FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

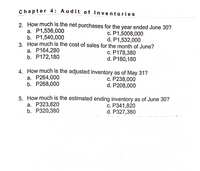

Transcribed Image Text:Chapter 4: Audit of Inventories

2. How much is the net purchases for the year ended June 30?

a. P1,536,000

b. P1,540,000

3. How much is the cost of sales for the month of June?

a. P164,280

b. P172,180

c. P1,5008,000

d. P1,532,000

c. P178,380

d. P180,180

4. How much is the adjusted inventory as of May 31?

a. P264,000

b. P268,000

c. P238,000

d. P208,000

5. How much is the estimated ending inventory as of June 30?

a. P323,820

b. Р320,380

с. Р341,820

d. P327,380

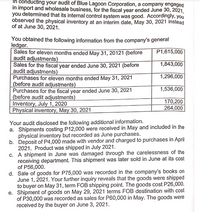

Transcribed Image Text:In conducting your audit of Blue Lagoon Corporation, a company engaged

in import and wholesale business, for the fiscal year ended June 30, 2021,

you determined that its internal control system was good. Accordingly, you

observed the physical inventory at an interim date, May 30, 2021 instead

of at June 30, 2021.

You obtained the following information from the company's general

ledger.

Sales for eleven months ended May 31, 20121 (before

audit adjustments)

Sales for the fiscal year ended June 30, 2021 (before

audit adjustments)

Purchases for eleven months ended May 31, 2021

(before audit adjustments)

Purchases for the fiscal year ended June 30, 2021

(before audit adjustments)

Inventory, July 1, 2020

Physical inventory, May 30, 2021

P1,615,000

1,843,000

1,296,000

1,536,000

170,200

264,000

Your audit disclosed the following additional information.

a. Shipments costing P12,000 were received in May and included in the

physical inventory but recorded as June purchases.

b. Deposit of P4,000 made with vendor and charged to purchases in April

2021. Product was shipped in July 2021.

c. A shipment in June was damaged through the carelessness of the

receiving department. This shipment was later sold in June at its cost

of P56,000.

d. Sale of goods for P75,000 was recorded in the company's books on

June 1, 2021. Your further inquiry reveals that the goods were shipped

to buyer on May 31, term FOB shipping point. The goods cost P26,000.

e. Shipment of goods on May 29, 2021 terms FOB destination with cost

of P30,000 was recorded as sales for P60,000 in May. The goods were

received by the buyer on June 3, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sandra: We are beginning our audit of Imex and have prepared ratio analyses to determine if there have been significant changes in financial position. This helps us guide the audit process. This analysis indicates that the inventory turnover has decreased from 5 to 2.8 and the accounts receivable turnover has decreased from 12 to 8. I was wondering if you could explain this change in operations. Travis: There is little need for concern. The inventory represents computers that we were unable to sell during the holiday buying season. We are confident, however, that we will be able to sell these computers as we move into the next fiscal year. Sandra: What gives you this confidence? Travis: We will increase our advertising and provide some very attractive price concessions to move these machines. We have no choice. Newer technology is already out there, and we have to unload this inventory. Sandra: …and the receivables? Travis: As you may be aware, the company is under tremendous pressure…arrow_forwardScope Limitations. D. Brady has been engaged as the auditor of Patriot Company andis currently planning the year-end physical inventory counts. Patriot is a retailer that holdssignificant inventories in its warehouses and stores in six regions across the United States.Because of timing and logistics, Brady is able to observe the physical inventory at only oneof Patriot’s warehouses, which accounts for 20 percent of Patriot’s inventories.In Brady’s professional judgment, the fact that inventories held at only one warehousecan be observed does not provide sufficient evidence with respect to Patriot’s inventorybalances at the date of the financial statements. Although physical inventory counts couldbe delayed at the remaining warehouses for Brady to observe the counts, the flow of goodsin and out of the warehouses would result in a discrepancy between the inventory quantitieson hand at year-end and the inventory quantities on hand at the date of the count.Required:a. Assume that Brady…arrow_forwardDuring the audit of BAC Company's 2029 financial statements, the auditors discovered that the 2029 ending inventory had been understated by $12,000 and that the 2029 beginning inventory was overstated by $9,000. Before the effect of these errors, 2029 pretax income had been computed as $115,000. What should be reported as the correct 2029 pretax income? A) $112,000 B) $94,000 C) $118,000 D) $136,000 E) $103,000arrow_forward

- Marilyn Terrill is the senior auditor for the audit of Uden Supply Company for the year ended December 31, 20X4. In planning the audit, Marilyn is attempting to develop expectations for planning analytical procedures based on the financial information for prior years and her knowledge of the business and the industry, including these: 1. Based on economic conditions, she believes that the increase in sales for the current year should approximate the historical trend in terms of actual dollar increases. 2. Based on her knowledge of industry trends, she believes that the gross profit percentage for 20X4 should be about 2 percent less than the percentage for 20X3. 3. Based on her knowledge of regulations, she is aware that the effective tax rate for the company for 20X4 has been reduced by 5 percent from that in 20X3. 4. Based on her knowledge of economic conditions, she is aware that the effective interest rate on the company's line of credit for 20X4 was approximately 12 percent. The…arrow_forwardAs a result of analytical procedures an auditor determines that gross profit has declined from 30% to 15% in the current year. The auditor should.. A. Document manamgent intentions with respect to reversing the trend. B. Evaluate managment's performance in causing the deline C. Require a footnote disclosure D. Consider the possibility of an error in the financial statements.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education