Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

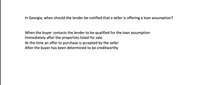

Transcribed Image Text:In Georgia, when should the lender be notified that a seller is offering a loan assumption?

When the buyer contacts the lender to be qualified for the loan assumption

Immediately after the properties listed for sale

At the time an offer to purchase is accepted by the seller

After the buyer has been determined to be creditworthy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- What is the main reason lenders pay borrowers' property taxes through a pre-paid escrow account? It prevents a tax lien from being applied to the home. The tax lien would be senior to the mortgage lien. It prevents the borrower from refinancing with another lender because they would lose all of their escrow funds. It allows the lender to earn interest on the pre- paid tax money as itsits in the account. It allows the lender to take advantage of corporate tax deductions.arrow_forwardAn agreement between two franchisors in which the two franchisors offer their products together is called double franchising.; True or Falsearrow_forwardIf you could create a new credit or deduction, what would you create? Please provide as much detail as possible as it pertains to rules and any potential exceptions. Also, would you prefer it to be a credit or deduction and why?arrow_forward

- White, an employee of ABC Corporation, intentionally issued two payments for the same invoice.After the disbursements had been mailed, White called the vendor and explained that a doublepayment had been made by mistake. She asked the vendor to return one of the checks to herattention. When the vendor returned the check, White took it and cashed it. This is an example of: a. A pass-through scheme b. A pay and return scheme c. A shell company scheme d. A receivables skimming schemearrow_forwardA private offering is a sale of securities in which: X investors may resell their stock within 3 months of acquisition. the security can only be sold within the home state of the offeror. the security is exempt from registration. the issuer provides less disclosures in return to selling less stock to fewer investors.arrow_forwardAn apartment building in Ithaca, New York with 72 units was financed with a $7.2 million non-recourse first mortgage loan at a 3.6% annual interest rate and an additional $3.6 million fully recourse second mortgage loan at a 7.2% annual interest rate. The owner later borrowed another $720,000 with a fully recourse third mortgage loan at a 10.8% annual interest rate. The borrower ultimately found itself in financial distress and unable to make the monthly mortgage payments on the three outstanding mortgage loans and the property went into foreclosure. What happens to the claims of the second and third mortgage lenders if the foreclosure lawsuit by the first mortgage lender includes all junior mortgage lenders and the property is sold to an unrelated third party for a net price of $6.6 million at the foreclosure sale? a. The mortgage liens of the junior claimants and the loan amounts owed to them are unaffected by the foreclosure sale b. The mortgage liens of the junior claimants are…arrow_forward

- es Congress has enacted a number of regulations that have established criteria for evaluating home loan applicants and mandating disclosures in the origination of home loans. Which of the following congressional acts requires important disclosures concerning the cost of consumer credit, including the computation of the annual percentage rate (APR)? Multiple Choice Equal Credit Opportunity Act (ECOA) Truth-in-Lending Act (TILA) Real Estate Settlement Procedures Act (RESPA) О Home Ownership and Equity Protection Act (HOEPA)arrow_forwardWhat is the importance of the settlor? Provide an explanationarrow_forwardStructural subordination occurs when O There is a holding company and a group lends to its operating subsidiary One group lends to a holding company and there is no debt at its operating subsidiaries One group lends to an operating subsidiary on an unsecured basis O One group lends to a holding company and another group lends to its operating subsidiaryarrow_forward

- Describe the basic features of each of the following types of bonds: Mortgage bonds Debentures Subordinated debentures Equipment trust certificates Collateral trust bonds Income bonds Explain the differences between par value, book value, and market value per share of common stock. Discuss the various stockholder rights.arrow_forwardExplain the differences between cooperative insurance and commercial insurance?arrow_forwardYou own a manufacturing company that has a very profitable contract with a large retail chain. One of your competitors learns of your agreement and contacts the retail chain, telling them that your products are poorly manufactured and that the retail chain should refrain from buying your products. Instead, the competitor suggests that the retail chain enter into a contract with them to manufacture the products they seek. After this conversation, the retail chain cancels the contract with your manufacturing company, essentially breaching the contract, and begins buying their required merchandise from your competitor. The products manufactured by your company are in fact very high quality products. There have never been complaints in the industry relative to the service or products that you provide. And, you have longstanding contractors with other retailers to support the quality of your product. Under the law, you can sue both the manufacturing competitor and the retail chain for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.