ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

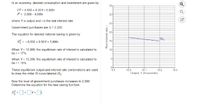

Transcribed Image Text:In an economy, desired consumption and investment are given by

35-

Cd = 4,500 + 0.20Y- 5,000r

N = 3,000 - 4,000r

30-

where Y is output and r is the real interest rate.

25-

Government purchases are G = 2,000.

20-

The equation for desired national saving is given by:

s4 = -6,500 + 0.80Y + 5,000r.

15-

When Y = 10,000, the equilibrium rate of interest is calculated to

10-

ber= 17%.

When Y = 10,200, the equilibrium rate of interest is calculated to

be r= 15%.

5-

These equilibrium output and interest rate combinations are used

to draw the initial IS curve labeled IS,-

9.9

10.0

10.1

10.2

10.3

Output, Y (thousands)

Now the level of government purchases increases to 2,500.

Determine the equation for the new saving function:

Real interest rate, r

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Ñ6arrow_forwardAssume there are no investment projects in the economy that yield an expected rate of return of 25 percent or more. But suppose there are $10 billion of investment projects yielding expected returns of between 20 and 25 percent; another $10 billion yielding between 15 and 20 percent; another $10 billion yielding between 10 and 15 percent; and so forth. a. Cumulate these data and present them graphically using the graph below, putting the expected rate of return (and the real interes rate) on the vertical axis and the amount of investment on the horizontal axis. Instructions: Use the tool provided 'ID' to plot the investment demand curve (plot 6 points total). 30 Tools ID 20 15 10 10 20 30 40 50 60 Investment (billions of dollars) Instructions: Enter your answers as a whole number. b. What will be the equilibrium level of aggregate investment if the real interest rate is: 15 percent: $ billion 10 percent: $ billion 5 percent: $ billion Expected rate of return, percent 25arrow_forward20 Desired Consumption Expenditure 0 FIGURE 21-1 Y₁ 7₂ Real Disposable Income Select one: OA Y3F. OB. Y3D. OC DE OD. FD. OE Y2Y3. ID %₂ C-YA Consumption Function Refer to Figure 21-1. If disposable income is Y3, the level of desired saving isarrow_forward

- Refer to the figure below: CHANGE FROM PRIOR QUARTER (percent) +16 +12 +8 +4 Consumption ° -4 -8 יוון וון -12 -16 Investment -20 -24 Investment is more volatile than consumption. 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2000 2001 2002 2003 2004 2005 CALENDAR QUARTER 2006 2007 2008 What was the range, in absolute value of percentage change, of the variation in quarterly growth rates between 2005 and 2008 of Instructions: Enter your responses as a percent rounded to the nearest whole number. (a) Consumer spending? 1 percent to 4 percent 3 percent to 7 percent 5 percent to 9 percent (b) Investment spending? 1 percent to 22 percent 3 percent to 30 percent 5 percent to 37 percentarrow_forward2arrow_forwardFor a closed economy, GDP is $10, consumption is $8, taxes are $1, and the buget deficit is $1, What are private saving and national saving? a. $2 and $1 O b. $1 and $2 O c. $1 and $0 O d. $1 and $1arrow_forward

- 8. Given the following information: C = Ca + 0.8Yd Ip = 1900 - 40r G = 1800 NX = 700 - 0.14Y %D T= 200 + 0.20 Y Ca = 260 - 1Or Md/P = 0.25Y - 25r Ms/P = 2000 Find: 1. The equilibrium level of interest rate and output. 2. If Government expenditure increased by 100, find the new equilibrium level of interest rate and outputarrow_forward4. An economy has government purchases of 1000. Desired national saving and desired investment are given by gd=200+5000r+0.10Y-0.20G jd=1000-4000r When the full-employment level of output equals 5000, calculate the real interest rate that clears the goods market.arrow_forwardYou observe a closed economy that has a government deficit and positive investment. Which of the following is correct? Select one: O a. Private saving is negative; public saving is positive. O b. Both private saving and public saving are negative. O . Private saving is positive; public saving is negative. O d. Private and public saving are both positive.arrow_forward

- Suppose that conditions in the economy are such that the after-tax expected real interest rate is described by the equationRa = a X gWhere a is a number that depends on how people value their consumption in one period compared with another period, and g is the growth rate of the economy. The a equals 1 when people prefer consumption to be balanced, with the same amount of consumption each period; a may be bigger than the one when people prefer consumption today over consumption in the future, with a being larger and larger the more impatient people are:A - Suppose that a = 2, g = 0.02, the inflation rate is expected to be steady at pi = 0.03, and the tax rate is .40. What are the values of the equilibrium nominal interest rate and the before-tax expected real interest rate?B - Beginning with the situation in part a, if the growth rate of the economy increases to .04, what are the new values of the equilibrium nominal interest rate and the before-tax expected real interest rate?C-…arrow_forwardReal Interest Rate 1₂ 1. 4 FIGURE 25-2 1 11 12 13 -10 Quantity of Investment and Saving (5) Refer to Figure 25-2. Suppose national saving is reflected by NS, and investment demand is reflected by Now suppose the government implements a policy that encourages investment. What is the effect in th market for financial capital? Select one: a. National saving shifts to NS₁, investment demand shifts to 1₁D, and the quantity of national saving rises t b. There is no effect on NS or ID and the quantity of national saving supplied remains at I". c. National saving shifts to NS₁, and the quantity of national saving supplied rises to 12. d. Investment demand shifts to 1₁D and the quantity of national saving supplied rises to 1₁. e. Investment demand shifts to 1₁D, national saving shifts to NS₁, and the quantity of nationalarrow_forward) A college is considering investing $6 million to add 10,000 seats to its football stadium. The athletic department forecasts it can sell all these extra seats at each game for a ticket price of $20 per seat, and the team plays six home games per year. If the school can borrow at an interest rate of 14%, should the school undertake this project? (Show your math!) What would happen if the school expected a losing season and could sell tickets for only 5,000 of the seats?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education