FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

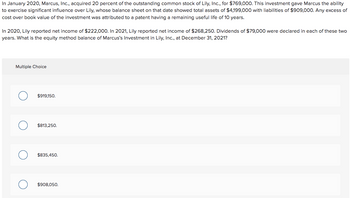

Transcribed Image Text:In January 2020, Marcus, Inc., acquired 20 percent of the outstanding common stock of Lily, Inc., for $769,000. This investment gave Marcus the ability

to exercise significant influence over Lily, whose balance sheet on that date showed total assets of $4,199,000 with liabilities of $909,000. Any excess of

cost over book value of the investment was attributed to a patent having a remaining useful life of 10 years.

In 2020, Lily reported net income of $222,000. In 2021, Lily reported net income of $268,250. Dividends of $79,000 were declared in each of these two

years. What is the equity method balance of Marcus's Investment in Lily, Inc., at December 31, 2021?

Multiple Choice

$919,150.

$813,250.

$835,450.

$908,050.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Matthew, Inc., owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2021, the balance in the Investment in Lindman account is $365,000. Amortization of excess fair value associated with the 30% ownership is $12,600 per year. In 2021, Lindman earns an income of $132,000 and declares cash dividends of $33,000. Previously, in 2020, Lindman had sold inventory costing $33,600 to Matthew for $56,000. Matthew consumed all but 20 percent of this merchandise during 2020 and used the rest during 2021. Lindman sold additional inventory costing $44,800 to Matthew for $80,000 in 2021. Matthew did not consume 40 percent of these 2021 purchases from Lindman until 2022. a. What amount of equity method income would Matthew recognize in 2021 from its ownership interest in Lindman? b. What is the equity method balance in the Investment in Lindman account at the end of 2021? a. b. Equity…arrow_forwardMatthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee’s operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $365,000. Amortization associated with this acquisition is $12,600 per year. In 2018, Lindman earns an income of $132,000 and declares cash dividends of $33,000. Previously, in 2017, Lindman had sold inventory costing $33,600 to Matthew for $56,000. Matthew consumed all but 20 percent of this merchandise during 2017 and used the rest during 2018. Lindman sold additional inventory costing $44,800 to Matthew for $80,000 in 2018. Matthew did not consume 40 percent of these 2018 purchases from Lindman until 2019. What amount of equity method income would Matthew recognize in 2018 from its ownership interest in Lindman? What is the equity method balance in the Investment in Lindman account at the end of 2018?arrow_forwardDenber Co. acquired 60% of the common stock of Kailey Corp. on September 1, 2019. For 2019, Kailey reported revenues of $810,000 and expenses of $630,000, not including its investment in Denber, and all reflected evenly throughout the year. The annual amount of amortization related to this acquisition was $15,000. What is the amount of the noncontrolling interest's share of Kailey's income for 2019? a. $72,000. b. $22,000. c. $66,000. d. $24,000. e. $48,000.arrow_forward

- On July 1, 2019, Killearn Company acquired 105,000 of the outstanding shares of Shaun Company for $19 per share. This acquisition gave Killearn a 40 percent ownership of Shaun and allowed Killearn to significantly influence the investee’s decisions. As of July 1, 2019, the investee had assets with a book value of $5 million and liabilities of $1,101,500. At the time, Shaun held equipment appraised at $280,000 more than book value; it was considered to have a seven-year remaining life with no salvage value. Shaun also held a copyright with a five-year remaining life on its books that was undervalued by $650,000. Any remaining excess cost was attributable to goodwill. Depreciation and amortization are computed using the straight-line method. Killearn applies the equity method for its investment in Shaun. Shaun's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1. Shaun's income, earned evenly throughout each year, was $640,000 in 2019, $670,600 in…arrow_forwardSurrell Inc. owns 30% of the outstanding voting common stock of Vicker Co. and has the ability to significantly influence the investee's operations and decision making. On January 1, 2019, the balance in the Investment in Vicker Co. account was $402,000. Amortization associated with this acquisition is $10,800 per year. During 2019, Vicker earned an income of $108,000 and paid cash dividends of $36,000. Previously in 2018, Vicker had sold inventory costing $28,800 to Surrell for $48,000. All but 25% of this merchandise was consumed by Surrell during 2018. The remainder was used during the first few weeks of 2019. Additional sales were made to Surrell in 2019; inventory costing $33,600 was transferred at a price of $60,000. Of this total, 40% was not consumed until 2020. What amount of equity income would Surrell have recognized in 2019 from its ownership interest in Vicker? $9,936. $24,840. $19,872. $21,114. $18,948.arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- Renfroe, Inc. acquired 10% of Stanley Corporation on January 4, 2020, for $90,000 when the book value of Stanley was $1,000,000. During 2020, Stanley reported net income of $215,000 and paid dividends of $50,000. The book value of the 10% investment was the same as the fair value of that investment when, on January 1, 2021, Renfroe purchased an additional 30% of Stanley for $325,000. Any excess of cost over book value is attributable to goodwill with an indefinite life. During 2021, Stanley reported net income of $320,000 and paid dividends of $50,000. How much is the adjustment to the Investment in Stanley Corporation for the change from the fair-value method to the equity method on January 1, 2021? O There is no adjustment. O A debit of $165,000. O A debit of $90,000 O A debit of $16,500arrow_forwardIn January 2020, Domingo, Inc., acquired 20 percent of the outstanding common stock of Martes, Inc., for $846,000. This investment gave Domingo the ability to exercise significant influence over Martes, whose balance sheet on that date showed total assets of $4,428,000 with liabilities of $978,000. Any excess of cost over book value of the investment was attributed to a patent having a remaining useful life of 10 years. In 2020, Martes reported net income of $221,000. In 2021, Martes reported net income of $266,000. Dividends of $94,000 were declared in each of these two years. What is the equity method balance of Domingo’s Investment in Martes, Inc., at December 31, 2021?arrow_forwardOn January 1, 2023, Payne Company bought a 15 percent interest in Scout Company. The acquisition price of $225,500 reflected an assessment that all of Scout’s accounts were fairly valued within the company’s accounting records. During 2023, Scout reported net income of $121,900 and declared cash dividends of $36,200. Payne possessed the ability to significantly influence Scout’s operations and, therefore, accounted for this investment using the equity method. On January 1, 2024, Payne acquired an additional 80 percent interest in Scout and provided the following fair-value assessments of Scout’s ownership components: Consideration transferred by Payne for 80% interest $ 1,454,400 Fair value of Payne's 15% previous ownership 272,700 Noncontrolling interest's 5% fair value 90,900 Total acquisition-date fair value for Scout Company $ 1,818,000 Also, as of January 1, 2024, Payne assessed a $435,000 value to an unrecorded database internally developed by Scout. The database is…arrow_forward

- On January 1, 2022, Oriole Corp. bought 28,000 shares of the available 100,000 common shares of Iceberg Inc., a publicly traded firm. This acquisition provided Oriole with significant influence. Oriole paid $722,000 cash for the investment. At the time of the acquisition, Iceberg reported assets of $2,493,000 and liabilities of $1,192,000. Asset values reflected fair market value, except for capital assets that had a net book value of $505,000 and a fair market value of $753,000. These assets had a remaining useful life of five years. For 2022 Iceberg reported net income of $390,000 and paid total cash dividends of $100,000. On May 16, 2023, Oriole sold 14,000 of its shares in Iceberg for $425,000. Oriole has no immediate plans to sell its remaining investment in Iceberg. Iceberg is actively traded, and stock price information follows: January 1, 2022 $29 December 31, 2022 $31 January 1, 2023 $32 (a) Assuming Oriole is using the equity method under ASPE. did the initial investment…arrow_forwardOn January 1, 2018, Harrison Ltd acquired 90 percent of Starr Company in exchange for $1,125,000 fair-value consideration. The fair value of the total net assets of Starr Company was assessed at $1,200,000. Starr Company reported a net profit of $70,000 in 2018 and $90,000 in 2019, with dividend declarations of $30,000 each year. Apart from its investment in Starr Company, Harrison had a net profit of $220,000 in 2018 and $260,000 in 2019 and declared dividends of $40,000 each year. During the year ending 31 December 2019, Harrison sold inventory to Starr for a price of $90,000. The inventory costs Harrison Ltd $50,000 to produce. 40% of the inventory is still on hand of Starr Company as at 31 December 2019. The management of Harrison Ltd measures non-controlling interest at fair value. Required: Based on the information given, what should be the total balance of the non-controlling interests reported in the consolidated financial statement as at December 31 2019 (Ignore the…arrow_forwardOn January 1, 2024, Pine Company owns 40 percent (124,000 shares) of Seacrest, Incorporated, which it purchased several years ago for $700,600. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2024, is $905,200. Excess patent cost amortization of $37,200 is still being recognized each year. During 2024, Seacrest reports net income of $846,000 and a $372,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 24,800 shares of Seacrest on August 1, 2024, for $236,528 in cash. However, Pine retains the ability to significantly influence the investee. During the last quarter of 2023, Pine sold $71,000 in inventory (which it had originally purchased for only $42,600) to Seacrest. At the end of that fiscal year, Seacrest's inventory retained $12,800 (at sales price) of this merchandise, which was subsequently sold in the first…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education