ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

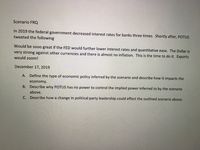

Transcribed Image Text:Scenario FROQ

In 2019 the federal government decreased interest rates for banks three times. Shortly after, POTUS

tweeted the following

Would be so00 great if the FED would further lower interest rates and quantitative ease. The Dollar is

very strong against other currencies and there is almost no inflation. This is the time to do it. Exports

would zoom!

December 17, 2019

A. Define the type of economic policy inferred by

scenario and describe how it impacts the

economy.

B. Describe why POTUS has no power to control the implied power inferred to by the scenario

above.

C. Describe how a change in political party leadership could effect the outlined scenario above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Macro Economics 1. Explain how the effectiveness of fiscal and monetary policy depends on whetherthe policy change is initiated at a low or high level of output relative to full-employment output. Make sure to provide your answer with the relevant graphsand mathematical equations.arrow_forwardUsing economic concepts, discuss the impact of the following events on the equilibrium price level and putput:a. In an effort to inflation, the Reserve of Australia decides to implement contractionary monetary policy.b. In an effort to fight economic recession Australian Government decides to increase spending.c. Due to the outbreak of disease in Asia, shipments of input products from Asia to Australia have decreased significantly.arrow_forwardDeterminants of aggregate demandarrow_forward

- Suppose the evening news anchor announces that "The Bank of Canada Raises the Target Overnight Rate for the First Time This Year." What is the Bank of Canada trying to do? a. Offset a possible rise in the inflation rate b. Increase exports C. Decrease unemployment O d. Stimulate the economyarrow_forwardAccording to the Keynesian framework, ___________ may cause a recession, but not inflation a. a decrease in interest rates b.a decrease in a major trading partners export prices c. a major trading partner's economic slowdown d. an increase in domestic investmentarrow_forwardWhen current output is less than potential output, the economy must have which of the following? ( Pick 1 Answer) A. Trade deficit B. Rise in inflationary expectations C. Increasing wages D. Cyclical unemploymentarrow_forward

- K In 2007 and 2008, Canada was affected by the global financial crisis that had begun with the U.S. housing collapse. By 2009, the Canadian economy had entered a recession, largely due to a reduction in investment and a The policy objective for the Bank of Canada and the government at this time was to OOOOO A. fall in housing starts; shift the AD curve to the left to close the recessionary output gap B. fall in net exports, shift the AS curve to close the inflationary output gap C. fall in consumption; shift the AD curve to the left to close the recessionary output gap D. fall in consumption; shift the AD curve to the right to close the inflationary output gap E. fall in net exports, shift the AD curve to the right to close the recessionary output gaparrow_forward1. What are so-called heterodox adjustment programs? Are they a sound long-term approach? 2. Use the IS/LM/BP graph to illustrate the effects of a revaluation. Show the fiscal and monetary policy changes that would make it more likely that a revaluation will succeed in eliminating a payments surplus.arrow_forward2arrow_forward

- Question 5A Starting from a baseline Long Run Steady State Equilibrium (LRSSE), the federal reserve increases interest rates. i. What kind of policy is this (Monetary or fiscal; ii. iii. expansionary or contractionary? How do you know? As a response which curve will start shifting in which direction? Why? How will this policy make the economy move away from the baseline Long Run Steady State Equilibrium (how would it change unemployment or price level relative to the long run steady state equilibrium )? iv. Draw a graph to show the changes to the long run steady state equilibrium (LRSSE).arrow_forwardNote: don't use chat gpt.arrow_forwardConsider the following shocks: A. The government cuts the personal income tax B. Firms expect a recession in the coming years C. A country the US trades with experiences an economic slowdown D. The government cuts unemployment benefits E. The central bank decides to cut the money supply F. US dollar appreciates against other currencies G. The government cuts its spending on infrastructure H. The government of a country the US trades with introduces tariffs on US-produced goods I. There is a stock market crash. For each shock: 1) explain which component of aggregate expenditure would the shock affect and why; 2) Illustrate in the (Y, P) coordinates how the shock would affect the position of the AD curve 3) explain how the shock would affect equilibrium output and the price level in the economy according to the classical school of economic thought (aka the long run approach)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education