Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hello tutor provide answer this financial accounting question

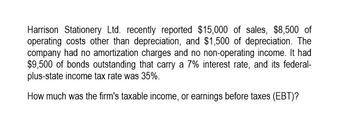

Transcribed Image Text:Harrison Stationery Ltd. recently reported $15,000 of sales, $8,500 of

operating costs other than depreciation, and $1,500 of depreciation. The

company had no amortization charges and no non-operating income. It had

$9,500 of bonds outstanding that carry a 7% interest rate, and its federal-

plus-state income tax rate was 35%.

How much was the firm's taxable income, or earnings before taxes (EBT)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Frederickson Office Supplies recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)? * 3935.93 3748.50 3400 3230 4000arrow_forwardFrederickson Office Supplies recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)?(general account)arrow_forwardFrederickson Office Supplies recently reported $10,000 of sales, $7,250 of operating costs other than depreciation and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes? a. $1,300 b. $1,100 c. $900 d. $1,200arrow_forward

- A company recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)? Show your answer using the income statement structure.arrow_forwardCan you please answer this financial accounting question?arrow_forwardHow much was the firm's taxable income or earnings before taxes on this financial accounting question?arrow_forward

- Meric Mining Inc. recently reported $16,300 of sales, $7,900 in operating costs other than depreciation, and $1,600 in depreciation. The company had no amortization charges, it had outstanding $6,550 of bonds that carry a 6.50% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's net income after taxes? Meric uses the same depreciation expense for tax and stockholder reporting purposes. Don't Use AIarrow_forwardMeric Mining Inc. recently reported $16,300 of sales, $7,900 in operating costs other than depreciation, and $1,600 in depreciation. The company had no amortization charges, it had outstanding $6,550 of bonds that carry a 6.50% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's net income after taxes? Meric uses the same depreciation expense for tax and stockholder reporting purposes.arrow_forwardMeric Mining Inc. recently reported $14,700 of sales, $7,600 of operating costs other than depreciation, and $1,100 of depreciation. The company had no amortization charges, it had outstanding $6,700 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 30%. How much was the firm's net income after taxes? Meric uses the same depreciation expense for tax and stockholder reporting purposes. Group of answer choices $3,320.84 $3,711.53 $3,906.88 $3,995.53 $4,102.22arrow_forward

- Edwards Electronics recently reported $15,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? Select the correct answer. a. $6,324.00 b. $6,349.50 Oc$6,273.00 O d. $6,298.50 e. $6,375.00arrow_forwardEdwards Electronics recently reported $11,250 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? a. $3,375.00 b. $3,045.94 c. $3,206.25 d. $2,748.96 e. $2,893.64arrow_forwardGeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning