Concept explainers

“I’m not sure we should lay out $375,000 for that automated welding machine,” said Jim Alder, president of the Superior Equipment Company. “That’s a lot of money, and it would cost us $99,000 for software and installation, and another $66,000 per year just to maintain the thing. In addition, the manufacturer admits it would cost $62,000 more at the end of three years to replace worn-out parts.”

“I admit it’s a lot of money,” said Franci Rogers, the controller. “But you know the turnover problem we’ve had with the welding crew. This machine would replace six welders at a cost savings of $129,000 per year. And we would save another $9,000 per year in reduced material waste. When you figure that the automated welder would last for six years, I’m sure the return would be greater than our 14% required

“I’m still not convinced,” countered Mr. Alder. “We can only get $24,500 scrap value out of our old welding equipment if we sell it now, and in six years the new machine will only be worth $45,000 for parts. But have your people work up the figures and we’ll talk about them at the executive committee meeting tomorrow.”

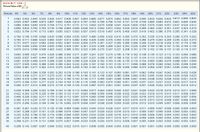

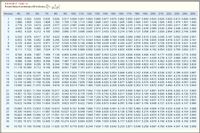

Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. Compute the annual net cost savings promised by the automated welding machine.

2a. Using the data from (1) above and other data from the problem, compute the automated welding machine’s

2b. Would you recommend purchasing the automated welding machine?

3. Assume that management can identify several intangible benefits associated with the automated welding machine, including greater flexibility in shifting from one type of product to another, improved quality of output, and faster delivery as a result of reduced throughput time. What minimum dollar value per year would management have to attach to these intangible benefits in order to make the new welding machine an acceptable investment?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

- Heer Enterprises needs someone to supply it with 160,000 cartons of machine screws per year to support its manufacturing needs over the next three years, and you've decided to bid on the contract. It will cost you $840,000 to install the equipment necessary to start production and you estimate that it can be salvaged for $160,000 at the end of the three-year contract. Your fixed production costs will be $290,000 per year, and your variable production costs should be $8.50 per carton. If you require a 12 percent return on your investment, what is the minimum bid price you should submit?arrow_forwardWhispering Winds Company manufactures automobile components for the worldwide market. The company has three large production facilities in Virginia, New Jersey, and California, which have been operating for many years. Brett Harker, vice president of production, believes it is time to upgrade operations by implementing computer-integrated manufacturing (CIM) at one of the plants. Brett has asked corporate controller Connie Carson to gather information about the costs and benefits of implementing CIM. Carson has gathered the following data: Initial equipment cost $ 6,174,000 Working capital required at start-up $ 600,000 Salvage value of existing equipment 76,350 Annual operating cost savings 855,120 Salvage value of new equipment at end of its useful life 203,600 Working capital released at end of its useful life 600,000 Useful life of equipment 10 years Whispering Winds Company uses a 12% discount rate. Click here to view the factor table $ $ $ $arrow_forwardSuppose we are thinking about replacing an old computer with a new one. The old one cost us $1,620,000; the new one will cost, $1,949,000. The new machine will be depreciated straight-line to zero over its five-year life. It will probably be worth about $405,000 after five years. The old computer is being depreciated at a rate of $336,000 per year. It will be completely written off in three years. If we don't replace it now, we will have to replace it in two years. We can sell it now for $531,000; in two years, it will probably be worth $153,000. The new machine will save us $363,000 per year in operating costs. The tax rate is 23 percent, and the discount rate is 10 percent. a-1. Calculate the EAC for the the old computer and the new computer. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. What is the NPV of the decision to replace the computer now? (A negative answer should…arrow_forward

- Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,860,000; the new one will cost, $2,261,000. The new machine will be depreciated straight-line to zero over its five-year life. It will probably be worth about $585,000 after five years. The old computer is being depreciated at a rate of $432,000 per year. It will be completely written off in three years. If we don't replace it now, we will have to replace it in two years. We can sell it now for $639,000; in two years, it will probably be worth $189,000. The new machine will save us $423,000 per year in operating costs. The tax rate is 25 percent, and the discount rate is 12 percent. a-1. Calculate the EAC for the the old computer and the new computer. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. What is the NPV of the decision to replace the computer now? (A negative answer should…arrow_forward“I’m not sure we should lay out $350,000 for that automated welding machine,” said Jim Alder, president of the Superior Equipment Company. “That’s a lot of money, and it would cost us $94,000 for software and installation, and another $60,000 per year just to maintain the thing. In addition, the manufacturer admits it would cost $57,000 more at the end of three years to replace worn-out parts.” “I admit it’s a lot of money,” said Franci Rogers, the controller. “But you know the turnover problem we’ve had with the welding crew. This machine would replace six welders at a cost savings of $124,000 per year. And we would save another $8,500 per year in reduced material waste. When you figure that the automated welder would last for six years, I’m sure the return would be greater than our 15% required rate of return.” “I’m still not convinced,” countered Mr. Alder. “We can only get $22,000 scrap value out of our old welding equipment if we sell it now, and in six years the new machine…arrow_forwardplease asnwer correctly: Your company has been approached to bid on a contract to sell 5,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $3.4 million and will be depreciated on a straight-line basis to a zero salvage value. Production will require an investment in net working capital of $395,000 to be returned at the end of the project, and the equipment can be sold for $325,000 at the end of production. Fixed costs are $595,000 per year, and variable costs are $85 per unit. In addition to the contract, you feel your company can sell 12,300, 14,600, 19,200, and 11,600 additional units to companies in other countries over the next four years, respectively, at a price of $180. This price is fixed. The tax rate is 23 percent, and the required return is 10 percent. Additionally, the president of the company…arrow_forward

- I’m not sure we should lay out $265,000 for that automated welding machine,” said Jim Alder, president of the Superior Equipment Company. “It would cost us $78,000 for software and installation, and another $40,800 per year just to maintain. In addition, the manufacturer admits it would cost $41,000 more at the end of three years to replace worn-out parts.” “I admit it’s a lot of money,” said Franci Rogers, the controller. “But you know the turnover problem we’ve had with the welding crew. This machine would replace six welders at a cost savings of $108,000 per year. And we would save another $6,900 per year in reduced material waste. When you figure the automated welder would last six years, I’m sure the return would be greater than our 19% required rate of return.” “I’m still not convinced,” countered Mr. Alder. “We can only get $14,000 scrap value for our old welding equipment if we sell it now, and in six years the new machine will only be worth $24,000 for parts.” Click here to…arrow_forwardBailey, Inc., is considering buying a new gang punch that would allow them to produce circuit boards more efficiently. The punch has a first cost of $105,000 and a useful life of 15 years. At the end of its useful life, the punch has no salvage value. Annual labor costs would increase $3,000 using the gang punch, but annual raw material costs would decrease $16,000. MARR is 4.0 %/year. a)What is the present worth of this investment? b)What is the decision rule for judging the attractiveness of investments based on present worth? c)Should Bailey buy the gang punch?arrow_forwardAssume that United Technologies is evaluating a proposal to change the company's manual design system to a computer-aided design (CAD) system. The proposed system is expected to save 10,000 design hours per year; an operating cost savings of $50 per hour. The annual cash expenditures of operating the CAD system are estimated to be $250,000. The CAD system requires an initial investment of $500,000. The estimated life of this system is five years with no salvage value. The tax rate is 40 percent. United Technologies has a cost of capital of 20 percent.Assume that management intends to use double-declining balance depreciation with a switch to straight-line depreciation (applied to any undepreciated balance) starting in Year 4.Determine the project's net present valuearrow_forward

- A small company that manufactures vibration isolation platforms is trying to decide whether it should immediately upgrade the current assemblysystem D, which is rather labor-intensive, with the more highly automated system C one year from now. Some components of the current system canbe sold now for $9000, but they will be worthless hereafter. The operating cost of the existing system is $192,000 per year. System C will cost $320,000 with a $50,000 salvage value after four years. Its operating cost will be $68,000 per year. If you are told to do a replacement analysis using an interest rate of 10% per year, which system do you recommend?arrow_forwardNikularrow_forwardEmperor's Clothes Fashions can invest $5 million in a new plant for producing invisible makeup. The plant has an expected life of 5 years, and expected sales are 6 million jars of makeup a year. Fixed costs are $3.8 million a year, and variable costs are $2.50 per jar. The product will be priced at $3.90 per jar. The plant will be depreciated straight-line over 5 years to a salvage value of zero. The opportunity cost of capital is 10%, and the tax rate is 30%. a. What is project NPV under these base-case assumptions? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. b. What is NPV if variable costs turn out to be $2.80 per jar? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. c. What is NPV if fixed costs turn out to be $3.3 million per year? Note: Do not round intermediate calculations. Enter your answer in millions, rounded to 2 decimal places. d. At what price per jar…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education