Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

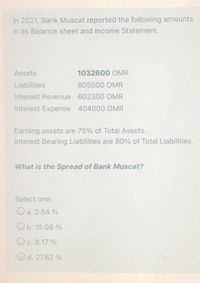

Transcribed Image Text:In 2021, Bank Muscat reported the following amounts

in its Balance sheet and Income Statement.

Assets

1032600 OMR

Liabilities

805500 OMR

Interest Revenue 602300 OMR

Interest Expense 404000 OMR

Earning assets are 75% of Total Assets.

Interest Bearing Liabilities are 80% of Total Liabilities.

What is the Spread of Bank Muscat?

Select one:

Oa. 2.54 %

Ob. 15.08 %

Oc. 8.17 %

Od. 27.62 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the Crane Ltd's 2020 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities NT$3,536.0 31,408.0 3,016.0 16,640.0 Compute the following values. Interest expense Income taxes Net income NT$520.0 (a) Debt to assets ratio. (Round to O decimal places, e.g. 62%.) 1,976.0 4,590.0 (b) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) % timesarrow_forwardYou have been presented with the following selected information from the financial statements of one of Canada's largest dairy producers, Saputo Inc. (in $ millions): Statement of financial position 2021 2020 2019 Accounts receivable $1,217 $1,372 $1,248 Inventory 2,294 2,221 1,681 Total current assets 3,948 4,069 3,134 Total assets 13,123 13,793 9,886 Current liabilities 2,146 2,494 1,932 Total liabilities 6,679 7,234 4,465 Statement of income Sales $14,294 $14,944 $13,502 Cost of goods sold 9,575 10,181 9,179 Interest expense 79 96 67 Income tax expense 218 217 230 Net income 626 583 755arrow_forwardCalculate ROE, ROA, Net interest margin, Net noninterest margin, Earnings spreadarrow_forward

- Hello- Is there a way to get Times inteset earned using the attached data. Please advise. Thanks, Ityla Lungu 773.780.7930arrow_forward4. A Company has Net Sales of 2,000,000 for 2020, Accounts Recitable for 500,000 in 2020, and Accounts Receivable of 350,000 in 2019. Calculate the Accounts Receivable Turnover Ratio.arrow_forwardThe financial statements for BSW National Bank (BSWNB) are shown below: What is the dollar value of earning assets held by BSWNB? What is the dollar value of interest-bearing liabilities held by BSWNB? What is BSWNB’s total operating income? Calculate BSWNB’s asset utilization ratio. Calculate BSWNB’s net interest margin.arrow_forward

- The following information for Rainbow National Bank are given:Report of Income Tk.Interest income 1,250Interest expense 500Total assets 40,000Securities losses or gains 1,000Earning assets 30,000Total liabilities 30,000Taxes paid 1,000Shares of common stock outstanding 3,000Noninterest income 8,000Noninterest expense 6,000Provision for loan losses 2,500Calculate:ROE, ROA, net interest margin, earnings per share, net noninterest margin and netoperating margin.arrow_forwardWhat is net income ? 251+113 = 364 ??? İs true or notarrow_forwardCalculate the current ratio and the quick ratio for the following partial financial statement for Tootsie Roll. (Round your answers to the nearest hundredth.) Assets Current assets: Current liabilities: Cash and cash equivalents (Note 1) $ 4,144,190 Notes payable to banks $ 752,221 Investments (Note 1) 32,453,769 Accounts payable 7,084,075 Accounts receivable, less allowances of$740,000 and $736,000 16,126,648 Dividends payable 656,607 Inventories (Note 1): Accrued liabilities (Note 5) 9,906,534 Finished goods and work in progress 12,570,955 Income taxes payable 4,551,429 Raw materials and supplies 10,195,858 Prepaid expenses 1,957,710arrow_forward

- . The financial statements for BSW National Bank (BSWNB) are shown below: Earning assets: $13,884 Interest-bearing liabilities (Spread) = $9,012 Calculate BSWNB’s asset utilization ratio. 2. Calculate BSWNB’s net interest marginarrow_forwardPlease Do not Give image formatarrow_forwardCalculate the current ratio current assets/current liabilities for Castle rock construction round to one decimal place. The current ratio 2:1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education