ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

No excel, show all work. Thanks

Transcribed Image Text:### Understanding Car Financing Options: Buying vs. Leasing

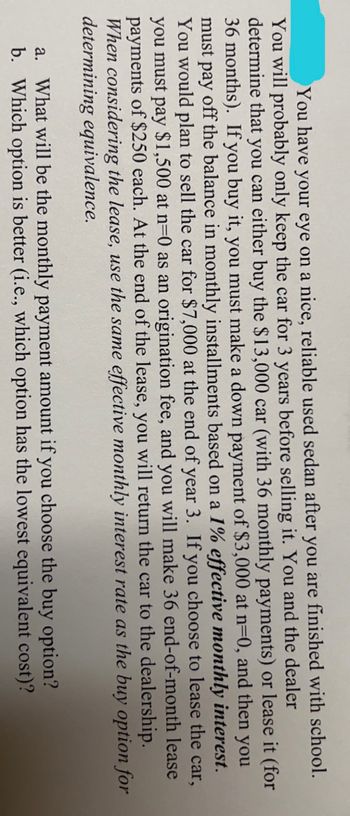

You've found a reliable used sedan that you want to use post-graduation. Given that you'll likely keep the car for only three years before selling it, there are crucial financial decisions to be made. You have the option to either purchase the car directly or lease it. Let’s break down both scenarios:

1. **Buying the Car**:

- **Initial Cost**: $13,000.

- **Down Payment**: $3,000 at the start (t = 0).

- **Monthly Installments**: The remaining balance will be paid in monthly installments for 36 months, based on an effective monthly interest rate of 1%.

- **Selling the Car**: At the end of 3 years, it is assumed you will sell the car for $7,000.

2. **Leasing the Car**:

- **Monthly Lease Payments**: You will make 36 end-of-month lease payments of $250 each.

- **Origination Fee**: There is an additional one-time fee of $1,500.

- **End-of-Lease**: After 36 months, you will return the car to the dealership.

#### Financial Assessments:

To make an informed decision, you need to calculate and compare the following:

**a. Monthly Payment Amount for Buying Option:**

This involves determining the exact monthly installment you need to pay if you choose to buy the car.

**b. Cost Evaluation:**

Assess which option (buying vs. leasing) is more financially viable in terms of the lowest equivalent cost.

### Additional Considerations:

- **Interest Rate Consistency**: For a fair comparison, the same effective monthly interest rate will be applied for both options.

- **Resale Value**: The potential resale value of the car at the end of 3 years is an important factor in the purchase option.

By evaluating these aspects, you can choose the most cost-effective method to finance your vehicle over the intended period of use.

---

This structured educational breakdown will help you navigate the financial intricacies of car ownership and leasing, assisting in making an informed and prudent decision.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How do you find total fixed cost?arrow_forwardYou have been hired as an HR consultant to help implement a high-performance work system at a large firm. To date, you have discussed the need for change with employees and explained strategy and the vision of the future. What should you do next? O Perform a process audit. O Allocate resources. Engage senior management. Tie the HPWS to performance. Use your knowledge of high-performance work systems to answer the following question. You have been hired as an HR consultant to monitor and evaluate a high-performance work system that has been in place for two years at a large firm. What are the best questions to include in your process audit? Check all that apply. Is the organization more competitive than in the past? What is the employee turnover rate? What is the overall satisfaction rate of employees? Are employees being treated fairly so that power differences are minimal?arrow_forwardA team is much more than a group of people brought together. What factors contribute to effective teams? How might you go about building a high performing innovation team using this information?arrow_forward

- A student once said she 'didn't believe in sunk costs. She meant that the idea that 'some costs are sunk and shouldn't be accounted for in making decisions' didn't make sense and that all costs associated with a project were important. Do you think the concept of sunk costs is important to business decision-making? Why or why not?arrow_forwardSuppose that you want to open a new business or purchase an existing one. Describe that business. What good or service would you provide? Where would you be located? What would be some explicit costs of starting the business? What would be some implicit costs?arrow_forwardOutput (Concession Stand Items) Number of Workers Employed Per day Price of Labor Per Worker Per Day Total Variable Cost of Labor Total Fixed Costs Per Day Total Cost Per Day Average Price of Concession Stand Items Total Revenue Profit Average Variable Cost Average Fixed Cost Average Total Cost Marginal Cost Marginal Revenue 0 0 $120 $2,000 $8.00 100 2 $120 $2,000 $8.00 400 4 $120 $2,000 $8.00arrow_forward

- please view photo uploadedarrow_forwardWhat are different types of costs involved in production of goods and services? Analyze the relationship between cost and productivity in the short run.arrow_forwardCalculate and plot the following: No of units Total cost 0 2 1 9 2 12 3 15 4 20 5 30 6 42 Variable cost Fixed cost Average fixed cost Average variable cost Marginal costarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education