Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

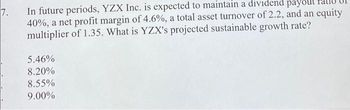

Transcribed Image Text:7.

In future periods, YZX Inc. is expected to maintain a dividend payout

40%, a net profit margin of 4.6%, a total asset turnover of 2.2, and an equity

multiplier of 1.35. What is YZX's projected sustainable growth rate?

5.46%

8.20%

8.55%

9.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If the Synyster Corp. has an ROE of 17 percent and a payout ratio of 25 percent, what is its sustainable growth rate?arrow_forwardThe Green Giant has a 7 percent profit margin and a 61 percent dividend payout ratio. The total asset turnover is 1.4 and the equity multiplier is 1.6. What is the sustainable rate of growth?arrow_forwardPlease helparrow_forward

- XYZ Corp. is anticipating a sustained growth rate of 15% per year. Is it possible for them to achieve this growth rate given the following numbers. Debtequity ratio of 0.40 times Profit margin is 5.3 percent Capital Intensity Ratio is 0.75 times To answer: determine what the dividend payout ratio must be. How do you interpret the result? no excel plzarrow_forwardQuestion: Growth and Profit Margin - Dante Co. wishes to maintain a growth rate of 12 percent per year, a debt-equity ratio of .85, and a dividend payout ratio of 30 percent. The ratio of total assets to sales is constant at .95. What profit margin must the firm achieve? Question: Sustainable Growth Rate - You have located the following information on Rock Company: debt ratio = 45%, capital intensity ratio = 2.45 times, profit margin = 18%, and dividend payout ratio = 35%. What is the sustainable growth rate for Rock?arrow_forwardFind the profitability index (PI) for the following series of future cash flows, assuming the company’s cost of capital is 13.85 percent. The initial outlay is $328,041. Year 1: $196,585 Year 2: $165,370 Year 3: $148,695 Year 4: $188,689 Year 5: $128,457arrow_forward

- If A7X Company has an ROA of 14 percent and a payout ratio of 16 percent, what is its internal growth rate?arrow_forward(Measuring growth) If Pepperdine, Inc.'s return on equity is 16 percent and the management plans to retain 59 percent of earnings for investment purposes, what will be the firm's growth rate? The firm's growth rate will be %. (Round to two decimal places.)arrow_forwardCompany has expected earnings of $4.8 per share for next year. The firm's ROE is 16%, and its earnings retention ratio is 55%. If the firm's market capitalization rate is 12%, what is the present value of its growth opportunities?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education