Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

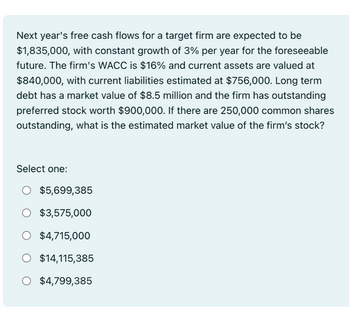

Transcribed Image Text:Next year's free cash flows for a target firm are expected to be

$1,835,000, with constant growth of 3% per year for the foreseeable

future. The firm's WACC is $16% and current assets are valued at

$840,000, with current liabilities estimated at $756,000. Long term

debt has a market value of $8.5 million and the firm has outstanding

preferred stock worth $900,000. If there are 250,000 common shares

outstanding, what is the estimated market value of the firm's stock?

Select one:

$5,699,385

O $3,575,000

O $4,715,000

O $14,115,385

O $4,799,385

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A company projects a rate of return of 20% on new projects. The executive team plan to plow back 20% of all earnings into the firm. Earnings this year will be $6 per share, and investors expect a rate of return of 12% on stocks facing the same risks as the company. 1) what is the sustainable growth rate 2) what is the stock price 3) What is the present value growth opportunities 4) what is the P/E ration 5) what would the price and PE ratio be if the firm paid out all earnings as dividends?arrow_forwardThe stock of Z-Tech Plc is currently selling for £10 per share. Earnings per share in the coming year are expected to be £1.50. The company has a policy of paying out 20% of its earnings each year in dividends. The rest is retained and invested in projects that earn a 7% internal rate of return per year. This situation is expected to continue indefinitely. a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Z-Tech’s investors require? b. By how much does Z-Tech’s stock price change if all its earnings are paid as dividends and nothing is reinvested? c. If the company were to increase its dividend payout ratio from 20% to 60%, what would happen to its stock price?arrow_forwardWild Berry (WB) will remain in business for one more year. At the end of next year, the firm will generate a liquidating cash flow of S370M in a boom year and S150M in a recession year; both states are equally likely. The cost of equity for the unlevered firm is rU = 10%. The firm's outstanding debt matures in a year and has amarket (and book) value of S150M today. The interest payment on this debt is S15M at the end of next year. The corporate tax is ?c = 35%. Corporate taxes is the only relevant market imperfection. 23. What s WB's value as an unlevered firm (VU )2 (A)5 236.4M (8)S 260.0M (€)5336.4M (D) $370.0Marrow_forward

- Laurel Enterprises pays annual dividends, and the next dividend is expected to be in one year. Laurel expects earnings next year of $3.58 per share and has a 50% retention rate, which it plans to keep constant. Its equity cost of capital is 11%, which is also its expected return on new investment; this is expected to continue forever. What do you estimate the firm's current stock price to be? (Hint: its next dividend is due in one year.) C The current stock price will be $ (Round to the nearest cent.)arrow_forwardWhat is the cash cow value and the value of its growth opportunities (NPVGO) if a corporation has current earnings of $5 per share and expects to be able to make an investment of 20% of its earnings next year in a new one-time project with an expected return on invested capital of 24%? The discount rate for the firm is 8%. Cash cow value is $62.50 and NPVGO is $1.85 Cash cow value is $20.83 and NPVGO is $2 Cash cow value is $62.50 and NPVGO is $14 Cash cow value is $25.00 and NPVGO is $3 Cash cow value is $25.00 and NPVGO is $3arrow_forwardNikularrow_forward

- NIKE Corporation will pay an annual dividend of $0.65 one year from now. It expects this dividend to grow at 12% per year thereafter until the fifth year. Thereafter, growth will level off at 2% per year. What is the value of a share of Gillette stock if the firm's equity cost of capital is 8% ?arrow_forwardConsider a firm that distributes the entire annual earnings to its shareholders through dividends once a year. The firm’s dividends are expected to grow at a rate of 8% per year for the next 5 years until the end of 2035. From 2036 on, the firm’s growth rate is expected to be 4% per year forever. Assume that investors command 12% return on the investments comparable to the firm’s stock. In addition, the firm has just paid an annual dividend of $10 per share at the end of 2030. Required: If you were considering buying the firm’s shares on the first day of 2031, at what price would you buy the shares?arrow_forwardI suppose the firms FCF is expected to be $30mn in one year $20mn in two years and there after the firms FCF’s are expected to increase by 5% a year for the forseeable future. Further suppose that the market value of the firms debt is $50mn and the market value of the firms preferred stock is $20mn and that the firm has 20 million shares of common stock outstanding. If the required return on the firms assets is 10% how much should the stock price per share be selling for?arrow_forward

- DataCore INc. has an all-equity capital structure. However, the firm is considering a recapitalization that would structure the firm with 25% debt and 75% equiy by issuing an appropriate amount of debt and repurchasing an equal amount of common stock; the debt is expected to have a 5% coupon rate. The firm expects the following scenarios over the next year for EBIT: Outlook Probability EBIT Good 35% $800,000 Average 40% $525,000 Poor 25% $75,000 The firm currently has 200,000 shared of common stock outstanding at $43 per share. The firm is in a 0% tax bracket 1. Determine the expected earnings before interest and taxes, net income, and earnings per share (a) if the firm maintains its current unlevered capital structure and (b) if it recapitalizes at 25% debt and uses the procedes to repurchase common stock. 2. Following the assumptions behind M&M's Proposition I, calculate the…arrow_forwardBanco Tech is an early stage financial technology firm. Earnings this year where $20 per share and are expected to grow at 20% per year for the next three years. Banco does not plan to pay a dividend until three years time, when the payout ratio will be 43%. Dividends are expected to grow at 6% thereafter. The required rate of return is 9%. Calculated intrinsic value.arrow_forwardABC Corporation just paid an annual dividend of $0.75. Analysts expect this dividend to grow at 10% in 2020, 8% in 2021, 5% in 2022, and then maintain a constant growth rate of 2%. If the expected cost of capital is 7% what is the present value of the stock?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education