FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

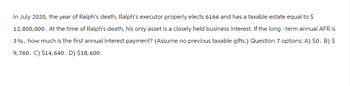

Transcribed Image Text:In July 2020, the year of Ralph's death, Ralph's executor properly elects 6166 and has a taxable estate equal to $

12,800,000. At the time of Ralph's death, his only asset is a closely held business interest. If the long-term annual AFR is

3%, how much is the first annual interest payment? (Assume no previous taxable gifts.) Question 7 options: A) $o. B) $

9,760. C) $14,640. D) $18, 600.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A-7arrow_forwardH2. profile-image Oliver, an insurance agent and sole practitioner, decided to sell his insurance agency to Grace. Under the terms of the sales agreement, Grace paid $8,000 for the goodwill that Oliver had garnered throughout his insurance career. The purchase was completed on March 3, 2021. What is Grace's 2021 deduction for amortization?arrow_forwardSuppose that at the beginning of 2019 José's basis in his S corporation stock was $17,000 and José has directly loaned the S corporation $5,000. During 2019, the S corporation reported an $75,000 ordinary business loss and no separately stated items. How much of the ordinary loss is deductible by José if he owns 40 percent of the S corporation? Explain the rule and show computation.arrow_forward

- 13. B purchased two parcels of land in 2016 for $50,000 each. Parcel 1 was purchased to hold until its value increased and then offered for sale. Parcel 2 was purchased to build a rental property and collect rents over time. In 2022 parcel 1 was sold for $40,000 and parcel 2 was sold for $100,000 as part of the rental property sale. Determine the amount that B’s net income for tax purposes will increase in 2022.arrow_forward22.Suppose that at the beginning of 2019 Jamaal's basis in his S corporation stock was $32,500 and Jamaal has directly loaned the S corporation $9,900. During 2019, the S corporation reported an $85,500 ordinary business loss and no separately stated items. How much of the ordinary loss is deductible by Jamaal if he owns 50 percent of the S corporation?arrow_forwardOn July 1, 2022, Gwen purchased an XYZ September 50 Put for $450. The option expired on September 17, 2022. How should this be reported on Gwen's 2022 return? No gain or loss. $450 of capital gain. $450 of capital loss. $450 of investment expense.arrow_forward

- A7arrow_forwardSuppose that at the beginning of 2020 Jamaal's basis in his S corporation stock was $27,000 and Jamaal has directly loaned the S corporation $10,000. During 2020, the S corporation reported an $80,000 ordinary business loss and no separately stated items. How much of the ordinary loss is deductible by Jamaal if he owns 50 percent of the S corporation? Question 10 options: a) $10,000 b) $27,000 c) $37,000 d) $40,000 e) $0arrow_forwardWhat is a Capital Asset?, Holding Period, and Calculation of Gain or Loss (LO 4.1, 4.2, 4.3) Martin sells a stock investment for $26,000 on August 2, 2021. Martin's adjusted basis in the stock is $15,000. a. If Martin acquired the stock on November 15, 2019, calculate the amount and the nature of the gain or loss. $1 Long-term capital gain b. If Martin had acquired the stock on September 10, 2020, calculate the amount and nature of the gain or loss. Short-term capital gainarrow_forward

- Problem 13-84 (LO. 8, 9) Karl purchased his residence on January 2, 2019, for $260,000, after having lived in it during 2018 as a tenant under a lease with an option to buy clause. On August 1, 2020, Karl sells the residence for $315,000. On June 13, 2020, Karl purchases a new residence for $367,000. If an amount is zero, enter "0". a. What is Karl's recognized gain? His basis for the new residence?Karl's recognized gain is $fill in the blank aa8a5403c02a012_1, and his basis for the new residence is $fill in the blank aa8a5403c02a012_2. b. Assume that Karl purchased his original residence on January 2, 2018 (rather than January 2, 2019). What is Karl's recognized gain? His basis for the new residence? Karl's recognized gain is $fill in the blank f8cfe3ffcff0ffc_1, and his basis for the new residence is $fill in the blank f8cfe3ffcff0ffc_2. c. In part (a), what could Karl do to minimize his recognized gain?To minimize his recognized gain, he can continue to…arrow_forwardJim and Jane file jointly and have AMTI of $1,000,000 before considering their AMT exemption. What is their AMTI after taking into consideration the exemption amount for their filing status for 2023? $0 $873,500 $126,500 $1,000,000arrow_forwardIn 2019, Mrs. Ulm paid $80,000 for a corporate bond with a $100,000 stated redemption value. Based on the bond's yield to maturity, amortization of the $20,000 discount was $1,512 in 2019, $1,480 in 2020, and $295 in 2021. Mrs. Ulm sold the bond for $84,180 in March 2021. Assume the taxable year is 2021. Required: a. What are her tax consequences in each year assuming that she bought the newly issued bond from the corporation? b. What are her tax consequences in each year assuming that she bought the bond in the public market through her broker? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B What are her tax consequences in each year assuming that she bought the bond in the public market through her broker? 2020 Ordinary Income Amount $ 0 2021 Ordinary Income $ 893 2021 Long-term capital gain $ 893 2019 Ordinary Income $ 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education