ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

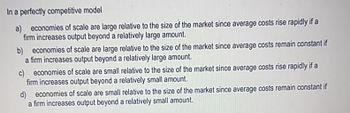

Transcribed Image Text:In a perfectly competitive model

a) economies of scale are large relative to the size of the market since average costs rise rapidly if a

firm increases output beyond a relatively large amount.

b) economies of scale are large relative to the size of the market since average costs remain constant if

a firm increases output beyond a relatively large amount.

c) economies of scale are small relative to the size of the market since average costs rise rapidly if a

firm increases output beyond a relatively small amount.

d) economies of scale are small relative to the size of the market since average costs remain constant if

a firm increases output beyond a relatively small amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Show full answers and steps to part d) e) & f)arrow_forwardThe cost curves below are for a firm competing in a perfectly competitive industry. If the market price is $5, in the short - run a profit - maximizing firm would: Produce and earn a negative economic profit Not produce (as it leads to a negative profit) Produce and earn a normal profit Produce and earn a positive economic profit The cost curves below are for a firm competing in a perfectly competitive industry. If the market price is $5, in the short-run a profit-maximizing firm would: Price and cost 16 15 14 13 12 11 10 9 8 6 3 MO O Produce and earn a negative economic profit O Not produce (as it leads to a negative profit) O Produce and earn a normal profit O Produce and earn a positive economic profit ATC AVC 6 bis & Quantityarrow_forwardEach firm in a perfectly competitive industry has the following production function: q = K1/4L1/4 Each firm takes factor prices as given. Factor prices are r = 4, w = 16 Suppose firms in this industry face a recurring fixed cost FC=144, ie, firms face a fixed cost FC=144 in the long run. Rewrite long run MC(q) and AC(q) functions and then find the long run equilibrium price.arrow_forward

- Suppose a typical (representative) corn farm has a short run production technology which results in the outcome of U-shaped Average Variable Cost (AVC), Average Total Cost (ATC), and Marginal Cost (MC). Further, suppose this firm sells its product in a market where the price of the good is determined by the interaction of market Demand and Supply. Because an individual firm is very small compared to the rest of the market, we treat the market price as the price given to the firm, and the individual firm cannot impact that price. assume we are in the Short Run for this firm. In graphing, put $ on the vertical axis and lower-case q (firm output) on the horizontal axis. Start with the AFC0, AVC0, ATC0, and MC0 curves . show shifts in any of the cost curves, reflecting the higher cost of land (keeping in mind that this higher cost is independent of how much or how little corn is actually produced) and labeling the changed cost curves with a subscript 1. On the graph with $ on the…arrow_forwardWhat is the term for the lowest level of output at which a firm's goods are produced at minimum long-run average total cost? the point of diminishing returns the minimum total product the minimum efficient scale the point of zero marginal costarrow_forwardIf the market price of a product is $10 that lie between the minimum average variable cost $8 (AVC) and minimum average total cost $15 (ATC) of a firm, that firm will:___________ a) always shut down. b) always continue to produce.c) produce in the short run but shut down in the long run. d) produce in the long run but shut down in the short run. e) make positive economic profits.arrow_forward

- Show full answers and steps to part a) b) & c)arrow_forwardThe implications of diminishing marginal returns is that: Group of answer choices beyond some point, the extra utility derived from additional units of a product will yield the consumer smaller and smaller extra amounts of satisfaction. as extra units of a variable resource are added to a fixed resource, marginal product will decline beyond some point. because of economies and diseconomies of scale, a competitive firm's long-run average total cost curve will be U-shaped. the demand for goods produced by purely competitive industries is downsloping.arrow_forwardThe following figures depict the market supply and demand curves for a constant cost, competitive industry (left) and the per unit cost curves for a typical firm (right). For parts (a) and (c), below, you can again include your answers directly on the graph. A) Identify the short-run equilibrium in this market, indicating the price, aggregate quantity and the amount supplied by an individual firm. b) Explain why it is not a long-run equilibrium. c) Explain how the market would adjust to an equilibrium in the long-runarrow_forward

- Increasing returns and imperfect competition: (a) The production function for the word processor is Y = X – 100 million if X is larger than 100 million, and zero otherwise. By spending $100 million, you create the first copy, and then $1 must be spent distributing it (say for the DVD it comes on). For each dollar spent over this amount, you can create another copy of the software. (b) The production function is plotted in Figure 6.5. Output is zero whenever X is less than 100 million. Does this production function exhibit increasing returns? Yes. We spend $100 million (plus $1) to get the first copy, but doubling our spending will lead to 100 million copies (plus 2). So there is a huge degree of increasing returns here. Graphically, this can be seen by noting that the production function “curves up” starting from an input of zero, a common characteristic of production functions exhibiting increasing returns. (Constant returns would be a straight line starting…arrow_forwardSuppose a firm’s short-run cost curves were found to be: Total Cost = SRTC = 1 + 2Q + Q2 Marginal Cost = SRMC = 2 + 2Q, Where Q is output. Assume the firm behaves as a price taker and sells its output at P = K8 per unit. (a) If the firm maximizes profits, how much will it produce? (b) What are the marginal, average and total cost at that point? (c) What is the firms’ profit?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education