ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

. Calculating tax incidence Suppose that the local government of Ogden decides to institute a tax on seltzer consumers. Before the tax, 20 billion packs of seltzer were sold every year at a price of $9 per pack. After the tax, 13 billion packs of seltzer are sold every year; consumers pay $12 per pack (including the tax), and producers receive $6 per pack. The amount of the tax on a pack of seltzer is $ burden that falls on producers is $ True per pack. True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on producers. False per pack. Of this amount, the burden that falls on consumers is $. per pack, and the

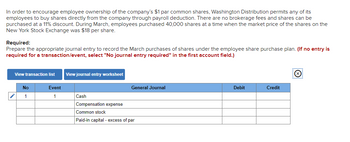

Transcribed Image Text:In order to encourage employee ownership of the company's $1 par common shares, Washington Distribution permits any of its

employees to buy shares directly from the company through payroll deduction. There are no brokerage fees and shares can be

purchased at a 11% discount. During March, employees purchased 40,000 shares at a time when the market price of the shares on the

New York Stock Exchange was $18 per share.

Required:

Prepare the appropriate journal entry to record the March purchases of shares under the employee share purchase plan. (If no entry is

required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

✓

No

1

Event

1

View journal entry worksheet

Cash

General Journal

Compensation expense

Common stock

Paid-in capital - excess of par

Debit

Credit

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 5. Calculating tax incidence Suppose that the local government of Raleigh decides to institute a tax on soda producers. Before the tax, 25 million liters of soda were sold every month at a price of $11 per liter. After the tax, 19 million liters of soda are sold every month; consumers pay $16 per liter, and producers receive $7 per liter (after paying the tax). The amount of the tax on a liter of soda is 3 that falls on producers is 5 per liter. O True per liter. Of this amount, the burden that falls on consumers is True or False: The effect of the tax on the quantity sold would have been the same as if the tax had been levied on consumers. False per liter, and the burdenarrow_forwardOnly typed answerarrow_forwardHelparrow_forward

- If buyers pay more of a tax than do the sellers اختر أحد الخيارات a. demand is more elastic than supply O .b. supply is more elastic than demand O C. None of the above answers is correct O .d. the equilibrium price paid by buyers rises by less than half the amount of the tax „e. the amount of tax revenue collected by the government is almost zeroarrow_forwardols 4. The Laffer curve Government-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections. To understand the effect of such a tax, consider the monthly market for champagne, which is shown on the following graph. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph, Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. PRICE (Dollars per case) 22***RES 40 35 Show Transcribed Text AX REVENUE (Dolan) 018 27 345 54 63 72 81 00 QUANTITY (Cases) Suppose the government imposes a $10-per-case tax on suppliers. At this tax amount, the equilibrium quantity of champagne is [ . 648 576 504 432 360 204 3214 144 72 D Supply . Demand Now calculate the government's tax revenue if it sets a tax of $0, $10, $20, $25, $30, $40, or $50 per case. (Hint: To find the equilibrium quantity…arrow_forwardThe figure shows the market for tires. The figure shows that the government has imposed a tax of per tire. Price (dollars per tire) O A. $40 S+ tax 70 В. $60 60 O C. $30 50 +..... O D. $10 hat ma O E. None of the above answers is correct. 40 As 30 20 Ass 10 10 20 30 40 50 60 70 Quantity (millions of tires per month) its AR O Time Remaining: 00:59:31 Next ompleted This course (ECON202 s2022 online) is based on Bade/Parkin: Foundations of Microeconomics, 9e MacBook Pro terwebsite namearrow_forward

- Figure 8-8 Suppose the government imposes a $10 per unit tax on a good. Price 24 22- 20 18 Supply 16+ 14+ 12 F G 10+ H 6- 4- K M Demand 3 69 12 15 18 21 24 27 30 33 36 39 Quantity Refer to Figure 8-8. One effect of the tax is to O reduce producer surplus from $96 to $24. O create a deadweight loss of $72. O reduce consumer surplus from $180 to $72. All of the above are correct. 00 2.arrow_forward5. Calculating tax incidence Suppose that the U.S. government decides to charge cola producers a tax. Before the tax, 25 million cases of cola were sold every month at a price of $7 per case. After the tax, 18 million cases of cola are sold every month; consumers pay $8 per case, and producers receive $5 per case (after paying the tax). The amount of the tax on a case of cola is $ per case. Of this amount, the burden that falls on consumers is $ per case, and the burden that falls on producers is $ per case. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on consumers. O True O Falsearrow_forward1. Suppose that the market demand for coffee is Pd = 15 - Qd and the market supply is Ps= Qs - 5. What is the equilibrium price and quantity for coffee? Suppose that the government imposes a tax of $1 per unit to reduce coffee consumption and raise government revenues. What will be the new equilibrium quantity? What price will the buyer pay? What price will the seller receive? A o F2 BE #3 ㅁㅁ F3 $ A t 4 OFFIC DEO DOD 000 F4 % 5 F5 MacBook Air 6 F6 & 7 L * 8arrow_forward

- Using the supply and demand data for wheat below, what would happen if the government placed a $3 per bushel tax on wheat? Bushels demanded 45 50 56 61 67 Price per bushel $6 $5 $4 LA LA LA $3 $2 Bushels supplied 77 73 68 61 57 O the producer price would fall, the consumer price would rise, and the quantity sold would increase. The producer price would fall, the consumer price would rise, and the equilibrium quantity would fall O Both the consumer price and the producer price would rise the consumer price would rise by less than $3 while the producer price would fall by more than $3 O the equilibrium consumer price would rise by $3arrow_forwardSuppose that the government decides to charge cola consumers an excise tax. Before the tax, 12 million cases of cola are sold every month at a price of $3.50 per case. After the tax, 6million cases of cola are sold every month; consumers pay $4.00 per case and producers receive $2.00 per case. a. What is the excise tax on cola?b. On whom does the incidence of the tax fall more heavily?c. How much government revenue will be generated by the excise tax?arrow_forward30 Helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education