FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

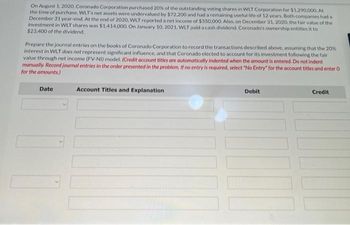

Transcribed Image Text:On August 1, 2020, Coronado Corporation purchased 20% of the outstanding voting shares in WLT Corporation for $1.290,000. At

the time of purchase, WLT's net assets were undervalued by $72,200 and had a remaining useful life of 12 years. Both companies had a

December 31 year-end. At the end of 2020, WLT reported a net income of $350,000. Also, on December 31, 2020, the fair value of the

investment in WLT shares was $1,414,000. On January 10, 2021, WLT paid a cash dividend. Coronado's ownership entitles it to

$23,400 of the dividend.

Prepare the journal entries on the books of Coronado Corporation to record the transactions described above, assuming that the 20%

interest in WLT does not represent significant influence, and that Coronado elected to account for its investment following the fair

value through net income (FV-NI) model. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O

for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 2, 2019, U Co. purchased 75% of the outstanding shares of N Co. resulting to a goodwill of P60,000. On that date, the non-cash assets of N Co. whose book values did not equal their book values were accounts receivable which was overstated by P4,500 and equipment with a remaining 5 year life on the purchase date which was understated by P50,000. For the year 2010, U and N reported net income of P350,000 and P200,000 each respectively. U’s beginning inventory included merchandise purchased from N Company amounting to P39,000 which was sold to them by N at a 30% markup, 80% of these goods were sold during the year. N, on the other hand, included inventory items which they purchased from U Co. amounting to 18,000. These goods were sold by U at a 25% markup. 90% of these goods were sold by N for the year. Determine the consolidated net income for 2020. compute for the total realized gross profit (from upstream and downstream sales)arrow_forwardiarrow_forwardOn January 1, 2021, Flesh-n-Bone Corporation acquired 30% of Doug Corporation's 200,000 outstanding shares at P50 per share. Doug's net assets had a book value on the same date at P8,200,000. On the acquisition date, the following assets were deemed understated: Building having a remaining useful life of 20 years was understated by P1,500,000. Equipment having a remaining life of 10 years was understated by P500,000. Doug reported net income for the year at P2,000,000 and paid cash dividends of P10 per share by December 31. 20. How much investment income should be reported in Flesh-n-Bone Corporation's profit or loss for 2021? a. 600,000 b. 577,500 c. 622,500 d. 562,500 21. What is the carrying amount of the investment in Doug as of December 31, 2021? a. 3,562,500 b. 3,000,000 c. 3,622,500 d. 3,022,500 The answer for number 20 is Letter C and for number 21 is Letter D. Please provide the solution for the two items showing the correct answers above.arrow_forward

- On January 1, 2019, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $50,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $242,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows: NI Div Paid 2019 $150,000 $33,600 2020 $166,400 $55,600 2021 $184,000 $75,000 On December 31, 2021, Vacker owed $20,800 to Carper. There have been no changes in Carper's common stock account since the acquisition. 2. Calculate the following amounts for individual accounts: the balance of investment in Carper on Vacker’s book on Dec 31st 2020; noncontrolling interest on consolidated financial statement on Dec 31st, 2020); and the balance of noncontrolling interest on Dec 31st 2021. 3. List all…arrow_forwardOn January 1, 2024, Green Corporation purchased 20% of the outstanding voting common stock of Gold Company for $300,000. The book value of the acquired shares was $275,000. The excess of cost over book value is attributable to an intangible asset on Gold's books that was undervalued and had a remaining useful life of five years. For the year ended December 31, 2024, Gold reported net income of $125,000 and paid cash dividends of $25,000. What is the carrying value of Green's investment in Gold at December 31, 2024?arrow_forwardOn August 1, 2020, Whispering Corporation purchased 20% of the outstanding voting shares in WLT Corporation for $1,300,000. At the time of purchase, WLT’s net assets were undervalued by $73,500 and had a remaining useful life of 12 years. Both companies had a December 31 year-end. At the end of 2020, WLT reported a net income of $320,000. Also, on December 31, 2020, the fair value of the investment in WLT shares was $1,425,000. On January 10, 2021, WLT paid a cash dividend. Whispering’s ownership entitles it to $18,100 of the dividend.Prepare the journal entries on the books of Whispering Corporation to record the transactions described above, assuming that the 20% interest in WLT does not represent significant influence, and that Whispering elected to account for its investment following the fair value through net income (FV-NI) model.arrow_forward

- Assume that, on January 1, 2021, Sycamore Corp. paid $2,040,000 for its investment in 36,000 shares of Starfish Inc. Further, assume that Starfish has 120,000 total shares of stock issued and estimates an eight-year remaining useful life and straight-line depreciation with no residual value for its depreciable assets. At January 1, 2021, the book value of Starfish's identifiable net assets was $7,060,000, and the fair value of Starfish was $10,000,000. The difference between Starfish's fair value and the book value of its identifiable net assets is attributable to $1,950,000 of land and the remainder to depreciable assets. Goodwill was not part of this transaction. The following information pertains to Starfish during 2021: Net Income $600,000 Dividends declared and paid $360,000 Market price of common stock on 12/31/2021 $ 80/share What amount would Sycamore Corp. report in its year-end 2021 balance sheet for its investment in Starfish Inc.? Multiple Choice $2,074,875. $2,220,000.…arrow_forwardAt the start of the current year, SBC Corp. purchased 30% of Sky Tech Inc. for $45 million. At the time of purchase, the carrying value of Sky Tech's net assets was $75 million. The fair value of Sky Tech's depreciable assets was $15 million in excess of their book value. For this year, Sky Tech reported a net income of $75 million and declared and paid $15 million in dividends.The total amount of additional depreciation to be recognized by SBC over the remaining life of the assets is:arrow_forwarddetermine adjusting entriesarrow_forward

- On January 1, 2022, Mojito Corporation purchased 20% (20,000 shares) of the outstanding stock of Dulcinea Corporation for $153,000. During 2022, Dulcinea Corporation paid total dividends of $45,000 and earned $80,000 in net income. At the end of 2022, Dulcinea Corporation’s stock had a fair market value of $155,000. Required: Prepare the journal entries that Mojito would make during 2022 assuming that they do NOT have significant influence over Dulcinea as a result of their stock ownership (i.e. fair value method). Prepare the journal entries that Mojito would make during 2022 assuming that they do have significant influence over Dulcinea as a result of their stock ownership (i.e. equity method).arrow_forwardDuring 2020, Peerless Company’s wholly-owned subsidiary, Safeco Inc. reported net income of $1,600,000 and declared and paid dividends of $600,000. Peerless acquired Safeco on January 2, 2020, at a cash cost of $8,000,000, which was $1,000,000 in excess of the book value of net assets acquired. Safeco’s equipment (five-year life) was undervalued by $500,000. Its inventory, reported using FIFO, was undervalued by $200,000. The remaining $300,000 could not be allocated to identifiable assets and liabilities. Impairment testing indicates that goodwill was impaired by $50,000 during 2020. Safeco’s beginning inventory was sold during 2020. Required: Prepare the journal entries recorded by Peerless in 2020 to record the acquisition and apply the complete equity method. Prepare the necessary eliminating entries to consolidate the financial statements of Peerless and Safeco at December 31, 2020.arrow_forwardM On January 1, 2023, Stream Company acquired 21 percent of the outstanding voting shares of Q-Video, Incorporated, for $718,000. Q- Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of $2.6 million and $768,000, respectively. A customer list compiled by Q-Video had an appraised value of $312,000, although it was not recorded on its books. The expected remaining life of the customer list was six years with straight-line amortization deemed appropriate. Any remaining excess cost was not identifiable with any particular asset and thus was considered goodwill Q-Video generated net income of $284,000 in 2023 and a net loss of $108,000 in 2024 In each of these two years, Q-Video declared and paid a cash dividend of $10,000 to its stockholders During 2023, Q-Video sold inventory that had an original cost of $80,000 to Stream for $160,000. Of this balance, $77,000 was resold to outsiders during 2023, and the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education