Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

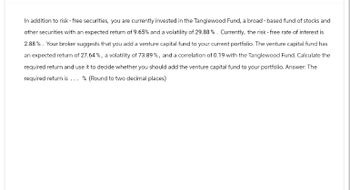

Transcribed Image Text:In addition to risk - free securities, you are currently invested in the Tanglewood Fund, a broad-based fund of stocks and

other securities with an expected return of 9.65% and a volatility of 29.88% . Currently, the risk-free rate of interest is

2.88%. Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has

an expected return of 27.64%, a volatility of 73.89%, and a correlation of 0.19 with the Tanglewood Fund. Calculate the

required return and use it to decide whether you should add the venture capital fund to your portfolio. Answer: The

required return is... % (Round to two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following information and then calculate the required rate of return for the Global Equity Fund, which includes 4 stocks in the portfolio. The market's required rate of return is 16.00%, the risk-free rate is 5.25%, and the Fund's assets are as follows:Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. Stock Investment Beta A $205,000 1.45 B $375,000 0.85 C $555,000 –0.45 D $1,130,000 2.08arrow_forwardA mutual fund manager expects her portfolio to earn a rate of return of 11% this year. The beta of her portfolio is 0.9. The rate of return available on risk-free assets is 4% and you expect the rate of return on the market portfolio to be 14%. a. What expected rate of return would you demand before you would be willing to invest in this mutual fund? Note: Do not round intermediate calculations. Enter your answer as a whole percent. b. Is this fund attractive to you? a. "Expected rate of return b. Is this fund attractive to you? %arrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. 1ITT Market Risk-Free Year Fund 2011 -21.8% -41.5% 3% 2012 25.1 21.2 4 14.1 2013 14.5 8.8 2014 6.4 4 -2.22 2015 -5.2 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Sharpe ratio Treynor ratioarrow_forward

- Badhibenarrow_forwardYou plan to invest in the Kish Hedge Fund, which has total capital of $500 million invested in five stocks: Stock's Beta Coefficient 0.3 1.4 2.3 1.0 E 1.3 Kish's beta coefficient can be found as a weighted average of its stocks' betas. The risk-free rate is 3%, and you believe the following probability distribution for future market returns is realistic: Stock A B III. 4.1% + (11,6%) b TV. 4.1% + (11.5%) b V. n-3.0 % + (11.6%) b) C Investment $160 million 120 million D 80 million 80 million 60 million Market Return -25% 0 13 0.2 32 0.1 55 a. What is the equation for the Security Market Line (SML)? (Hint: First determine the expected market return.) 1.5.2% + (10.5%) b II. n-3.0%+ (11.5%) b Probability 0.1 0.2 0.4 -Select B b. Calculate Kish's required rate of return. Do not round intermediate calculations. Round your answer to two decimal places. % c. Suppose Rick Kish, the president, receives a proposal from a company seeking new capital. The amount needed to take a position in the…arrow_forwardPlease answer these twoarrow_forward

- Suppose you are the money manager of a $3.92 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 360,000 1.50 B 700,000 (0.50 ) C 960,000 1.25 D 1,900,000 0.75 If the market's required rate of return is 10% and the risk-free rate is 5%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardAssume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 2.00%. What rate of return should investors expect (and require) on this fund? Do not round your intermediate calculations. Stock A B C D 11.16% 10.82% 9.93% 9.37% 9.71% Amount $1,075,000 $675,000 $750,000 $500,000 $3,000,000 Beta 1.20 0.50 1.40 0.75arrow_forwardSuppose that a mutual fund manager has a $20 million portfolio with a beta of 1.7. Also suppose that the risk free rate is 4.5% and the market risk premium is 5%. The manager expects to receive an additional $5 million, which is to be invested in a number of new stocks to add to the portfolio. After these stocks are added, the manager would like the fund's required rate of return to be 12%. For notation, let represent the required return, let RF represent the risk free rate, let b represent the beta of a group of stocks, and m represent the market return. According to the video, which equation most closely describes the security market line (SML)? OT=TRE+bx (M + TRF) O TRE-6x (rM - TRF) Or=TRF + TM-TRF ORF + bx (rM - TRF) Hint: Recall that the manager wants the new required rate of return for the portfolio to remain at 12%. Using the equation you just identified, and plugging in the relevant information, yields a beta of the portfolio, after the new stocks have been added, of…arrow_forward

- I need all answerarrow_forwardSuppose you are the money manager of a $5.56 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 380,000 1.50 B 800,000 (0.50 ) C 1,480,000 1.25 D 2,900,000 0.75 If the market's required rate of return is 10% and the risk-free rate is 4%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardSuppose you are the money manager of a $5.39 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 340,000 1.50 B 720,000 (0.50) C 1,380,000 1.25 D 2,950,000 0.75 If the market's required rate of return is 12% and the risk-free rate is 5%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education