FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Rahul

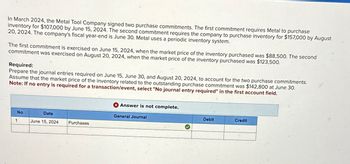

Transcribed Image Text:In March 2024, the Metal Tool Company signed two purchase commitments. The first commitment requires Metal to purchase

inventory for $107,000 by June 15, 2024. The second commitment requires the company to purchase inventory for $157,000 by August

20, 2024. The company's fiscal year-end is June 30. Metal uses a periodic inventory system.

The first commitment is exercised on June 15, 2024, when the market price of the inventory purchased was $88,500. The second

commitment was exercised on August 20, 2024, when the market price of the inventory purchased was $123,500.

Required:

Prepare the journal entries required on June 15, June 30, and August 20, 2024, to account for the two purchase commitments.

Assume that the market price of the inventory related to the outstanding purchase commitment was $142,800 at June 30.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

No

1

Date

June 15, 2024

Purchases

Answer is not complete.

General Journal

Debit

Credit

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education