ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

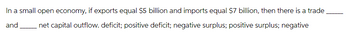

Transcribed Image Text:In a small open economy, if exports equal $5 billion and imports equal $7 billion, then there is a trade

and net capital outflow. deficit; positive deficit; negative surplus; positive surplus; negative

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Catherin Mann (2006), “The Current Account and the Budget Deficit: A Disaggregated Perspective,” in Kopcke, Tootell, and Triest (eds.), The Macroeconomics of Fiscal Policy, MIT Press In the article, Mann notes that the foreign financing of the US current account deficit has increasingly taken the form of foreigners purchasing US Treasury bonds. She is concerned that the increase of foreign holdings of US Treasury bonds may worsen the US current account deficit in the future. Which of the following statements is inconsistent with her reasons behind the concern? a. As global interest rates starts to climb, the overall payments on interest-bearing liabilities (including US Treasury bonds) will rise. b. The interest paid on US government debt (ie, US Treasury bonds) will be increasingly paid to foreign holders, setting up a negative feedback loop between fiscal deficit and current account deficit. c. The greater the US current account deficit, the larger the risk of eventual, sharp…arrow_forwardSuppose that the government deficit is 20, interest on the government debt is 15, taxes are 55, government expenditures are 50, consumption expenditures are 65, ne factor payments are 25, the current account surplus is - 10, and national saving is 40. Calculate the following (not necessarily in the order given): a. Private disposable income = b. Transfers from the government to the private sector = c. Gross national product d. Gross domestic product : e. The government surplus = f. Net exports %D g. Investment expenditures =arrow_forwardIf national income Y = 10,000, disposable income Yd = 8,000 , consumption is C = 7,500, transfer payments TR = 100 and the budget deficit is BD = 150, what is the level of private domestic investment, I ? (please insert the round number without the Euro symbol)arrow_forward

- If a country is experiencing a budget deficit and the government reduced spending, resulting in a balanced budget. How a country’s shift from budget deficit to balanced budget would affect its investments, economic growth, net capital outflow and currency exchange rate? Use diagrams where necessary?arrow_forwardConsider two large open economies - U.S. and Europe. If expansionary fiscal policy is adopted in Europe, what happens in the U.S? net capital outflow rises, the real interest rate falls and investment spending rises. net capital outflow falls, the real interest rate rises and investment spending rises. net capital outflow falls, the real interest rate rises and investment spending falls. net capital outflow rises, the real interest rate rises and investment spending falls. In a large open economy, if political instability abroad lowers the net capital outflow function, then the real interest rate: rises, while the real exchange rate falls and net exports rise. falls, while the real exchange rate rises and net exports fall. rises, while the real exchange rate rises and net exports fall. falls, while the real exchange rate rises and net exports rise. Political instability in the U.S. Political instability in the U.S.arrow_forwardQuestion 4 All other things being equal, which of the following is most likely to lead to improvement in the balance of payments deficit of a country? A fall in an ABCD income tax rates. unemployment. the exchange rate. exports.arrow_forward

- Question: What is the term for a situation where a country exports more goods and services than it imports? A) Trade deficit B) Current account surplus C) Budget deficit D) Fiscal surplusarrow_forwardImagine that the U.S. economy finds itself in the following situation: a government budget deficit of $100 billion, total domestic savings of $1,500 billion, and total domestic physical capital investment of $1,600 billion. According to the national saving and investment identity, what will be the trade balance? What will be the trade balance if investment rises by $50 billion, while the budget deficit and national savings remain the same?arrow_forwardA current account deficit is generally a result of: a large amount of U.S. purchases of foreign real estate. U.S. purchases of bonds issued by foreign corporations. imports exceeding exports. exports exceeding imports.arrow_forward

- A net exports deficit will become a surplus if _______. A. the country appreciates its currency B. the government budget deficit is turned into a surplus and the private sector has a surplus C. private saving and government saving exceed private investment D. the private sector surplus adjusts to equal the government sector deficitarrow_forward8:12 O YTB Output, Y Output, Y 3 A' ZZ' B Trade deficit NX ZZ • Summary: - An increase in domestic demand leads to an increase in domestic output but leads also to a deterioration of the trade balance. An increase in foreign demand leads to an increase in domestic output and an improvement in the trade balance. Implications: - Shocks to demand in one country affect all other countries. Economic interactions complicate the task of policy makers. Policy coordination is not so easy to achieve. 1 Q 4 ...arrow_forwardAustralia has a current account surplus of $3 billion per quarter and a net income deficit of $3 billion per quarter. Which of the following is true? The capital account deficit is $6 billion per quarter Net foreign liabilities are increasing All of the other options The trade surplus is $6 billion per quarterarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education