ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

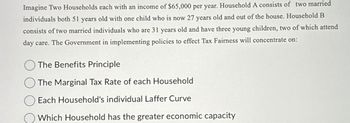

Transcribed Image Text:Imagine Two Households each with an income of $65,000 per year. Household A consists of two married

individuals both 51 years old with one child who is now 27 years old and out of the house. Household B

consists of two married individuals who are 31 years old and have three young children, two of which attend

day care. The Government in implementing policies to effect Tax Fairness will concentrate on:

The Benefits Principle

The Marginal Tax Rate of each Household

Each Household's individual Laffer Curve

Which Household has the greater economic capacity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- E2arrow_forwardPrice 65 60 55 50 45 40 35 30 25 20 15 10 5 0 0 50 100 Type your answers in all of the blanks and submit X, X' S2- the market, the equilibrium quantity is 200 Type your answer here 150 200 Quantity in total tax revenue. DI 250 S₁ 300 Consider the market in the figure where D1 denotes demand and S1 denotes supply. When a unit tax of 15 is imposed on sellers in 350 The government collects 400arrow_forwardThe Australian government have suggested that they might need to increase GST to help fund the COVID-19 rescue package. GST is a tax on goods and services usually paid at the point of sale. Consider the market for bread. Suppose a loaf costs $4.15 and includes a 15-cent tax per loaf. q5-Why would this tax be both socially inefficient and inegalitarian? Use the concepts of deadweight loss and wealth inequality.arrow_forward

- suppose Lena makes $50000 per year and Mariah makes $65000 per year. If each pays $5000 in taxes: What would their individual tax rates be? Would you describe this tax system as proportional, progressive, or regressive?arrow_forwardNeed help with this. THanks!arrow_forward1. Understanding the implications of taxes on welfare The following graph represents the demand and supply for blinkies (an imaginary product). The black point (plus symbol) indicates the pre-tax equilibrium. Suppose the government has just decided to impose a tax on this market; the grey points (star symbol) indicate the after-tax scenario. PRICE (Dollars per blinkie) Demand Supply A 56.00 40.00 B DE 24.00 F QUANTITY (Blinkies) Complete the following table, given the information presented on the graph. Result Per-unit tax Value Price producers receive after tax Equilibrium quantity before tax (?) In the following table, indicate which areas on the previous graph correspond to each concept. Check all that apply. Concept Producer surplus before the tax is imposed Deadweight loss after the tax is imposed Consumer surplus after the tax is imposed A B C D E F ☐ ☐ ☐arrow_forward

- 4. The Laffer curve Government-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections. To understand the effect of such a tax, consider the monthly market for gin, which is shown on the following graph. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. PRICE (Dollars per bottle) 100 90 80 20 10 0 0 Supply Demand 14 28 42 56 70 84 98 112 126 140 QUANTITY (Bottles) Graph Input Tool At this tax amount, the equilibrium quantity of gin is Market for Gin Suppose the government imposes a $20-per-bottle tax on suppliers. Quantity (Bottles) Demand Price (Dollars per bottle) Tax (Dollars per bottle) 56 60.00 20.00 Supply Price (Dollars per bottle) bottles, and the government collects $ ? 40.00 in tax revenue.arrow_forwardIf there is a $3 tax, what is the CS, PS, tax revenue, TS, and deadweight loss? Include graph! Does welfare go up or down? Explain.arrow_forwardOcarrow_forward

- The graph shows befire-tax, where the equilibrium is at 25. When the government levies the tax of 30 on X, price consumer have to pay changes to 35, and prince sellers recieve changes to 5. And at Ps:5, quantity is at 10. What is the consumers’ tax incidence and sellers’ tax incidence, when comaparing the chnage in the prices from before-tax equilibrium price 25??arrow_forwardWhich type of tax takes a larger percentage of income from high-income earners than from low-income earners? A. Regressive tax B. Proportional tax C. Progressive tax D. Flat taxarrow_forwardSuppose that a country has 20 million households. Ten million are poor households that each have labor market earnings of $20,000 per year and 10 million are rich households that each have labor market earnings of $80,000 per year. If the government enacted a marginal tax of 10 percent on all labor market earnings above $20,000 and transferred this money to households earning $20,000 or less, would the incomes of the poor rise by $8,000 per year? O A. No. Workers in rich and poor households would work less because of the marginal tax. O B. Yes. 10% of $80,000 is $8,000; therefore, $8,000 from each rich household would be transferred to each poor household. O C. There is not enough information to determine household behavior in this case. O D. No. Only workers in rich households would work less because of the marginal tax.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education