ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

P3

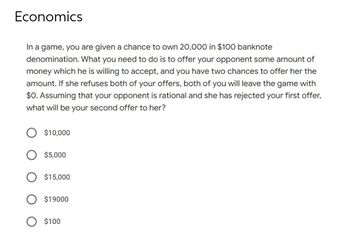

Transcribed Image Text:Economics

In a game, you are given a chance to own 20,000 in $100 banknote

denomination. What you need to do is to offer your opponent some amount of

money which he is willing to accept, and you have two chances to offer her the

amount. If she refuses both of your offers, both of you will leave the game with

$0. Assuming that your opponent is rational and she has rejected your first offer,

what will be your second offer to her?

$10,000

$5,000

$15,000

$19000

$100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You are going to put $X into an account each year for 5 years, beginning in Year 1. Then, from Years 9 through 12, you will withdraw $2,000 per year. If the account has an annual interest rate ? of 11%, what is X? 1054.67 Xarrow_forward(SO2P11) To get the AW of a cash flow of $10,000 that occurs every 10 years forever, with the first one occuring 10 years from now, you should Select one: a. Multiply $10,000 by (A/P,i,10) b. Multiply $10,000 by (A/F,i,10) c. Multiply $10,000 by i d. Multiply $10,000 by (A/F,i,n) and then multiply byarrow_forwardSolve question no.8 and show a clear and readable solution.Note: The answer is given on the bottom side of the number, just show the solution on how to get it. Also, please write the given and the required.Thanks!!!arrow_forward

- If you take four (4) $100 bills out of your secret hiding place and deposit them into your savings account at your local bank, M1 will __________ and M2 will _________. Increase $400; increase $400 Decrease $400; decrease $400 Increase $400; decrease $400 Decrease $400; increase $400arrow_forwardDetermine the equivalent value of x from the cash flow indicated in the diagram on the left side. 2 G₁ 7 59 10 i% Xarrow_forwardNo excel, show all work. Thanksarrow_forward

- John is a very cost-conscious investor. His rule of thumb is that it costs $300 per year, starting in the first year of vehicle life to maintain an automobile. This expense increases by $300 each year over the life of the car. John is now considering the purchase of a six-year old car with 40,000 miles on it for $7,000. How much money will John have to set aside now to pay for maintenance (as a lump sum) if he keeps this car for seven years? John's interest rate is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 4% per year. John will have to set aside $ to pay for maintenance. (Round to the nearest dollar.)arrow_forwardWhat will a $90,000 house cost 10 years from now if the price appreciation for homes over that period .averages 3% compounded annually?arrow_forwardIf $4,000 is borrowed today and $8,955 is paid back in 10 years, what interest rate compounded annually has been earned? % Round entry to one decimal place. Tolerance is ±0.2.arrow_forward

- You know that paying yourself by depositing money in a savings account is a prudent start to your retirement plan. You determined that, based on your other obligations, you can save 6,375.00 per year via an annual, single year-end deposit. You are 35 years old now, so your money will grow for the next 30 years until you turn 65. You will open a savings account at the Wells Fargo branch near your home. Its savings accounts are paying 6% interest. The following table shows the future value factors for various periods and interest rates: Future Value of an Annuity Factor Year 2% 3% 5% 6% 8% 9% 10% 10 10.950 11.460 12.578 13.180 14.487 15.190 15.937 12 13.412 14.190 15.917 16.870 18.977 20.140 21.384 15 17.293 18.600 21.578 23.270 27.152 29.360 31.772 20 24.297 26.870 33.066 36.780 45.762 51.160 57.274 25 32.030 36.460 47.726 54.860 73.105 84.700 98.346 30 40.567 47.570 66.438 79.060 113.282 136.300 164.491 35 49.994 60.460 90.318 111.430 172.314 215.700…arrow_forwardJohn is a very cost-conscious investor. His rule of thumb is that it costs $200 per year, starting in the first year of vehicle life to maintain an automobile. This expense increases by $200 each year over the life of the car. John is now considering the purchase of a four-year old car with 40,000 miles on it for $7,000. How much money will John have to set aside now to pay for maintenance (as a lump sum) if he keeps this car for eight years? John's interest rate is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i= 4% per year. John will have to set aside $ to pay for maintenance. (Round to the nearest dollar.)arrow_forwardI think the question b should be $500,000 NOT $5,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education