. The variable cost, which includes material, labor, and shipping costs, is $34 per doll. During the holiday selling season, FTC will sell the dolls for $42 each. If FTC overproduces

the dolls, the excess dolls will be sold in January through a distributor who has agreed to pay FTC $10 per doll. Demand for new toys during the holiday selling season is extremely

uncertain. Forecasts are for expected sales of 60,000 dolls with a standard deviation of 15,000. The normal probability distribution is assumed to be a good description of the demand.

FTC has tentatively decided to produce 60,000 units (the same as average demand), but it wants to conduct an analysis regarding this production quantity before finalizing the decision.

(a) Create a what-if spreadsheet model using a formula that relates the values of production quantity, demand, sales, revenue from sales, amount of surplus, revenue from sales of

surplus, total cost, and net profit.

What is the profit corresponding to average demand (60,000 units)?

$

(b) Modeling demand as a normal random variable with a mean of 60,000 and a standard deviation of 15,000, simulate the sales of the Dougie doll using production quantity of

60,000 units.

What is the estimate of the average profit associated with the production quantity of 60,000 dolls? (Use at least 1,000 trials. Round your answer to the nearest integer.)

(c) Before making a final decision on the production quantity, management wants an analysis of a more aggressive 70,000-unit production quantity and

50,000-unit production quantity. Run your simulation with these two production quantities. (Round your answers to the nearest integer.)

What is the mean profit associated with 50,000 units?

What is the mean profit associated with 70,000 units?

(d) In addition to mean profit, what other factors should FTC consider in determining a production quantity? (Select all that apply.)

O probability of a loss

O gut feeling

stock market

O probability of a shortage

Oprofit standard deviation

SHOW WORK FOR (a), (b), and (c) ON EXCEL SPREADSHEET.

more conservative

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Recapitulate provided information

VIEW Step 2: Create the what-if model in Excel

VIEW Step 3: Simulate the sales for the production quantity of 60,000

VIEW Step 4: Simulate the sales for the production quantities of 70,000 and 50,000

VIEW Step 5: Discuss other factors crucial to determining production quantity

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 10 images

Knowledge Booster

Similar questions

- 2arrow_forwardIn a hypothetical state, the government imposes a tax on the consumption of alcohol. The tax rate is set at 15% of the retail price of alcoholic beverages. If a bottle of whiskey retails for $50 before tax, what will be the total price including tax?arrow_forwardAcme Plumbing and Heating charges $45 for a service call plus $30 per hour. If the company estimates that a certain job will cost at least $255, how long will the job take?arrow_forward

- Suppose Nathan, Regina and Maxine go to a donut shop. Nathan buys 3 almond lover, 3 Bavarian kreme and 4 chocolate frosted donuts and ends up spending $14.40. Regina gets 6 of the almond lover, 7 Bavarian kreme and 3 chocolate frosted donuts for a total cost of $27.34. Lastly, Maxine spends $28.31 on 4 almond lover, 8 Bavarian kreme, and 7 chocolate frosted donuts. Assuming x = # of almond lover donuts, y = # of Bavarian kreme donuts, and 2 =# of chocolate frosted donuts, express the system of equations in augmented matrix form below: x y constant How much does each type of donut cost? Each almond lover donut costs $ Each Bavarian kreme donut costs $ Each chocolate frosted donut costs $arrow_forwardAlphonse donates a fair amount of money to various charities each year. He wants to know that his money is actually going to do the charity work, though. Suppose that 90% of the charities that he donates to are probably reputable and 10% are probably not. Also, suppose that 80% of the money that goes to the real charities ends up actually being used for the charity work, while 20% goes to administrative costs. If he donates the same amount to each charity, then what percent probably goes to actual charity work? 72| % SUBMIT ANSWER O ASK FOR HELP TURN IT IN to search 344 111 80 Y U D H. Varrow_forwardA chef must decide how many chocolate lava cakes to prepare for the upcoming Mother's Day Dinner special. The chef can either prepare 50, 100, or 150 lava cakes. Assume that demand for the lava cakes can be 50, 100, or 150. Each dish costs $5 to make and is priced at for $7 on the menu. Unsold cakes are donated to a nearby charity center. Assume that there is no opportunity cost for lost sales. The cafe owner told the chef that in the past years, the probability that clients will order 50 cakes is 0.30; the probability they will order 100 cakes is 0.50, and the probability that they will order 150 cakes is 0.20. What is the best alternative using the EMV criterion?arrow_forward

- DO ALL PASRT PLEASE!!!!!!!!!!!arrow_forwardA school district is buying new furniture for some classrooms. Each classroom must have 28 desks. The furniture company gives a special discount every 50 desks purchased. If the district wants to furnish complete classrooms with having to store any desks, and take full advantage of the discount what is the smallest number of desks it should purchase? How many rooms can be furnished with new desks?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON