Economics Today and Tomorrow, Student Edition

1st Edition

ISBN: 9780078747663

Author: McGraw-Hill

Publisher: Glencoe/McGraw-Hill School Pub Co

expand_more

expand_more

format_list_bulleted

Question

Don't use ai to answer I will report your answer Solve it Asap with explanation and calculation

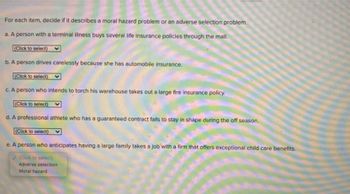

Transcribed Image Text:For each item, decide if it describes a moral hazard problem or an adverse selection problem.

a. A person with a terminal illness buys several life insurance policies through the mail.

(Click to select)

b. A person drives carelessly because she has automobile insurance.

(Click to select)

c. A person who intends to torch his warehouse takes out a large fire insurance policy.

(Click to select)

d. A professional athlete who has a guaranteed contract fails to stay in shape during the off season.

(Click to select)

e. A person who anticipates having a large family takes a job with a firm that offers exceptional child care benefits.

(Click to select)

Adverse selection

Moral hazard

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Recommended textbooks for you

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Survey of Economics (MindTap Course List)EconomicsISBN:9781305260948Author:Irvin B. TuckerPublisher:Cengage Learning

Survey of Economics (MindTap Course List)EconomicsISBN:9781305260948Author:Irvin B. TuckerPublisher:Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:9781305260948

Author:Irvin B. Tucker

Publisher:Cengage Learning