FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

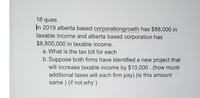

Transcribed Image Text:18 ques

In 2019 alberta based corporationgrowth has $88,000 in

taxable income and alberta based corporation has

$8,800,000 in taxable income .

a. What is the tax bill for each

b. Suppose both firms have identified a new project that

will increase taxable income by $10,000 . (how much

additional taxes will each firm pay) (is this amount

same ) (if not,why )

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- XYW Corp., a Domestic Corporation, registered in 2010 made available the following financial information for taxable year 2021: Balance Sheet: Asset - Php 500,000 Liability - Php 100,000 Stockholders' Equity - Php 400,000 Income Statement: Gross sales - Php 100,000,000 Cost of sales – Php 60,000,000 Operating Expenses - Php 30,000,000 How much is the excess MCIT which can be carried forward in 2022? Consider CREATE Law Choices: Php 800,000 Php 2,100,000 Php 400,000 Php 0arrow_forwardThe tax rates are as shown below: Taxable Income Tax Rate $ 0 - 50,000 15 % 50,001 - 75,000 25 % 75,001 - 100,000 34 % 100,001 - 335, 000 39 % Your firm currently has taxable income of $81,600. How much additional tax will you owe if you increase your taxable income by $22, 800 ?arrow_forwardThe tax rates are as shown below: Taxable Income $0 - 50,000 50,001 - 75,000 75,001 100,000 100,001 - 335,000 Tax Rate 15% 25% 34% 39% Your firm currently has taxable income of $80,700. How much additional tax will you owe if you increase your taxable income by $21,900?arrow_forward

- (Corporate income tax) Meyer Inc. has taxable income (earnings before taxes) of $300,000. Calculate Meyer's federal income tax liability using the tax table shown in the popup window: What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) Etext pages 2 W S mmand X Get more help # 3 80 F3 E D C $ 4 ODD 988 R F % 5 V FS T G 6 B MacBook Air F6 Y H & 7 F7 U N * 8 J PIL 1 M ( 9 K MOSISO DD F9 O ; FW1 { + [ option ? "1 1 Question Viewer 41 FYZ } delete returnarrow_forwardA division of Midland Oil & Gas has a taxable income (TI) of $8.85 million for a tax year. If the state tax rate averages 6% for all states in which the corporation operates, find the equivalent after-tax rate of return (ROR) required of projects that are justified only if they can demonstrate a before-tax return of 22% per year. Use the table given below to calculate taxes, the average tax rate Te and after-tax ROR. If Taxable Income ($) Is: But Not Of the Over over Тax Is Amount over 50,000 15% 50,000 75,000 7,500 + 25% 50,000 75,000 100,000 13,750 + 34% 75,000 100,000 335,000 22,250 + 39% 100,000 335,000 10,000,000 113,900 + 34% 335,000 10,000,000 15,000,000 3,400,000 + 35% 10,000,000 15,000,000 18,333,333 5,150,000 + 38% 15,000,000 18,333,333 35% The equivalent after-tax ROR is determined to be %.arrow_forwardUSE INFORMATION FOR QUESTION 35 and 36. Provo, Inc., had revenues of $10 million, cash operating expenses of $5 million, and depreciation and amortization of $1 million during 2020. The firm purchased $500,000 of equipment during the year while increasing its inventory by $300,000 (with no corresponding increase in current liabilities). The marginal tax rate for Provo is 40 percent. TOOL: Revenue - Operating Ex EBITDA - D&A EBIT - Taxes NOPAT + D&A CF Opns - Capital Expenditures + Add WC = FCFarrow_forward

- Suppose SAMI company had an additional $4 million depreciation expense in 2023. If SAMI's tax rate on pretax income is 35%, what would be the impact of this expense on SAMF's net income? OA. Decrease by $26 million OB. No change OC. Decrease by $1.4 million OD. Decrease by $4 million CHEDarrow_forwardStrand Inc. provides an incentives compensation plan under which its president receives a bonus equal to 10% of the corporation's income in excess of P 600,000 before income tax but after deduction of the bonus. Income before tax and bonus is P 1,920,000 and the tax rate is 32%, the amount of the bonus would be * A132,000 B.192,000 C.174,360 D.120,000arrow_forwardIn 2016, Merced had a long-term capital gain of $20,000. In 2019, Merced had a long-term capital gain of $10,000. These are the only capital transactions that Merced has had in the five years preceding 2020. Explain to the CEO of Merced what they can expect in terms of their overall tax liability for 2020. Also, explain any future planning opportunities that might arise regarding these capital transactions.arrow_forward

- A resident foreign corporation has the following income and expenses for the year: Philippines Abroad Gross sales P100,000,000 P40,000,000 Cost of sales 40,000,000 20,000,000 Operating expenses 30,000,000 12,000,000 1. How much is the income tax due assuming the taxable year is 2021?2. Assuming the corporation is a nonresident foreign corporation and the taxable year is 2021, how much is the income tax due?arrow_forwardJ-Matt, Inc., had pretax accounting income of $331,000 and taxable income of $376,000 in 2021. The only difference between accounting and taxable income is estimated product warranty costs of $45,000 for sales in 2021. Warranty payments are expected to be in equal amounts over the next three years (2022–2024) and will be tax deductible at that time. Recent tax legislation will change the tax rate from the current 25% to 20% in 2023. Determine the amounts necessary to record J-Matt’s income taxes for 2021 and prepare the appropriate journal entry.arrow_forwardEntity A has an incentive compensation plan under which the sales manager receives a bonus equal to 10percent of the company's income after deductions for bonus and income taxes. Income before bonus and incometaxes is P500,000. The effective income tax rate is 30 percent. How much is the amount of bonus (rounded to the nearest peso)?a. 32,710 b. 60,748 c. 30,974 d. 37,210 How much is the amount of income tax?a. 131,776 b. 140,708 c. 138,837 d. 140,187arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education