FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:yuara,

por

Lasi unt au un Apr its sales, ou percent is i Losi. On e Liquil baits, u

percent is collected during the month of the sale, and 50 percent is collected during the month following the sale.

Of direct materials purchases, 80 percent is paid for during the month purchased and 20 percent is paid in the following

month. Direct materials purchases for March 1 totaled $2,000. All other operating costs are paid during the month

incurred. Monthly fixed manufacturing overhead includes $250 in depreciation. During April, Iguana plans to pay $4,000

for a piece of equipment.

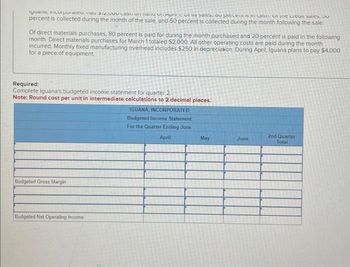

Required:

Complete Iguana's budgeted income statement for quarter 2.

Note: Round cost per unit in intermediate calculations to 2 decimal places.

Budgeted Gross Margin

Budgeted Net Operating Income

IGUANA, INCORPORATED

Budgeted Income Statement

For the Quarter Ending June

April

May

June

2nd Quarter

Total

Transcribed Image Text:Itranscript

Required information

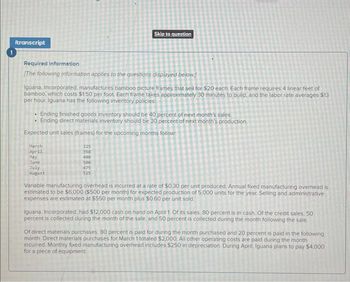

[The following information applies to the questions displayed below)

Iguana, Incorporated, manufactures bamboo picture frames that sell for $20 each. Each frame requires 4 linear feet of

bamboo, which costs $1.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $13

per hour. Iguana has the following inventory policies

Ending finished goods inventory should be 40 percent of next month's sales.

Ending direct materials inventory should be 30 percent of next month's production.

Expected unit sales (frames) for the upcoming months follow:

.

March

April

May

June

July

August

Skip to question

325

350

400

5:00

475

525

Variable manufacturing overhead is incurred at a rate of $0.30 per unit produced. Annual fixed manufacturing overhead is

estimated to be $6.000 ($500 per month) for expected production of 5,000 units for the year. Selling and administrative

expenses are estimated at $550 per month plus $0.60 per unit sold.

iguana, Incorporated, had $12,000 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50

percent is collected during the month of the sale, and 50 percent is collected during the month following the sale.

Of direct materials purchases. 80 percent is paid for during the month purchased and 20 percent is paid in the following

month. Direct materials purchases for March 1 totaled $2,000. All other operating costs are paid during the month

incurred. Monthly fixed manufacturing overhead includes $250 in depreciation. During April, Iguana plans to pay $4,000

for a piece of equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wesley Power Tools manufactures a wide variety of tools and accessories. One of its more popular items is a cordless power handisaw. Each handisaw sells for $40. Wesley expects the following unit sales: January 2,200 February 2,500 March 2,700 April 2,500 May 2,100 Wesley’s ending finished goods inventory policy is 35 percent of the next month’s sales. Suppose each handisaw takes approximately 0.65 hour to manufacture, and Wesley pays an average labor wage of $13.50 per hour. Each handisaw requires two plastic components that Wesley purchases from a supplier at a cost of $3.00 each. The company has an ending direct materials inventory policy of 10 percent of the following month’s production requirements. Materials other than the plastic components total $4.50 per handisaw. Manufacturing overhead for this product includes $66,000 annual fixed overhead (based on production of 24,000 units) and $0.90 per unit variable manufacturing overhead. Wesley’s selling expenses are 6 percent of…arrow_forwardWesley Power Tools manufactures a wide variety of tools and accessories. One of its more popular items is a cordless power handisaw. Each handisaw sells for $46. Wesley expects the following unit sales: January 3,800 February 4,000 March 4,500 April 4,300 May 3,700 Wesley’s ending finished goods inventory policy is 25 percent of the next month’s sales.Suppose each handisaw takes approximately 0.60 hours to manufacture, and Wesley pays an average labor wage of $22 per hour.Each handisaw requires a plastic housing that Wesley purchases from a supplier at a cost of $5.00 each. The company has an ending direct materials inventory policy of 20 percent of the following month’s production requirements. Materials other than the housing unit total $4.50 per handisaw.Manufacturing overhead for this product includes $72,000 annual fixed overhead (based on production of 27,000 units) and $1.20 per unit variable manufacturing overhead. Wesley’s selling expenses are 7…arrow_forwardSubject : Accountingarrow_forward

- Ceder Company has compiled the following data for the upcoming year: Sales are expected to be 16,000 units at $52 each. Each unit requires 4 pounds of direct materials at $2.40 per pound. Each unit requires 2.1 hours of direct labor at $13 per hour. Manufacturing overhead is $4.90 per unit. Beginning direct materials inventory is $5,400. Ending direct materials inventory is $6,950. Selling and administrative costs totaled $138,720. Determine Ceder's budgeted cost of goods sold. Complete Ceder's budgeted income statement.arrow_forwardA book publishing company is planning its inventory. The cost to store one book is $4 per month. The cost for a production run is $8 per run and $0.50 per book. The company sells 3,600 books per month. How many should be in a production run to minimize inventory costs?arrow_forwardRequired information [The following information applies to the questions displayed below.] Iguana, Incorporated, manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $13 per hour. Iguana has the following inventory policies: ⚫ Ending finished goods inventory should be 40 percent of next month's sales. • Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow: March April May June July August 310 320 370 470 445 495 Variable manufacturing overhead is incurred at a rate of $0.50 per unit produced. Annual fixed manufacturing overhead is estimated to be $4,800 ($400 per month) for expected production of 4,800 units for the year. Selling and administrative expenses are estimated at $500 per month plus $0.50 per unit sold. Iguana, Incorporated, had…arrow_forward

- Iguana, Inc., manufactures bamboo picture frames that sell for $30 each. Each frame requires 4 linear feet of bamboo, which costs $2.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $12 per hour. Iguana has the following inventory policies: Ending finished goods inventory should be 40 percent of next month’s sales. Ending direct materials inventory should be 30 percent of next month’s production. Expected unit sales (frames) for the upcoming months follow: March 280 April 260 May 310 June 410 July 385 August 435 Variable manufacturing overhead is incurred at a rate of $0.40 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,800 ($650 per month) for expected production of 3,000 units for the year. Selling and administrative expenses are estimated at $700 per month plus $0.50 per unit sold. Iguana, Inc., had $10,900 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit…arrow_forwardIguana, Inc., manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $14 per hour. Iguana has the following inventory policies: • Ending finished goods inventory should be 40 percent of next month's sales. Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow: March April May June July August 315 330 380 480 455 505 Variable manufacturing overhead is incurred at a rate of $0.60 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of 3,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.50 per unit sold. Iguana, Inc., had $11,000 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50 percent is…arrow_forwardDo not give answer in imagearrow_forward

- Vishnuarrow_forwardShadee Corporation expects to sell 610 sun shades in May and 340 in June. Each shade sells for $140. Shadee's beginning and ending finished goods inventories for May are 70 and 50 shades, respectively. Ending finished goods inventory for June will be 65 shades. Each shade requires a total of $50.00 in direct materials that includes 4 adjustable poles that cost $10.00 each. Shadee expects to have 120 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 110 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $12 per hour.. Additionally, Shadee's fixed manufacturing overhead is $9,000 per month, and variable manufacturing overhead is $14 per unit produced. Use the information and solutions presented to complete the requirements. Required: Determine Shadee's budgeted manufacturing cost per shade. (Note: Assume that fixed overhead per unit is $ 14.) Prepare Shadee's budgeted cost of…arrow_forwardShadee Corporation expects to sell 580 sun shades in May and 400 in June. Each shade sells for $134. Shadee's beginning and ending finished goods inventories for May are 60 and 40 shades, respectively. Ending finished goods inventory for June will be 55 shades. Each shade requires a total of $45.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 130 in direct materials Inventory on May 1, 100 poles in Inventory on May 31, and 120 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $13 per hour. Additionally, Shadee's fixed manufacturing overhead is $8,000 per month, and variable manufacturing overhead is $13 per unit produced. Additional information: • Selling costs are expected to be 7 percent of sales. ⚫ Fixed administrative expenses per month total $1,700. Required: Prepare Shadee's budgeted income statement for the months of May and June. Note: Do not round your…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education