Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

please do this typewritten and with calculation. kindly skip if you have already done this. thank you

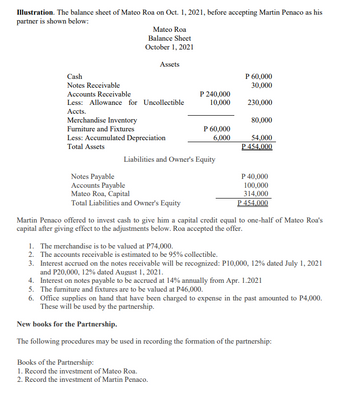

Transcribed Image Text:Illustration. The balance sheet of Mateo Roa on Oct. 1, 2021, before accepting Martin Penaco as his

partner is shown below:

Mateo Roa

Balance Sheet

October 1, 2021

Assets

Cash

P 60,000

30,000

Notes Receivable

Accounts Receivable

Less: Allowance for Uncollectible

230,000

Accts.

Merchandise Inventory

80,000

Furniture and Fixtures

Less: Accumulated Depreciation

54,000

P 454.000

Total Assets

Liabilities and Owner's Equity

Notes Payable

P 40,000

100,000

Accounts Payable

Mateo Roa, Capital

314,000

Total Liabilities and Owner's Equity

P454,000

Martin Penaco offered to invest cash to give him a capital credit equal to one-half of Mateo Roa's

capital after giving effect to the adjustments below. Roa accepted the offer.

1. The merchandise is to be valued at P74,000.

2. The accounts receivable is estimated to be 95% collectible.

3. Interest accrued on the notes receivable will be recognized: P10,000, 12% dated July 1, 2021

and P20,000, 12% dated August 1, 2021.

4. Interest on notes payable to be accrued at 14% annually from Apr. 1.2021

5. The furniture and fixtures are to be valued at P46,000.

6. Office supplies on hand that have been charged to expense in the past amounted to P4,000.

These will be used by the partnership.

New books for the Partnership.

The following procedures may be used in recording the formation of the partnership:

Books of the Partnership:

1. Record the investment of Mateo Roa.

2. Record the investment of Martin Penaco.

P 240,000

10,000

P 60,000

6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following is a portion of the current asset section of the balance sheets of HiROE Co., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for uncollectibleaccounts of $23,000 and $11,000, respectively $457,000 $359,000 e-2. What factors might have caused the change in this ratio? Check All That Apply Credit was extended to proportionately more slow-paying or high credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or high credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or lower credit-risk customers during 2020. Credit was extended to proportionately more slow-paying or high credit-risk customers during 2019. Credit was extended to proportionately more slow-paying or high credit-risk customers during 2019. Credit was extended…arrow_forwardOn January 1, 2021, the general ledger of Tripley Company included the following sccount balances: Accounts Debit Credit $250, 0e 78,0ee Cash Accounts receivable Allowance for uncollectible accounts Inventory Building Accunulated depreciation Land $ 35,800 33,000 223,0ee 48, e00 248,6e0 Accounts payable Notes payable (8x, due in 3 years) 170, e00 216,e00 113,600 242, e00 Conmon stock Retained earnings Totals $816,680 $816, 600 The $33,000 beginning balance of inventory consists of 330 units, esch costing $100. During January 2021, the company had the following transsctions: January 2 Lent $58,000 to an employee by accepting a 6% note due in six Tonths. 5 Purchased 5,000 units of inventory on account for $550,eee ($110 cach) with terms 1/1e, n/30. 8 Returned 100 defective units of inventory purchased on January 5. 15 Sold 4,8ae units of inventory on account for $768,000 ($16e cach) with terms 2/10, n/30. 17 Customers returned 20e units sold on January 15. These units were initially…arrow_forwardPrepare the income statements and balance sheets for years 2018 and 2019 for Thompson Company using the following information. The balance sheet numbers are at the end of year figures.Item20182019Accounts Payable120.0150.0Accounts Receivable150.0180.0Accumulated Depreciation330.0360.0Cash & Cash Equivalents10.012.0Common Stock150.0200.0Cost of Goods Sold750.0850.0Depreciation25.030.0Interest Expense30.033.0Inventory200.0180.0Long-term Debt150.0150.0Gross Plant & Equipment650.0780.0Retained Earnings208.5225.0Sales1,500.01,700.0SG&A Expenses500.0570.0Notes Payable51.567.0Tax Rate21%21%(2) Answer the following questions:(a) How much did Thompson Company spend in acquiring fixed assets in 2019?(b) How much dividend did Thompson Company pay out during 2019?(c) Using the end of year numbers, did the long-term solvency ratios improve or deteriorate from 2018 to 2019? Answer this question using at least two long-term solvency ratios.(d) Using the end of year numbers, did the asset…arrow_forward

- The following is a portion of the current assets section of the balance sheets of Avanti's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for baddebts of $9,750 and $15,336, respectively $179,866 $225,851 Required:a. If $11,849 of accounts receivable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint: Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) b. The December 31, 2020, Allowance account balance includes $3,034 for a past due account that is not likely to be collected. This account has not been written off.(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020? Yes No (2) If it had been written off, will there be any effect of the write-off on net income and ROI for the year ended December 31, 2020? Yes No c. The…arrow_forwardThe following selected accounts were taken from the trial balance of Romen Company as December 31, 2020: Accounts receivable 750,000 I nstallment receivable – 2018 150,000 Installment receivable - 2019 450,000 Installment receivable – 2020 2,700,000 Beginning inventory 525,000 Purchases 3,900,000 Freight-in 30,000 Repossessed merchandise @ NRV 150,000 Repossession loss 240,000 Cash sales 900,000 Credit sales 1,800,000 Installment sales 4,460,000 Deferred gross profit – 2018 222,000 Deferred gross profit – 2019 393,600 Operating expenses 150,000 Cost of installment sales 2,787,500 Additional information: Gross profit rate for 2018 and 2019 installment sales were 30% and 32%, respectively. The entry for repossessed goods was: Repossessed Merchandise 150,000 Repossession loss 240,000 Installment Receivable – 2018 180,000 Installment Received - 2019 210,000 Merchandise on hand at the end of 2020 (new and repossessed) was 282,000. Required: Compute for the following : Total realized…arrow_forwardPrepare the necessary joumal entries for the following fiscal year 2022 transactions made by Airflowing Corp. Additional Information: 1 Ai rflowing Corp. year-end is 12/31. 2 Assume straight-line amortization of discounts. 3 Ai rflowing Corp. records all purchases and payables at gross. Description Date February 2, 2022 Aiflowing Corp. purchased goods from Vents Inc for $ 250,00 ( 3/ 10, n 30 terms were February 26, 2022 Airfbwing Corp. paid Vents inc. for the 2/2/22 purchase. June 1, 2022 Arfbwing Corp. purchased a truck for $ 85,000 from Ford Mator Company Fleet Sales Division. The sales agreement call for Airfbwing Corp. to pay 10,000 on purchase date and to sign a 1-year, 10% note forthe remaning balance of the purchase price. July 1, 2022 Arfbwing Corp. borrowed from St. Paul Nat ibnalBank $ 3500,0 by signing a $ 3,700,000 zero-interest be aring note due one year from July 1 Airflowing Corp.s CFO has concerns re bted to cash the frst quarter of 2023.arrow_forward

- On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:Accounts Debit CreditCash $ 11,200Accounts Receivable 34,000Allowance for Uncollectible Accounts $ 1,800Inventory 152,000Land 67,300Buildings 120,000Accumulated Depreciation 9,600Accounts Payable 17,700Common Stock 200,000Retained Earnings 155,400Totals $384,500 $384,500During January 2021, the…arrow_forwardThe following Is a portion of the current assets section of the balance sheets of Avantl's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for bad debts of $9,884 and $18,755, respectively $178,387 $223,883 Requlred: a. If $11,579 of accounts recelvable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint. Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) Bad debt expense b. The December 31, 2020, Allowance account balance Includes $3,017 for a past due account that is not likely to be collected. This account has not been written off. |(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020? Yes No (2) If It had been written off, will there be any effect of the write-off on net Income and ROI for the year ended December 31, 2020? Yes No c. The level of Avantı's sales…arrow_forwardThe following are selected 2025 transactions of Nash Corporation. Sept. 1 Purchased inventory from Encino Company on account for $58,500. Nash records purchases gross and uses a periodic inventory system. Issued a $58,500, 12-month, 8% note to Encino in payment of account. Borrowed $58.500 from the Shore Bank by signing a 12-month, zero-interest-bearing $63,180 note. Oct. 1 Oct. 1 (a) Your answer is correct. Prepare journal entries for the selected transactions above. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement, List all debit entries before credit entries) Date September 1 v Date September 1 October 11 Account Titles and Explanation October 1 v Purchases Accounts Payable Prepare journal entries for the selected transactions above. (If no entry is required, select "No Entry for…arrow_forward

- Calculate the inventory turnover for 2019.arrow_forwardOn the December 31, 2021 balance sheet of Tiffany Company, the current receivables consisted of the following: Trade accounts receivable 232,500 ( 5,000) 7,500 Allowance for uncollectible accounts Claim against shipperfor goods lost in transit (Oct. 2022) Selling price of unsold goods sent by Tiffany to consignee 65,000 Security deposit on lease of warehouse used for storing Inventories 75,000 Total 375,000 At December 31, 2021, how much should be Tiffany's total current net receivables?arrow_forwardUse the following information for Company COLTIB to create the BalanceSheet for 2020 and 2021arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning