Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

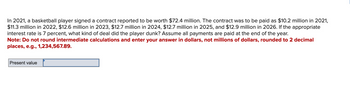

Transcribed Image Text:In 2021, a basketball player signed a contract reported to be worth $72.4 million. The contract was to be paid as $10.2 million in 2021,

$11.3 million in 2022, $12.6 million in 2023, $12.7 million in 2024, $12.7 million in 2025, and $12.9 million in 2026. If the appropriate

interest rate is 7 percent, what kind of deal did the player dunk? Assume all payments are paid at the end of the year.

Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal

places, e.g., 1,234,567.89.

Present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- In 2019, the average salary of petroleum engineers was $98,400. Predict what their salary will be in 2028 if their salary increases only by the inflation rate. Assume the inflation rate over this time period is constant at 3.8% per year. The salary of the petroleum engineers will be $ .arrow_forwardA sports star can sign a 6-year contract that starts at $12M with increases of $3M each year for his expected playing career of 6 years. It is also possible to sign a contract that starts at $8M for the first year and then increases at $2M each year for 10 years If his interest rate for the time value of money is 8%, what is the value of each choice?arrow_forwardGarland Inc. offers a new employee a single-sum signing bonus at the date of employment, June 1, 2021. Alternatively, the employee can receive $39,000 at the date of employment plus $10,000 each June 1 for five years, beginning in 2025. Assuming the employee's time value of money is 9% annually, what single amount of the employment date would make the options equally desirable? (EV. of $1. PV of $1. EVA of $1. PVA of $1 EVAD of 51 and PVAD of 5) (Use appropriate factor(s) from the tables provided.) Prarrow_forward

- Lindy Appliance begins operations in 2021 and offers a one-year warranty on all products sold. Total appliance sales in 2021 are $1,600,000, and Lindy estimates future warranty costs in 2022 to be 2% of current sales. Actual warranty costs in 2022 are $25,000. Also in 2022, Lindy has additional sales of $2,400,000 and revises its estimate of warranty costs associated with sales in 2022 to be 1.5%.Required:1. Record the adjusting entry for estimated warranty costs at the end of 2021.2. Record the summary entry for actual warranty expenditures in 2022, assuming all costs were paid in cash.3. Record the adjusting entry for estimated warranty costs at the end of 2022.4. What is the balance in Warranty Liability at the end of 2021 and 2022?arrow_forwardc) Man - Duen wants to buy a $28,000.00 T - bill that matures on 2019 - 12 - 08. His target price is $27,729.66, the (annual) simple interest rate is 3.120% and the daycount convention is ACT /360. What is the last date on which he can still buy the T - bill? How much does he pay?arrow_forwardA football player is offered a 5-year contract which pays him the following amounts: Year 1: $1.2 million Year 2: 1.6 million Year 3: 2.0 million Year 4: 2.4 million Year 5: 2.8 million Under the terms of the agreement all payments are made at the end of each year. Instead of accepting the contract, the football player asks his agent to negotiate a contract which has a present value of $1 million more than that which has been offered. Moreover, the player wants to receive his payments in the form of a 5-year annuity due. All cash flows are discounted at 10 percent. If the team were to agree to the player's terms, what would be the player's annual salary (in millions of dollars)? $1.500 $1.659 $2.439 $1.989 None of the abovearrow_forward

- please answer within 30 minutes..arrow_forwardOn January 1, 2021, Tropical Paradise borrows $33,000 by agreeing to a 6%, four-year note with the bank. The funds will be used to purchase a new BMW convertible for use in promoting resort properties to potential customers. Loan payments of $775.01 are due at the end of each month with the first installment due on January 31, 2021. Record the issuance of the installment note payable and the first two monthly payments. (Do not round intermediate calculations. Round your final answers to 2 decimal places. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardIn March 2018, the Buffalo Bills signed Star Lotulelei to a contract reportedly worth $50 million. Lotulelei's salary (including bonuses) was to be paid as $17.1 million in 2018, $8.9 million in 2019, $7.5 million in 2020, and $8.25 million in 2021 and 2022. If the appropriate interest rate is 11 percent, what kind of deal did the defensive tackle sack? Assume all payments are paid at the end of each year. (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) Present valuearrow_forward

- In 2021, a basketball player signed a contract reported to be worth $60.8 million. The contract was to be paid as $8.2 million in 2021, $9.7 million in 2022, $10.6 million in 2023, $10.7 million in 2024, $10.7 million in 2025, and $10.9 million in 2026. If the appropriate interest rate is 10 percent, what kind of deal did the player dunk? Assume all payments are paid at the end of the year. Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89. Present valuearrow_forwardGus deposits $8,000 on February 2, 2021. How much does Gus have on November 11, 2021 if the simple interest rate is 4%?arrow_forwardA baseball player is offered a 5-year contract that pays him the following amounts: Year 1: $1.26 million Year 2: $1.87 million Year 3: $2.49 million Year 4: $2.54 million Year 5: $3.15 million Under the terms of the agreement all payments are made at the end of each year. Instead of accepting the contract, the baseball player asks his agent to negotiate a contract that has a present value of $1.63 million more than that which has been offered. Moreover, the player wants to receive his payments in the form of a 5-year ANNUITY DUE. All cash flows are discounted at 12.00 percent. If the team were to agree to the player's terms, what would be the player's annual salary (in millions of dollars)? (Express answer in millions. $1,000,000 would be 1.00)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education